**Cap Weighted vs Equal Weighted: Assessing the Impact on Investment Strategies**

Image: www.tradingview.com

In the realm of index investing, two primary weighting methodologies hold significant sway: capitalization and equal weighting. Each approach offers distinct characteristics that influence portfolio construction and investment outcomes.

Cap-Weighted Indexes

This method assigns greater weight to companies with larger market capitalizations (shares outstanding multiplied by stock price). As such, a cap-weighted index, like the S&P 500, is heavily influenced by the most valuable companies in the market. For example, in the S&P 500, Apple and Microsoft carry significant weight, reflecting their dominance in market capitalization.

Equal-Weighted Indexes

In contrast, equal-weighted indexes give equal weight to each constituent regardless of market size. This approach ensures that the index’s performance is not overly influenced by a select few large-cap companies. Instead, it provides a broader representation of the market as a whole.

Image: seekingalpha.com

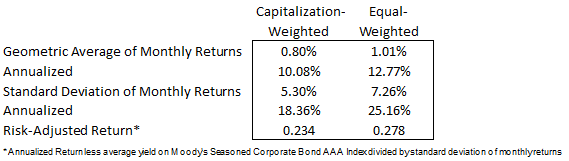

Performance Considerations

The weighting methodology can significantly impact index performance. Historically, cap-weighted indexes have outperformed equal-weighted indexes due to the superior growth potential of larger companies. However, in certain market conditions, such as when small- and mid-cap stocks experience strong performance, equal-weighted indexes may outperform their cap-weighted counterparts.

Diversification and Risk

Equal-weighted indexes offer greater diversification than cap-weighted indexes. By minimizing concentration in a few large companies, equal-weighted indexes reduce idiosyncratic risk and potentially provide more consistent performance over the long term. However, they may also carry higher systematic risk due to their exposure to smaller and less established companies.

Investment Implications

The choice between a cap-weighted and equal-weighted index depends on individual investment goals and risk tolerance. Cap-weighted indexes may be more suitable for investors seeking a market-representative portfolio with the potential for higher returns. However, investors seeking greater diversification and potential downside protection may prefer equal-weighted indexes.

Current Trends and Developments

In recent years, there has been growing interest in equal-weighted indexing due to its potential to capture the performance of a broader range of companies. This trend is driven in part by the increasing popularity of small- and mid-cap investing.

Tips and Expert Advice for Investors

- Consider investment goals: Determine your investment objectives and risk tolerance before choosing an index methodology.

- Diversify your portfolio: Combine cap-weighted and equal-weighted indexes to create a balanced, well-diversified portfolio.

- Monitor performance: Periodically review the performance of your indexes and adjust your allocations as needed.

- Consult with a financial advisor: Seek guidance from a qualified financial advisor for personalized advice on index investing strategies.

Frequently Asked Questions

- Which is better, cap-weighted or equal-weighted? There is no definitive answer; the best choice depends on investment goals and risk tolerance.

- Do equal-weighted indexes beat cap-weighted indexes? Historically, cap-weighted indexes have outperformed equal-weighted indexes, but performance can vary depending on market conditions.

- Is it risky to invest in equal-weighted indexes? Equal-weighted indexes may carry higher systematic risk due to their exposure to smaller companies, but they also offer greater diversification than cap-weighted indexes.

Cap Weighted Vs Equal Weighted

https://youtube.com/watch?v=g6diE71GdpI

Conclusion

The choice between cap-weighted and equal-weighted indexes is a key consideration for investors. Understanding the distinctions between these methodologies and their implications for performance and risk is crucial for making informed investment decisions. By tailoring their index investing strategies to their individual needs, investors can optimize their portfolio’s potential for long-term success.

Are you interested in learning more about index investing and the merits of cap-weighted versus equal-weighted methodologies?