Unveiling the Secrets of Profitable Short-Term Forex Trading

Are you yearning to unlock the lucrative potential of forex scalping? Look no further than the 20 pips forex scalping strategy with linear weighted moving average (LWMA). This time-tested approach empowers forex traders, regardless of their experience level, to harness the power of short-term price movements, capturing profits quickly and efficiently.

Image: www.cmcmarkets.com

Understanding the Linear Weighted Moving Average

At the core of this strategy lies the LWMA, a technical indicator that smooths out price fluctuations, making it easier to identify trends. Unlike traditional moving averages, the LWMA assigns greater weight to recent prices, allowing it to adapt more quickly to changing market conditions. This responsiveness makes it an ideal tool for scalpers who seek to identify profitable trading opportunities.

How to Implement the 20 Pips Forex Scalping Strategy

To implement this strategy, follow these steps:

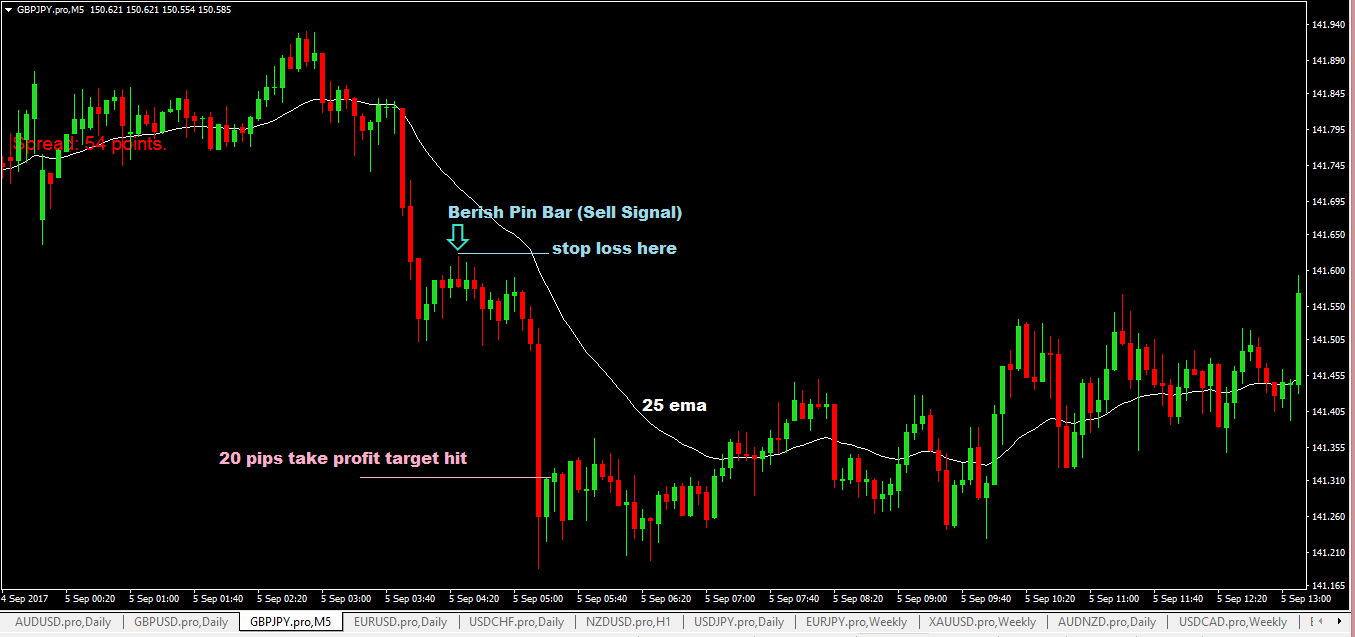

- Select a Currency Pair: Choose a currency pair with high liquidity, such as EUR/USD or GBP/USD.

- Set the LWMA Period: The optimal period for the LWMA depends on the timeframe being traded. For 5-minute charts, use a period of 10-20; for 15-minute charts, use a period of 30-50.

- Identify the Trend: Look for the general direction of the LWMA. If the LWMA is sloping up, the trend is bullish; if it’s sloping down, the trend is bearish.

- Enter a Trade: When the price crosses the LWMA in the direction of the trend, enter a trade. For example, if the LWMA is sloping up and the price crosses above it, enter a buy trade.

- Set Stop Loss and Take Profit: Place a stop loss order a few pips below the LWMA and a take profit order 20 pips above or below the entry point, depending on the market volatility.

- Exit the Trade: Exit the trade once the take profit or stop loss order is hit.

Why Use the 20 Pips Forex Scalping Strategy with LWMA?

This strategy offers several advantages:

- Profitable: The 20 pips target offers a consistent source of income over time.

- Short Trade Duration: Trades are typically closed within minutes, reducing exposure to market risks.

- Scalable: The strategy can be scaled up or down depending on the trader’s risk tolerance and capital.

- Suitable for Beginners: The strategy is relatively straightforward and suitable for traders with limited experience.

- Adaptable: The LWMA can be customized to different timeframes and market conditions, enhancing versatility.

Image: www.forexcracked.com

20 Pips Forex Scalping Strategy With Linear Weighted Moving Average

Conclusion

The 20 pips forex scalping strategy with linear weighted moving average is a powerful tool that can help traders unlock the profit potential of short-term price movements. By harnessing the responsiveness of the LWMA, traders can identify trends quickly and execute profitable trades with confidence. Remember, successful scalping requires meticulous chart analysis, risk management, and unwavering discipline. So, embrace this strategy, master its nuances, and embark on a journey towards consistent forex trading success.