In today’s rapidly evolving financial landscape, Contract for Difference (CFD) trading has emerged as a highly popular and versatile instrument. CFDs provide traders with a way to speculate on the price movement of various assets, including stocks, indices, commodities, and currencies. This article offers a comprehensive exploration of CFD trading markets, empowering you with the understanding to make informed decisions and explore trading opportunities.

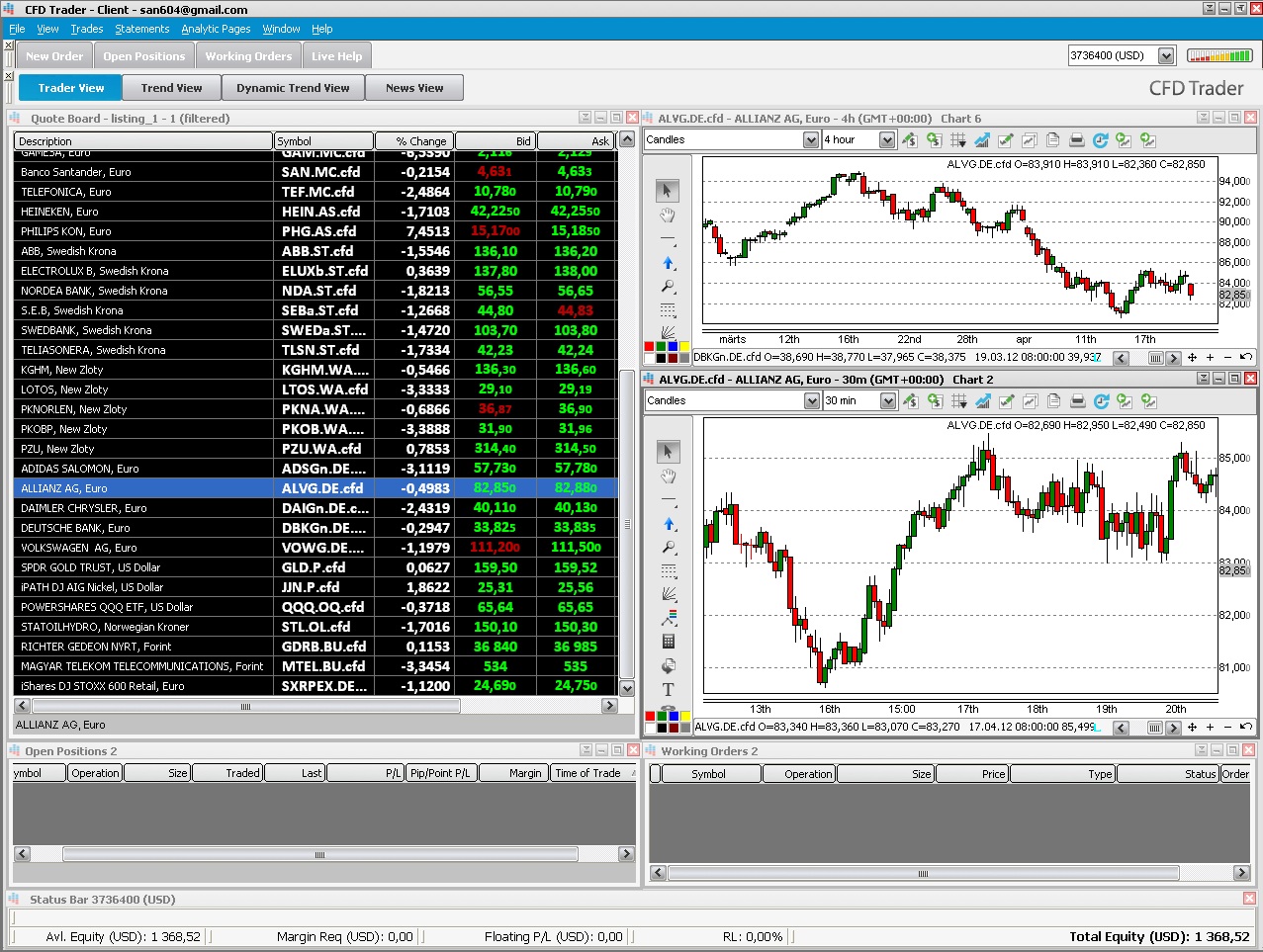

Image: www.financemagnates.com

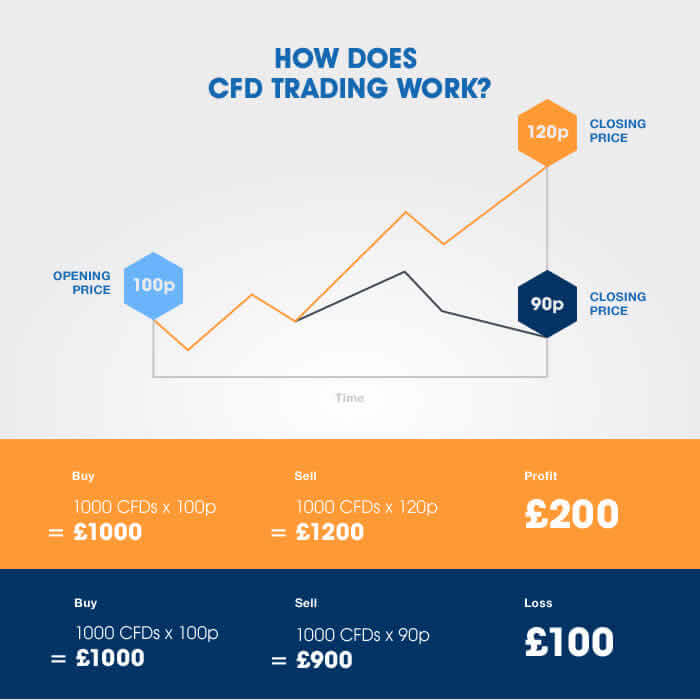

A CFD is a contract between two parties, the buyer and the seller, to exchange the difference in the price of an underlying asset from the time the contract is entered into to when it is closed. The buyer assumes the position that the price will rise, while the seller assumes the position that the price will fall. Unlike traditional asset ownership, with CFDs, you do not acquire actual ownership of the asset itself; instead, you are speculating on its price movements.

Advantages of CFD Trading

CFD trading offers several compelling advantages for traders:

- Leverage: CFDs enable traders to amplify their potential returns by providing leverage, which allows them to control larger positions with a smaller initial investment.

- Short Selling: Traders can speculate on falling prices by selling CFDs short. This enables them to potentially profit from market downturns.

- Diversification: CFDs provide access to a broad range of markets, allowing traders to diversify their portfolios and reduce overall risk.

- Accessibility: CFDs are widely available on various trading platforms, making them accessible to both experienced and novice traders.

- Unlimited Profit Potential: Unlike options, there is no limit to the potential profits in CFD trading, as the rewards are based on the price movement of the underlying asset.

Types of CFD Trading

CFD trading encompasses various types, each catering to different trading styles and objectives:

- Stock CFDs: These CFDs track the price movement of individual stocks on stock exchanges.

- Index CFDs: Index CFDs replicate the movement of stock market indices, providing exposure to a broader market.

- Commodity CFDs: Commodity CFDs allow traders to speculate on the price fluctuations of commodities such as gold, oil, and agricultural products.

- Currency CFDs: Forex CFDs offer traders the opportunity to capitalize on currency fluctuations and movements in the foreign exchange market.

CFD Trading Platforms

Selecting a reputable and reliable CFD trading platform is crucial for your trading success. Consider the following factors when choosing a platform:

- Regulation: Ensure that the platform is regulated by reputable financial authorities to maintain transparency and security.

- Fees and Spreads: Compare the trading fees and spreads offered by different platforms to minimize transaction costs.

- Features and Tools: Consider the trading platform’s functionality, including chart analysis, market research tools, and customer support.

- Reputation: Research the platform’s reputation among traders for reliability, efficiency, and transparency.

- Account Structure: Choose a trading platform that offers account types that suit your investment needs and trading style.

Image: www.spreadco.com

Risks of CFD Trading

While CFD trading provides opportunities for financial growth, there are inherent risks that should be carefully considered:

- Leverage Risk: While leverage can amplify profits, it can also magnify losses if the market moves against your position.

- Market Volatility: CFDs are subject to market fluctuations, and unexpected market events can lead to significant losses.

- Unlimited Loss Potential: Unlike options with predetermined risks, CFD traders are exposed to unlimited potential losses beyond their initial investment.

- Execution Risks: Market conditions, such as high volatility or low liquidity, may affect order execution and result in slippage or delayed trades.

- Margin Calls: When losses exceed the trader’s deposited margin, brokers may issue margin calls, demanding additional funds to cover the deficit.

Cfd Trading Markets

Strategies and Considerations for CFD Trading

Developing a sound trading strategy is essential for successful CDF trading. Here are some strategies and considerations to enhance your trading:

- Technical Analysis: Use technical analysis techniques to identify patterns, trends, and potential trading opportunities based on historical price data.

- Fundamental Analysis: Conduct fundamental analysis to understand the economic, financial, and industry factors that influence the underlying asset’s price.

- Risk Management: Implement proper risk management strategies such as stop-loss orders, position sizing, and leverage control to mitigate potential losses.

- Psychology: Understand the psychological aspects of trading, including emotional control and discipline, to avoid impulsive decisions.

- Education and Practice: Continuously educate yourself about CFD trading markets, strategies, and risk management principles through reputable resources and practice accounts.

In conclusion, CFD trading offers a dynamic and potentially rewarding opportunity to participate in financial markets. By understanding the concepts, advantages, and risks involved, as well as selecting a reliable trading platform and developing a sound trading strategy, you can harness the power of CFD trading and unlock the vast possibilities of today’s complex and interconnected financial landscape.