Introduction

Image: fxopen.com

Are you seeking an effective tool to decipher the intricate dance of price movements in the forex market? Look no further than the Chande Momentum Oscillator (CMO), a game-changing indicator shrouded in power and accuracy. Join us on an enlightening journey as we delve into its depths, exploring its genesis, unraveling its mechanics, and unlocking its potential to transform your trading prowess.

Unveiling the Chande Momentum Oscillator (CMO)

The CMO, a brainchild of eminent technical analyst Tushar Chande, stands as a reliable companion for traders seeking to unravel the underlying momentum of a given financial instrument. This versatile oscillator serves as a potent metric for identifying overbought and oversold conditions, pinpointing potential reversals, and much more.

Calculating the CMO: A Mathematical Journey

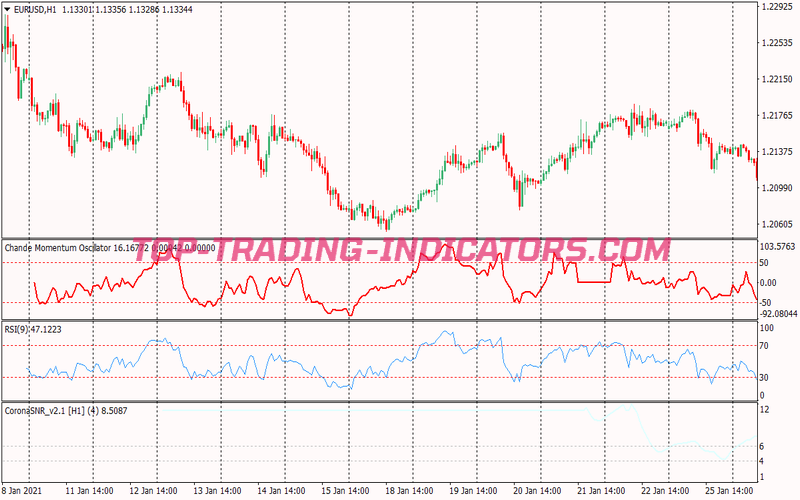

At the heart of the CMO lies a mathematical formula that harnesses the power of momentum to quantify market movements. It calculates the difference between two moving averages — one short-term and one long-term — of upward and downward price changes. The resulting value oscillates between -100 and +100, providing a clear visual representation of market momentum.

Zone System: Navigating the Oscillator’s Spectrum

To interpret the signals emanating from the CMO, Tushar Chande devised an ingenious Zone System. This system categorizes the oscillator’s values into five distinct zones, each assigned a specific price action scenario:

- Zone 1: Undersold (-100 to -50): A prime opportunity to consider potential buying opportunities as the market is deeply undervalued.

- Zone 2: Oversold (-50 to -20): A cautious area that suggests the market may be approaching an oversold condition, warranting consideration of long positions.

- Zone 3: Neutral (-20 to +20): A period of equilibrium, where buyers and sellers engage in a delicate balancing act.

- Zone 4: Overbought (+20 to +50): A signal to be wary of overvalued conditions, often signaling opportunities for profit-taking or short-selling.

- Zone 5: Extremely Overbought (+50 to +100): An indication that the market may be highly overextended and ripe for a potential reversal.

Unveiling the Secrets of the CMO

The CMO operates as a versatile tool, offering numerous insights to traders of all experience levels. Its arsenal of capabilities includes:

- Overbought and Oversold Conditions: Identifying extreme market conditions that may herald potential reversals or corrections.

- Trend Analysis: Validating or invalidating existing trends by confirming whether momentum aligns with the overall price direction.

- Reversal Signals: Pinpointing potential turning points where price momentum shifts, indicating a change in market sentiment.

- Divergences: Detecting discrepancies between the price action and the CMO, a phenomenon that often forewarns of a potential price reversal.

Conclusion

The Chande Momentum Oscillator emerges as an indispensable tool for traders striving to unlock the secrets of price movements. Its ability to quantify momentum, identify overbought and oversold conditions, and provide invaluable trading signals makes it a formidable ally in the pursuit of financial success. Embrace the power of the CMO, navigate market intricacies with newfound confidence, and unlock your trading potential.

Image: top-trading-indicators.com

Chande Momentum Oscillator Site Forex Station.Com