Introduction: Taming the Forex Beast with Trend Trading

The world of forex trading is a relentless battleground where traders vie for profits amidst the ever-fluctuating currency markets. In this arena, trend trading stands as a formidable ally, allowing traders to harness the inherent momentum of the market to their advantage. Whether you’re a seasoned pro or a novice seeking to decipher the intricate dance of currencies, this comprehensive guide will equip you with the knowledge and strategies to excel in the realm of trend trading.

Image: www.cashbackforex.com

Unveiling the Forex Trend Trading Trinity: Identifying, Confirming, and Riding the Wave

Mastering the art of trend trading hinges upon a three-step process: identification, confirmation, and execution. Identifying trends is the cornerstone of this strategy, and traders must possess a keen eye for recognizing when the market is making a sustained move in a particular direction. Confirmation comes next, as traders seek validation of the identified trend by examining multiple indicators and time frames. Finally, execution involves exploiting the confirmed trend, entering and exiting trades strategically to maximize profits.

Technical Indicators: Your Forex Trading Arsenal

The world of technical indicators is a treasure cove for trend traders, providing an array of tools to enhance trend analysis and decision-making. Leading indicators such as moving averages, Bollinger Bands, and parabolic SARs serve as valuable trend gauges, forecasting future price movements with varying degrees of precision. Lagging indicators like stochastic oscillators and relative strength index (RSI) offer confirmation of existing trends, while volume indicators provide insights into market sentiment and trading volume.

Moving Averages: Smoothing the Currency Rollercoaster

Moving averages stand among the most widely used trend indicators, offering a simplified representation of price action by eliminating random fluctuations. By smoothing out the data, moving averages unveil the underlying trend, enabling traders to identify potential trading opportunities. Traders can tailor moving averages to suit their strategies, adjusting the number of periods to achieve optimal trend identification and filtering.

Image: shimpacconte.blogspot.com

Bollinger Bands: Riding the Market’s Elastic Bands

Bollinger Bands are a versatile tool that provides insights into market volatility and trend direction. These bands consist of three lines: a middle moving average and two price channels that form around it. When prices stay within the Bollinger Bands, it suggests a period of low volatility and potential trend continuation. Breakouts above or below the Bollinger Bands, however, often signal a change in trend direction or increased volatility.

Stochastic Oscillators: Delving into Market Momentum

Stochastic oscillators gauge the momentum of a currency pair by measuring the relative position of its closing price within a specific timeframe. When the indicator is above 80%, it suggests an overbought condition and a potential reversal; when it falls below 20%, it indicates an oversold condition and a possible trend continuation. Stochastic oscillators help traders identify potential turning points in the market and time their entries and exits accordingly.

Relative Strength Index (RSI): Quantifying Market Strength

The relative strength index (RSI) is another momentum oscillator, but it measures the magnitude of price changes in a currency pair, not just the closing price. The RSI ranges from 0 to 100, with levels above 70 indicating an overbought condition and levels below 30 suggesting an oversold condition. Traders use RSI to identify divergences between the price of a currency pair and its RSI, which can provide valuable insights into potential trend reversals.

Volume Indicators: Deciphering the Market’s Dance

Volume indicators measure the amount of trading activity within a specific timeframe, providing valuable insights into market sentiment and trend confirmation. High volume during uptrends signals a stronger trend, while high volume during downtrends can indicate an intensifying sell-off. Volume indicators help traders assess the liquidity and volatility of a currency pair, enabling them to make informed trading decisions.

Harnessing the Power of Trend Trading: A Three-Step Game Plan

Once you’ve mastered the art of trend trading, it’s time to put your knowledge into action. Identifying trends, confirming their strength, and executing trades strategically are the three pillars of a successful trend trading plan. But remember, trend trading is like a grand chess game—patience, discipline, and risk management are crucial to outsmart the market and emerge victorious.

Identifying Trends: Spotting the Elusive Market Currents

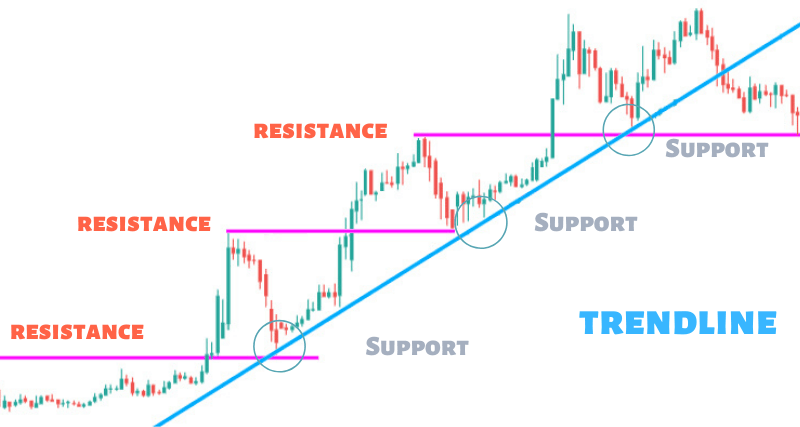

Identifying trends is the foundation of trend trading, and there are various techniques to help you master this skill. Price action analysis, which involves studying the raw price movements of a currency pair without relying on indicators, can provide valuable insights into trend direction. Trendlines and support and resistance levels are other tools that traders use to delineate trends and identify potential trading opportunities.

Confirming Trends: Corroborating Your Market Hypothesis

After identifying a potential trend, traders seek confirmation to minimize the risk of false signals. This can involve using multiple time frames to analyze the trend, examining the behavior of related currency pairs, and incorporating technical indicators. By confirming trends from multiple perspectives, you increase the probability of making profitable trades.

Trade Execution: Orchestrating Your Forex Symphony

Once a trend has been identified and confirmed, it’s time to orchestrate your trading execution with surgical precision. Enter the trade at a favorable price, carefully managing risk with stop-loss orders, and plan your exit strategy to lock in profits while preserving capital. Remember, the profit-taking and risk management decisions you make will ultimately determine your trading success.

Best Forex Trend Trading Strategy

Conclusion: Embracing the Trend, Mastering the Forex Market

In the ever-changing landscape of forex trading, trend trading emerges as a powerful tool, enabling traders to harness the momentum of the market and capture consistent profits. By understanding the principles of trend identification, confirmation, and execution, you can conquer the currency markets with confidence and precision. Remember, mastering trend trading is a journey, not a destination. Embark on this path with dedication, adapt to the evolving market landscape, and let the profits flow like a mighty river.