Picture yourself as a trader navigating the turbulent waters of the forex market. Amidst the relentless volatility and fluctuating prices, you crave an edge—a tool that can decipher market trends, predict price movements, and guide your trading decisions with precision. Behold the power of the Two Moving Averages Chaikin (TMAC) indicator!

Image: www.dailyforex.com

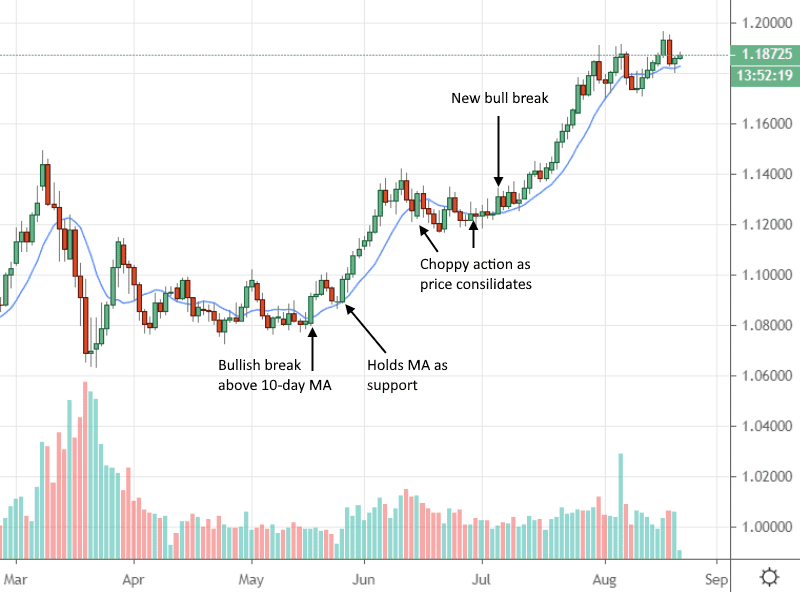

Aiding Decision-Making Through Visual Clues

The TMAC indicator is a versatile technical analysis tool that empowers forex traders with valuable insights into market momentum and trend direction. It combines the simplicity of moving averages with the insightful Chaikin oscillator to create a comprehensive indicator that simplifies decision-making, allowing traders to:

- Identify trending markets:

- Determine the strength and direction of trends:

- Spot potential reversals and trend changes:

Deciphering Market Dynamics

At its core, the TMAC indicator comprises two moving averages: a fast-moving average (FMA) and a slow-moving average (SMA).

The FMA, typically set to a shorter period (e.g., 10 days), responds swiftly to price movements, providing traders with an immediate snapshot of short-term market sentiment. The SMA, often set to a longer period (e.g., 20 days), smooths out price fluctuations, revealing the underlying trend.

Embracing the Chaikin Oscillator

The Chaikin oscillator adds a layer of sophistication to the TMAC indicator, measuring the difference between the Accumulation/Distribution (A/D) line and its exponential moving average (EMA). The A/D line gauges the net flow of money into and out of a security, providing insights into supply and demand dynamics.

When the Chaikin oscillator is rising, it indicates that buyers are in control and upward momentum is gaining strength. Conversely, a falling oscillator suggests that sellers are driving the market, and potential downtrends are on the horizon.

Image: forexwot.com

Navigating the TMAC Signals

The TMAC indicator generates trading signals based on the relationship between the moving averages and the Chaikin oscillator:

- Bullish signal: When the FMA crosses above the SMA from below, and the Chaikin oscillator is rising, it signals potential buying opportunities.

- Bearish signal: When the FMA crosses below the SMA from above, and the Chaikin oscillator is falling, it suggests a bearish trend and possible selling opportunities.

Tips and Expert Insights

To harness the full potential of the TMAC indicator, consider expert advice:

- Confirm signals: Never rely solely on TMAC signals. Validate them with additional technical analysis tools and fundamental factors.

- Set realistic expectations: No indicator is foolproof. Use TMAC as a guide, not a guarantee of success.

- Manage risk: Employ proper risk management strategies to protect your capital.

Frequently Asked Questions

- Q: What time frame is best for the TMAC indicator?

- Q: Can the TMAC indicator be used on any currency pair?

- Q: What are the limitations of the TMAC indicator?

A: The optimal time frame depends on the trading style. Scalpers typically use shorter time frames (1-5 minutes), while swing traders prefer longer time frames (daily or weekly).

A: Yes, the TMAC indicator is applicable to all currency pairs.

A: Like any technical analysis tool, the TMAC indicator is not infallible. It may provide false signals or fail to account for sudden market shifts.

Two Moving Averages Chaikin Forex Trading Indicator

Conclusion

The Two Moving Averages Chaikin Forex Trading Indicator is an invaluable asset for forex traders seeking to uncover market trends, predict price movements, and amplify their trading decisions. By understanding its inner workings and employing the insights it provides, traders can gain a competitive edge in the ever-evolving forex market.

Are you ready to unlock the power of the TMAC indicator and elevate your forex trading journey? Explore its intricacies further and discover how it can transform your trading experience!