Harnessing the power of forex momentum trading strategies can catapult your profitability to extraordinary heights. This engaging and comprehensive guide will equip you with the essential knowledge and tactics to master this dynamic trading style. Get ready to delve into the fast-paced world of forex momentum trading and unlock the secrets to consistent success.

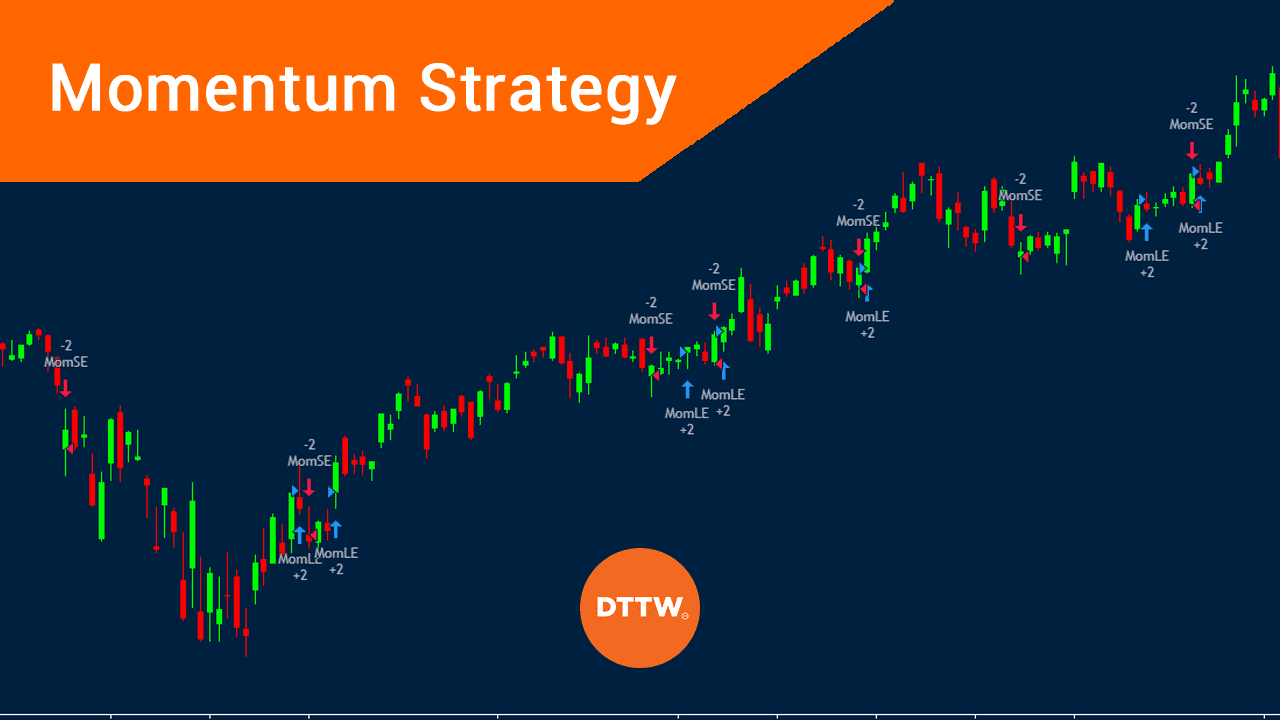

Image: www.daytradetheworld.com

Unveiling the Essence of Forex Momentum Trading

Forex momentum trading thrives on exploiting market trends by aligning trades with the prevailing momentum. This proactive trading approach seeks to capture substantial profits by identifying and riding the waves of price movements. By analyzing past price action and using technical indicators, momentum traders aim to time their entries and exits with precision, maximizing their chances of capitalizing on favorable market conditions.

Understanding the Basics of Momentum Trading

Momentum trading, in essence, is momentum investing applied to the foreign exchange market. Its premise is founded upon the notion that trends tend to persist, and by identifying and aligning with these trends, traders can significantly enhance their profitability.

At the heart of momentum trading lies the concept of price momentum, which measures the rate of change in an asset’s price over a specific period. By tracking the momentum of a currency pair, traders can discern whether its trend is strengthening or weakening, allowing them to make informed trading decisions.

The Importance of Momentum Trading in Forex

In the dynamic and ever-evolving world of forex trading, momentum trading stands out as a vital approach for several compelling reasons:

-

Predictability: Momentum trading provides traders with a structured framework for analyzing market trends, enabling them to make informed predictions about future price movements.

-

Magnified Profits: By aligning trades with prevailing momentum, traders can potentially amplify their profits by capturing significant price swings.

-

Risk Mitigation: Momentum trading often involves placing trades in line with the market’s dominant trend, which can reduce the likelihood of substantial losses.

Image: www.youtube.com

Identifying Momentum in the Forex Market

Identifying momentum in the forex market is a crucial skill for successful momentum trading. Here are some effective techniques:

Technical Indicators

Technical indicators are essential tools for identifying momentum in the forex market. Some of the most commonly used indicators for momentum trading include:

-

Relative Strength Index (RSI): The RSI is an oscillator that measures the magnitude of recent price changes to identify overbought or oversold conditions.

-

Moving Averages: Moving averages are trend-following indicators that smooth out price fluctuations and indicate the general direction of the trend.

-

Bollinger Bands: Bollinger Bands are a volatility indicator that creates an upper and lower band around the moving average, highlighting periods of high and low volatility.

Volume Analysis

Volume analysis is another valuable method for identifying momentum in the forex market. High volume typically indicates strong market sentiment and increased volatility, providing clues about the potential strength or weakness of a trend.

By combining technical indicators with volume analysis, momentum traders can make informed judgments about the direction and strength of a trend, allowing them to pinpoint trading opportunities with greater precision.

Winning Momentum Trading Strategies for Enhanced Profits

The forex market presents a vast array of momentum trading strategies, each offering unique strengths and risk profiles. Here are some popular and effective strategies to consider:

Trend-Following Strategies

Trend-following strategies capitalize on established trends by entering trades in the direction of the prevailing trend. These strategies aim to capture significant price swings while minimizing the risk of reversals.

Breakout Strategies

Breakout strategies seek to identify and trade breakouts from trading ranges or specific price levels. The underlying assumption is that breakouts often signal the start of a new trend, providing opportunities for substantial profits.

Pullback Strategies

Pullback strategies involve entering trades in the direction of the prevailing trend after a temporary correction or pullback. These strategies aim to capitalize on price retracements that often occur during a larger trend, offering traders an opportunity to buy or sell at more favorable prices.

Choosing the Right Momentum Trading Strategy for You

Selecting the most suitable momentum trading strategy depends on your individual risk tolerance, trading style, and market conditions. Here are some factors to consider when choosing a strategy:

-

Risk Tolerance: Trend-following strategies are generally considered less risky than breakout or pullback strategies, as they align trades with the prevailing trend.

-

Trading Style: Breakout strategies often require quick reaction times and a high level of trading activity, while pullback strategies may be more suitable for those seeking a less aggressive approach.

-

Market Conditions: Different momentum trading strategies perform better in specific market conditions. For example, trend-following strategies excel in trending markets, while breakout and pullback strategies may be more appropriate in volatile or range-bound markets.

Trade The Momentum Forex T

Conclusion

Momentum trading, with its ability to exploit price trends and amplify profits, is a highly effective trading approach in the fast-paced world of forex. By understanding the basics, identifying momentum, and adopting winning