Imagine a world where your vote in an election was determined by how much money you had. The wealthiest individuals would hold the majority of the power, while those with less financial resources would have little influence. This concept, while unsettling in a political context, is essentially what happens in market cap weighted indexes like the S&P 500, where companies with larger market capitalizations hold greater weight and influence the overall performance of the index.

Image: www.financestrategists.com

Market cap weighted indexes are a fascinating reflection of our capitalist system, where size and wealth often correlate with power. By understanding these indexes, we can gain valuable insights into the dynamics of the stock market and the strategies employed by investors.

Delving Deeper into Market Cap Weighted Indexes

A market cap weighted index, also known as a capitalization-weighted index, is a type of stock market index where the weight of each constituent company is determined by its market capitalization, which is calculated by multiplying the company’s outstanding shares by its current share price.

This means that companies with a larger market capitalization, representing a higher value of outstanding shares, have a greater influence on the index’s overall performance. Conversely, smaller companies with lower market capitalizations have a smaller impact. To illustrate, if Company A has a market capitalization of $1 billion and Company B has a market capitalization of $100 million, Company A will have a ten times greater weight in the index than Company B.

Historical Evolution

Market cap weighted indexes have a long history, dating back to the early 20th century. The Dow Jones Industrial Average (DJIA), one of the oldest and most widely known stock market indexes, originally used a price-weighted methodology, meaning each company’s stock price was weighted equally. However, this method proved susceptible to distortion, as companies with high stock prices could disproportionately affect the index’s performance.

In the mid-20th century, the concept of market capitalization weighting gained traction, culminating in the development of the S&P 500, a comprehensive index that captures the performance of 500 large-cap U.S. companies. The S&P 500 quickly became the benchmark for the U.S. stock market, as its market cap weighted structure provided a more accurate and representative measure of the market’s performance.

The Importance of Market Cap Weighting

Market cap weighted indexes are popular for a number of reasons, primarily because they:

- Reflect the true value of the market: By weighting companies based on their market capitalization, these indexes provide a more accurate representation of the overall market value, as they reflect the market’s collective assessment of the companies’ worth.

- Ease of calculation and transparency: Market capitalization is a readily available and easily calculated metric, making it a straightforward method for weighting index components. This also promotes transparency, as investors can easily understand how each company’s weight is determined.

- Promote investment in larger, more established companies: The weighting mechanism encourages investors to allocate more capital to larger, more established companies, which are perceived as having greater financial stability and growth potential. This also promotes a sense of confidence in the market, as investors are more likely to invest in companies that are already successful and have a strong track record.

Image: www.valueresearchonline.com

Emerging Trends in Market Cap Weighted Indexes

Market cap weighted indexes are constantly evolving, adapting to shifts in the global economy, investor preferences, and technological advancements. One notable trend is the rise of factor-based indexing, where indexes are constructed based on specific factors like value, momentum, or quality, rather than just market capitalization. This approach aims to capture investment opportunities that may be overlooked by traditional market cap weighted indexes.

Another emerging trend is the increasing popularity of ESG (environmental, social, and governance) investing, where investors consider a company’s ESG performance when making investment decisions. This has led to the development of ESG-focused market cap weighted indexes, which aim to track the performance of companies with strong ESG practices.

Expert Tips for Navigating Market Cap Weighted Indexes

Given the dominance of market cap weighted indexes, understanding their dynamics is crucial for navigating the stock market effectively. Here are some expert tips to consider:

- Diversification is key: While market cap weighted indexes offer a broad exposure to the market, it’s important to diversify your portfolio beyond these indexes. Consider investing in smaller-cap companies, international markets, and alternative asset classes to reduce overall portfolio risk and potential volatility.

- Focus on value, not just size: Remember that market capitalization alone is not a guarantee of investment success. Look beyond size and consider factors like profitability, growth prospects, and debt levels when evaluating individual companies.

- Stay informed about market trends: Keep abreast of market trends, news, and economic developments that can impact market valuations. Consider incorporating active investment strategies alongside your passive indexing approach to optimize portfolio performance.

By combining a passive investment approach focused on market cap weighted indexes with an active approach that includes diversification, value investing, and staying informed about market trends, you can create a well-rounded investment strategy that aligns with your individual financial goals and risk tolerance.

FAQ about Market Cap Weighted Indexes

Q: What is the difference between a market cap weighted index and a price-weighted index?

The key difference lies in how each company’s weight is determined. In a market cap weighted index, companies are weighted proportionally to their market capitalization (share price x number of outstanding shares), while in a price-weighted index, each company’s weight is based solely on its stock price. A market cap weighted index provides a more accurate representation of the market’s value, while a price-weighted index can be skewed by companies with high stock prices.

Q: Are market cap weighted indexes the best investment strategy?

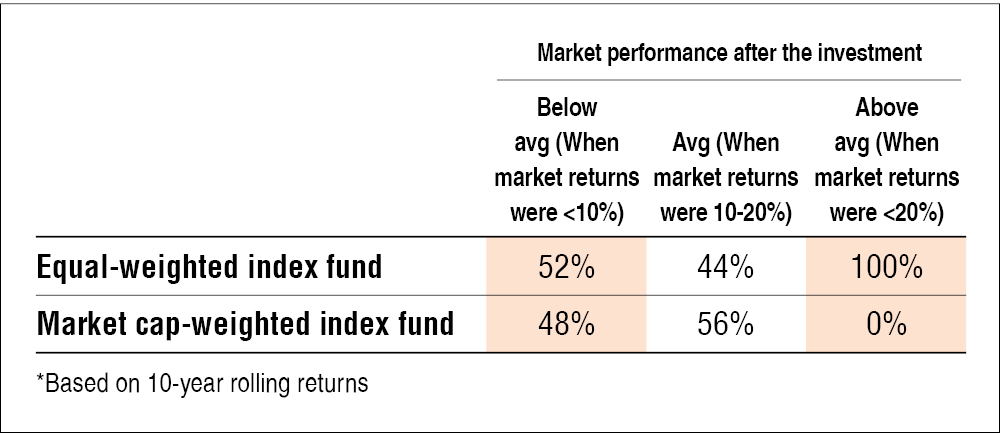

Market cap weighted indexes offer a convenient and generally well-performing investment strategy, but they are not without their limitations. They tend to favor larger, more established companies, which may not always outperform smaller-cap companies in certain market conditions. As with any investment strategy, it’s essential to carefully consider your individual financial goals, risk tolerance, and investment horizon before making any decisions.

Q: How can I invest in market cap weighted indexes?

You can invest in market cap weighted indexes through various methods, including exchange-traded funds (ETFs), mutual funds, and index tracking accounts. ETFs are primarily used by individual investors, while mutual funds are often preferred by institutional investors. Index tracking accounts are offered by some robo-advisors and online brokerage platforms, providing a hands-off approach to indexing.

Market Cap Weighted Index

Conclusion: Unveiling the Power of Size

Market cap weighted indexes play a central role in the stock market, offering investors a convenient and generally reliable way to track market performance. While these indexes offer significant advantages, it’s essential to remain aware of their limitations and to incorporate a well-rounded investment strategy that balances passive indexing with active investment approaches.

Are you interested in learning more about the ins and outs of market cap weighted indexes? Share your thoughts in the comments below!