Understanding Position Sizing In The Stock Market

Picture this: you’re a new investor, excited about the stock market and eager to make big profits. You see a hot stock going up and decide to invest a significant portion of your savings. Unfortunately, the stock takes a sudden dip, and you panic. You sell at a loss, feeling the sting of your impulsive decision. This scenario highlights the importance of good risk management, and a key component of that is position sizing.

Image: baxiamarkets.com

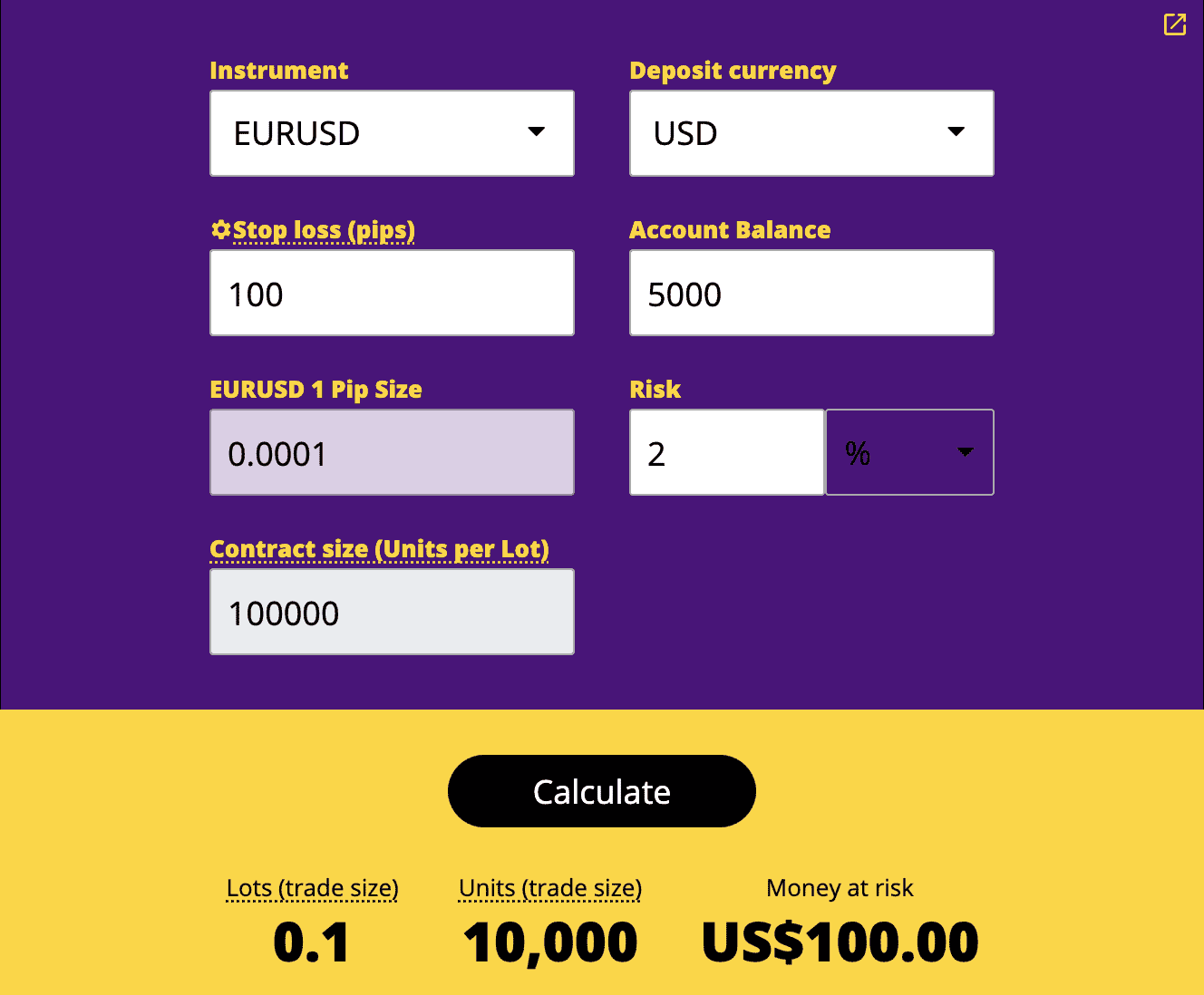

Position sizing refers to the amount of capital you allocate to each trade. Determining the optimal position size ensures you’re not risking too much on any given trade, protecting you from significant losses. This is where an indices position sizing calculator comes in handy.

The Role of Indices Position Sizing Calculators

What is an Indices Position Sizing Calculator?

An indices position sizing calculator is a tool used by traders and investors to determine the appropriate size of their positions based on their risk tolerance and the volatility of the market. This calculator takes various factors into account, including the market value of the index, your account size, your desired risk percentage, and the stop-loss order you set.

Why Use an Indices Position Sizing Calculator?

Using a position sizing calculator offers significant benefits for both seasoned traders and beginners. It helps you:

- Quantify Risk: The calculator helps you understand the potential losses associated with each trade, allowing you to manage your risk effectively.

- Control Your Emotions: By having a pre-determined position size, you’re less likely to panic when the market moves against you, promoting disciplined trading decisions.

- Optimize Portfolio Diversification: A calculator helps you allocate capital wisely, ensuring you’re not over-exposed to any single index or asset class.

- Maximize Profits: By managing risk effectively, you can maintain a consistent trading strategy, ultimately increasing your chances of long-term profitability.

Image: indicatorchart.com

Key Factors To Consider

Risk Tolerance:

Risk tolerance is your personal ability to handle potential losses. A higher risk tolerance might lead to larger position sizes, while lower risk tolerance requires smaller positions.

Account Size:

Your account size is fundamental in determining position size. Larger accounts can handle bigger trades, while smaller accounts should start with smaller positions.

Stop-Loss Orders:

Stop-loss orders are pre-determined exit points for your trades. They help you limit potential losses. When calculating position size, the calculator considers the potential loss at your stop-loss level.

The Benefits of Using an Indices Position Sizing Calculator

Enhanced Risk Management:

The most significant benefit of an indices position sizing calculator is its ability to help you manage risk effectively. By determining the appropriate position size, you can control potential losses and protect your capital.

Improved Trading Discipline:

Using a calculator promotes disciplined trading. Instead of making emotional decisions based on market fluctuations, you can stick to your pre-determined position sizes, minimizing impulsive trading.

Increased Profitability:

By minimizing losses and maximizing opportunities, a position sizing calculator can contribute to a more consistent trading strategy, boosting your overall profitability.

Tips for Effective Position Sizing

Start Small:

Especially for beginners, it’s recommended to start with small positions. This allows you to gain experience without risking excessive capital. As you become more comfortable and confident, you can gradually increase your positions.

Adjust Your Position Sizes:

The market dynamics are constantly changing. Be prepared to adjust your position sizes based on volatility, your risk appetite, and your trading strategy.

Use a Position Sizing Calculator:

There are numerous online and software-based position sizing calculators available. Utilize these tools to make informed decisions about your trade size.

Frequently Asked Questions

Q: How do I choose the right position size?

A: There’s no one-size-fits-all answer. It depends on your risk tolerance, account size, and the specific market conditions. A position sizing calculator can help you determine the appropriate size.

Q: Should I adjust my position size based on volatility?

A: Yes, it’s crucial to adjust your position size as market volatility changes. Higher volatility warrants smaller positions to limit risks, while lower volatility might allow for larger positions.

Q: Can I use a position sizing calculator for any market?

A: Yes, calculators can be applied to different markets, like stocks, indices, or futures. However, it’s important to use a calculator specifically designed for the type of market you’re trading in.

Indices Position Size Calculator

Conclusion

An indices position sizing calculator is an essential tool for traders and investors looking to manage risk effectively and improve their trading strategies. By understanding the factors that influence position size, and utilizing calculators, you can make informed decisions about how much capital to allocate to each trade. It’s important to select a calculator tailored to your needs, and to continually adapt your trading approach based on market dynamics.

Are you interested in learning more about indices position sizing calculators or improving your trading strategies? Let’s start a conversation in the comments below!