Have you ever wondered why the Dow Jones Industrial Average, one of the most famous stock market indices, seems to give disproportionate weight to companies like Boeing and Apple, even though their market capitalization is dwarfed by giants like Microsoft and Amazon? The answer lies in the fundamental difference between price-weighted and market-cap weighted indices. These seemingly simple concepts have far-reaching implications for how we understand market movements, analyze investment strategies, and even interpret economic data.

Image: www.slideshare.net

In this article, we’ll delve into the intricacies of these two indexing methodologies, revealing their underlying mechanics and exploring their unique strengths and weaknesses. We’ll also analyze how these differences impact the composition of popular indices and ultimately affect your investment decisions. Get ready to unravel the secrets of these financial heavyweights and gain a deeper understanding of the market forces that shape our investment landscape.

Unveiling the Price-Weighted Enigma

Imagine a simple basket containing three fruits: an apple, a banana, and a strawberry. In a price-weighted index, the weight of each fruit is determined solely by its price. For example, if the apple costs $1, the banana $0.50, and the strawberry $0.25, the apple would have the highest weighting in the basket because it is the most expensive. This is the fundamental concept behind price-weighted indices like the Dow Jones Industrial Average (DJIA).

The DJIA, established in 1896, uses a divisor to adjust the total price of its 30 component stocks, which are all large publicly traded American companies. Each stock’s price is added to the total, and the divisor is used to arrive at the final index value. This means that an increase in the price of a higher-priced stock will have a greater effect on the index than an equal percentage increase in the price of a lower-priced stock. The downside? This approach can make the index appear skewed towards larger, more expensive companies, and less representative of the overall market.

Sizing Up the Market-Cap Weighted Colossus

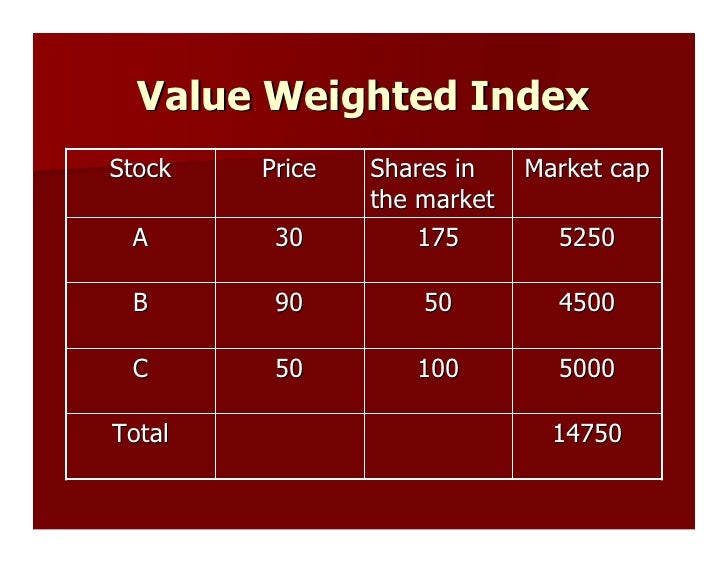

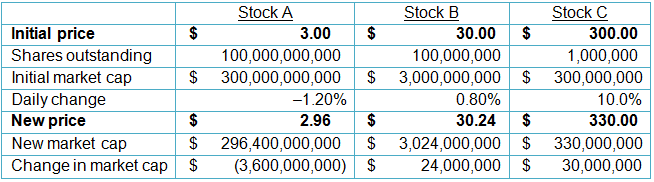

Instead of focusing on individual prices, market-cap weighted indices, like the S&P 500, assign weight to each company based on its market capitalization. This is calculated by multiplying the company’s share price by the number of its outstanding shares. Simply put, the larger a company’s market cap, the more weight it carries in the index. Think of it like a weighted average where the bigger companies have a bigger say.

For example, a company with a market cap of $100 billion would have a ten times greater weight in an index than a company with a market cap of $10 billion. This method tends to represent the overall market more accurately because it accounts for the overall size and influence of each company. However, market-cap weighting can be criticized for giving too much influence to a select few behemoths, potentially overshadowing smaller, faster-growing companies.

The Great Debate: Which One Reigns Supreme?

The choice between price-weighted and market-cap weighted indices has sparked a lasting debate in the investment world. While both have their merits, they reflect different philosophies and priorities. Price-weighted indices, like the DJIA, offer a historical perspective and can be a good indicator of the overall market sentiment. However, their susceptibility to price fluctuations in individual companies and their lack of representation of the overall market value can be limiting.

Conversely, market-cap weighted indices, such as the S&P 500, provide a more accurate representation of the overall market value and are less prone to the distortions of price-weighted indices. While they offer a comprehensive overview of market performance, they might not be ideal for tracking the performance of smaller, emerging companies or identifying growth opportunities in specific sectors.

Image: rhayzlzenia.blogspot.com

Beyond the Averages: Understanding the Nuances

The choice between price-weighted and market-cap weighted indices ultimately depends on the goals of the investor and the specific investment strategy. While price-weighted indices can be a good starting point for understanding overall market trends, market-cap weighted indices are favored by many investors who prioritize diversification and growth potential.

For instance, a long-term investor seeking to track the broader market performance would likely favor market-cap weighted indices. Conversely, an investor focused on investing in a specific sector or a collection of smaller companies might find price-weighted indices more relevant, providing a concentrated view of the performance of targeted companies.

Beyond the Traditional: Exploring Other Index Variations

The world of indexing is vast and diverse, and the traditional price-weighted and market-cap weighted approaches are just the tip of the iceberg. In recent years, specialized indexing strategies have emerged, tailored to specific investor needs and preferences. For instance, equal-weighted indices assign equal weight to each component security, regardless of its market capitalization. This strategy aims to provide a more balanced representation of market performance by leveling the playing field for smaller companies.

Other indexing methods, like fundamental weighting, consider factors like earnings, dividends, and book value to determine the weight of each component company. These approaches are gaining traction among investors seeking to mitigate the influence of large, established companies and uncover growth potential in overlooked sectors.

Navigating the Market: Making Informed Choices

Understanding the fundamental differences between price-weighted and market-cap weighted indices is crucial for making informed investment decisions. While there is no one-size-fits-all solution, taking the time to comprehend the advantages and limitations of each approach will empower you to select the index that aligns with your investment goals.

Whether you’re a seasoned veteran or a novice investor, researching different indexing strategies and their impact on your portfolio is a vital step towards achieving your financial goals. As the market continues to evolve and new indexing strategies emerge, staying informed and adaptable will be key to navigating the complexities of the investment landscape.

Price Weighted Vs Market Cap Weighted

Conclusion: Embracing the Evolution of Indexing

The battle between price-weighted and market-cap weighted indices is far from over. As the investment landscape continues to evolve, new indexing methods will emerge, challenging traditional approaches and offering investors a wider range of choices.

By understanding the unique strengths and weaknesses of each approach, investors can make informed decisions that align with their individual investment strategies and long-term goals. As you embark on your investment journey, remember to stay curious, embrace innovation, and continue to explore the fascinating world of financial indexing.