Introduction

Imagine walking into a bustling marketplace, overflowing with vibrant colors and enticing aromas. You want to get a sense of the overall health of this market, but with so many vendors and products, it’s overwhelming. A market-weighted index is like a skilled merchant, offering a concise summary of the market’s pulse, taking into account the size and influence of each participant.

Image: www.valueresearchonline.com

Just like the bustling marketplace, the financial world is a dynamic ecosystem with countless stocks, bonds, and commodities vying for investor attention. Understanding the overall health of this financial landscape is crucial for investors, and market-weighted indices provide that crucial snapshot.

Unveiling the Market-Weighted Index

What is a Market-Weighted Index?

A market-weighted index is a type of stock market index where the weighting of each constituent security is determined by its total market capitalization. Market capitalization refers to the total value of a company’s outstanding shares calculated by multiplying the share price by the number of shares outstanding.

Key Features of a Market-Weighted Index:

Market-weighted indices possess a few key characteristics that distinguish them from other index types:

- Size Matters: Larger companies with higher market capitalizations have a greater influence on the index value. This means that a small change in the price of a large-cap stock can significantly impact the overall index value.

- Dynamic Representation: As company market capitalizations fluctuate, their weighting within the index automatically adjusts. This ensures that the index remains a true reflection of the market’s overall health.

- Broader Perspective: Market-weighted indices typically encompass a diverse range of industries and sectors, providing a comprehensive overview of the stock market.

Image: novelinvestor.com

Examples of Market-Weighted Indices:

Many prominent stock indices across the globe are market-weighted, providing investors with valuable benchmarks for investment performance.

- S&P 500: This index tracks the performance of 500 large-cap U.S. companies.

- Nasdaq Composite: This index includes over 3,000 companies traded on the Nasdaq Stock Market, emphasizing technology and growth stocks.

- Dow Jones Industrial Average (DJIA): This index follows the performance of 30 large, publicly owned U.S. companies.

- FTSE 100: This index tracks the performance of the 100 largest companies listed on the London Stock Exchange.

Advantages and Considerations

Advantages of Market-Weighted Indices:

Market-weighted indices offer a multitude of benefits for investors and market analysts:

- Accurate Representation: They reflect the true weight of large companies within the market.

- Transparency and Comparability: Their methodology is well-defined, making it easy to compare performance across different indices.

- Investment Diversification: Investing in a market-weighted index automatically diversifies your portfolio across multiple companies and industries.

Considerations for Market-Weighted Indices:

Despite their numerous advantages, market-weighted indices do have some limitations:

- Domination by Large Caps: The performance of large-cap companies can heavily influence the overall index value, potentially overshadowing smaller, high-growth companies.

- Sensitivity to Economic Trends: These indices often closely track broader economic conditions, making them susceptible to market volatility.

- Index Bias: Market-weighted indices may not always accurately represent the performance of certain sectors or industries, especially if those sectors are dominated by smaller companies.

Trends and Developments

The use of market-weighted indices continues to evolve, driven by technological advancements and changing investor needs. Some notable trends in this area include:

- Rise of Factor Investing: Investors are increasingly using market-weighted indices to build portfolios based on specific factors like value, growth, or momentum, by investing in indices that specifically target these factors.

- Focus on ESG Investing: As environmental, social, and governance (ESG) considerations gain traction, market-weighted indices are being developed with ESG criteria, enabling investors to make socially responsible investments.

- Expansion into Emerging Markets: Market-weighted indices are expanding into emerging markets, offering investors access to a broader range of investment opportunities.

Tips for Using Market-Weighted Indices

Understanding the nuances of market-weighted indices can significantly enhance your investment strategy:

- Analyze Sector Weightings: Look beyond the overall index value to understand the contribution of different sectors to overall performance.

- Consider Index Volatility: Be aware of the inherent risk associated with market-weighted indices, especially during periods of market volatility.

- Diversify Your Portfolio: Don’t rely solely on market-weighted indices. Consider incorporating other index types, such as equal-weighted indices or thematic indices, into your investment strategy.

Expert Advice

It’s important to remember that market-weighted indices are simply tools – they provide a valuable framework for understanding market dynamics, but they don’t make investment decisions. When using these indices, it is essential to conduct thorough research, analyze market trends, and consult with a qualified financial advisor.

FAQ

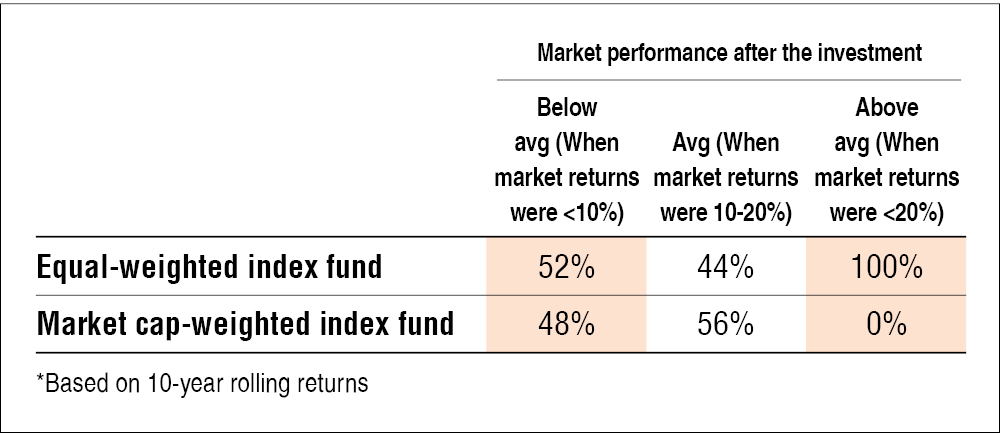

Q: What is the difference between a market-weighted index and an equal-weighted index?

In a market-weighted index, the weight of each security is determined by its market capitalization, meaning larger companies have a greater influence. In an equal-weighted index, each security receives an equal weight, regardless of its market capitalization. This provides a more balanced representation of smaller companies.

Q: How can I invest in a market-weighted index?

You can invest in market-weighted indices through index funds, exchange-traded funds (ETFs), or mutual funds. These funds track the performance of specific market-weighted indices, allowing investors to gain exposure to a diversified basket of securities.

Q: Are market-weighted indices suitable for all investors?

Market-weighted indices are a valuable tool for many investors, particularly those seeking diversification and broad market exposure. However, it’s important to consider your individual investment goals, risk tolerance, and time horizon to determine if these indices align with your specific investment strategy.

Market Weighted Index

Conclusion

Market-weighted indices provide a vital framework for understanding the overall health of the financial market. They offer valuable insights into market performance, enable diversified investments, and facilitate comparisons between different indices. As the financial landscape evolves, market-weighted indices will likely continue to play a significant role in guiding investment decisions.

Are you interested in learning more about market-weighted indices? Let us know in the comments below!