Picture this: you’re browsing your favorite financial news website and come across an article about a particular stock index climbing to record highs. You’re intrigued but you’re not sure what factors influence the index’s movement. Is it just the overall market sentiment or are there specific components driving the growth? This is where understanding the concept of value-weighted index calculation comes into play. It sheds light on the underlying mechanics of how these indexes function and helps us grasp the bigger picture of market dynamics.

Image: www.investorgreg.net

In this comprehensive article, we’ll delve into the world of value-weighted indexes, exploring how they are calculated, their significance in financial markets, and their impact on investors. We’ll examine real-world examples, discuss their advantages and limitations, and provide you with actionable insights to make informed investment decisions.

Understanding Value-Weighted Indexes: The Foundation of Market Performance

A value-weighted index, as the name suggests, is a type of market index that allocates weight to each component security based on its market capitalization – the total value of its outstanding shares. In simpler terms, the larger the company’s market capitalization, the greater its influence on the index.

Imagine a pie chart where each slice represents a company in the index. The size of each slice is determined by the company’s market capitalization. Companies with larger market caps have larger slices, meaning they have a greater impact on the index’s overall performance. This weighting mechanism ensures that the index accurately reflects the market value of the underlying securities.

The Mechanics of Calculation: A Step-by-Step Breakdown

Calculating a value-weighted index involves the following steps:

- Determine the Market Capitalization: Multiply the current share price of each company by the number of outstanding shares. This gives you the market capitalization for each individual company.

- Calculate the Total Market Capitalization: Sum up the market capitalization of all the companies included in the index.

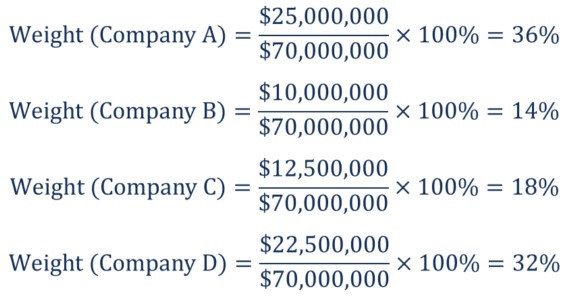

- Calculate the Weighting Factor: Divide each company’s market capitalization by the total market capitalization. This gives you the weighting factor for each company.

- Determine the Index Value: Multiply the weighting factor of each company by its current share price and sum up the results. This gives you the index value.

Illustrative Example: Unveiling the Importance of Weighting

Let’s consider a simple example with three companies: Company A, Company B, and Company C.

| Company | Share Price | Outstanding Shares | Market Capitalization | Weighting Factor |

|---|---|---|---|---|

| Company A | $100 | 100,000 | $10,000,000 | 0.50 |

| Company B | $50 | 500,000 | $25,000,000 | 0.625 |

| Company C | $20 | 200,000 | $4,000,000 | 0.125 |

From the table, we can see that Company B has the highest market capitalization and therefore the most significant weighting factor. If Company B’s share price increases by 10%, it will have a greater impact on the index’s overall value compared to Company A or Company C. This illustrates how the value-weighted system effectively reflects the influence of larger companies on the market.

Image: haipernews.com

Advantages and Limitations of Value-Weighted Indexes

Advantages:

- Reflection of Market Value: Value-weighted indexes accurately represent the market value of the underlying securities, providing a reliable gauge of overall market performance.

- Focus on Large Cap Companies: These indexes tend to be dominated by large-cap companies, which are often seen as more stable and less risky.

- Liquidity: Large-cap companies tend to have higher trading volumes, contributing to the liquidity of the index and facilitating easier trading for investors.

Limitations:

- Over-Representation of Large Companies: The emphasis on market capitalization can lead to an over-representation of large companies, potentially ignoring the performance of smaller, more dynamic companies.

- Distortion from Company Splits and Mergers: Corporate actions like stock splits and mergers can significantly impact the weighting of companies within the index, leading to potential distortions.

- Limited Diversity: Value-weighted indexes often emphasize specific sectors or industries, potentially limiting the diversity of investment options for investors.

Navigating the World of Value-Weighted Indexes: Tips for Investors

While value-weighted indexes play a crucial role in financial markets, it’s important to approach them with a balanced perspective. Consider these tips:

- Diversify Your Portfolio: Don’t rely solely on value-weighted indexes for your investment decisions. Diversifying your portfolio by investing in other asset classes, including smaller-cap companies, can help mitigate risks and enhance potential returns.

- Understand the Index Construction: Familiarize yourself with the specific companies included in the index and their respective weighting factors. This will help you understand the index’s composition and its potential biases.

- Consider Alternative Indexes: Explore other types of market indexes, such as equal-weighted indexes, which distribute weight equally across all component securities regardless of their market capitalization.

Frequently Asked Questions (FAQs):

Q: How frequently are value-weighted indexes recalculated?

A: The frequency of recalculation varies depending on the index. Some indexes are adjusted daily, while others are recalculated monthly, quarterly, or annually.

Q: Is it possible for the value of a value-weighted index to decline even if all the underlying companies increase in price?

A: Yes, it’s possible. If the weighting factor of some companies decreases due to factors like mergers, acquisitions, or stock splits, the overall index value might decline even if the prices of those companies increase.

Q: How do value-weighted indexes compare to price-weighted indexes?

A: Price-weighted indexes, such as the Dow Jones Industrial Average, assign weight to each component based on its share price. This means that companies with higher share prices have a larger influence on the index. Value-weighted indexes, on the other hand, consider market capitalization, making them more representative of the overall market value.

Value Weighted Index Calculation

Conclusion: Empowering Your Investment Journey

Value-weighted indexes offer valuable insights into the performance of financial markets. By understanding how these indexes are calculated and their advantages and limitations, you can make more informed investment decisions. Remember to diversify your portfolio, consider alternative indexes, and stay informed about market trends.

Are you interested in learning more about specific value-weighted indexes like the S&P 500 or the NASDAQ Composite? Share your thoughts and questions in the comments section below. Let’s continue the conversation and delve deeper into the fascinating world of market indices!