Calculating a price-weighted index is a valuable tool for investors seeking to track changes in the prices of a group of assets over time. This index, commonly used in the financial industry, provides insights into market movements and can aid in portfolio performance evaluation.

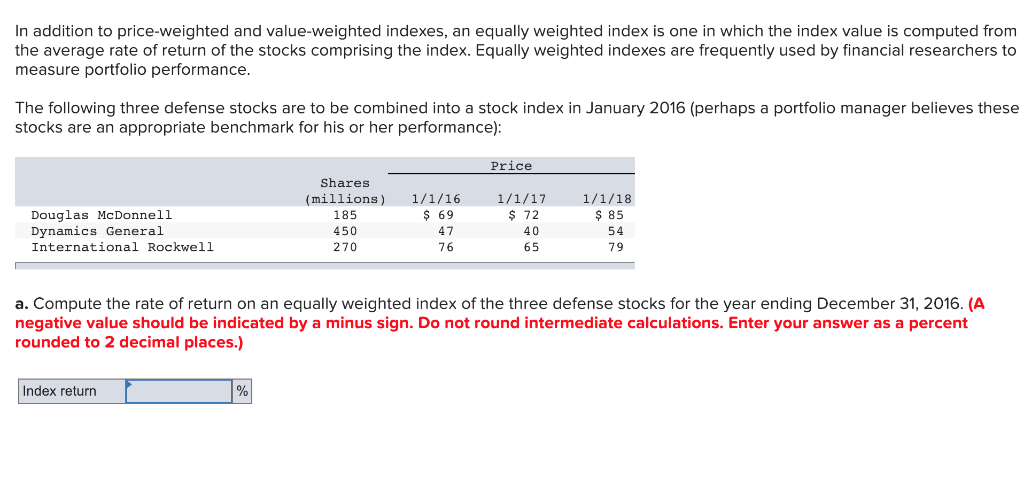

Image: www.chegg.com

Enter the **Price-Weighted Index (PWI)**, a simple yet effective measure that reflects the aggregate price changes of a defined set of assets. This index is often employed to gauge the performance of a specific market segment, such as stocks or commodities.

Understanding the Price-Weighted Index

The PWI’s calculation is straightforward, involving three key steps:

- Select Assets: Choose a group of assets whose price movements you wish to track.

- Assign Weights: Each asset is assigned a weight based on its market value or share price. Typically, the weight is proportional to the asset’s size or importance within the group.

- Calculate Price Weighted Index: Multiply each asset’s weight by its current price. Sum up these values to obtain the PWI.

The resulting PWI represents the average price of the assets in the group, weighted by their respective market values. An upward or downward trend in the PWI indicates an overall increase or decrease in the prices of the selected assets.

Recent Trends and Developments:

The PWI has witnessed growing adoption in recent times due to its simplicity and transparency. However, it is important to note that the PWI is susceptible to extreme movements caused by a few large assets within the group. For a more balanced representation, investors often combine the PWI with other market indices, such as the value-weighted index or the equal-weighted index.

Tips and Expert Advice

When calculating or utilizing the PWI, consider the following tips from experienced investors:

- Select Suitable Assets: Ensure that the assets included in your PWI align with your investment objectives and represent the market segment you wish to monitor.

- Review Weights Regularly: The weights assigned to each asset should be periodically reviewed and adjusted to reflect changes in market value or investment strategy.

- Consider Alternative Indices: Supplement the PWI with other market indices to gain a comprehensive view of market performance.

By adhering to these guidelines, investors can maximize the effectiveness of the PWI in their investment analysis and decision-making.

Image: blog.arch.finance

Frequently Asked Questions (FAQs)

Q: How does the PWI differ from a value-weighted index?

A: Unlike the PWI, a value-weighted index assigns weights based on the total market capitalization of each asset. This means that larger assets have a more significant influence on the index value.

Q: What are the advantages of using the PWI?

A: The PWI is simple to calculate, easy to understand, and provides a straightforward measure of price changes. It is also less susceptible to manipulation than some other indices.

Q: Are there any limitations to using the PWI?

A: The PWI can be heavily influenced by a few large assets within the group, leading to potential distortions in market representation.

Calculate Price Weighted Index

Conclusion

Calculating a price-weighted index is a valuable skill for investors and market analysts. By following the steps and considerations outlined in this article, you can effectively track and analyze price movements in a group of assets. Whether you are evaluating a stock portfolio or monitoring commodity prices, the PWI offers a versatile tool for gaining insights into market behavior.

Are you interested in putting your newfound knowledge into practice? Let us know in the comments below!