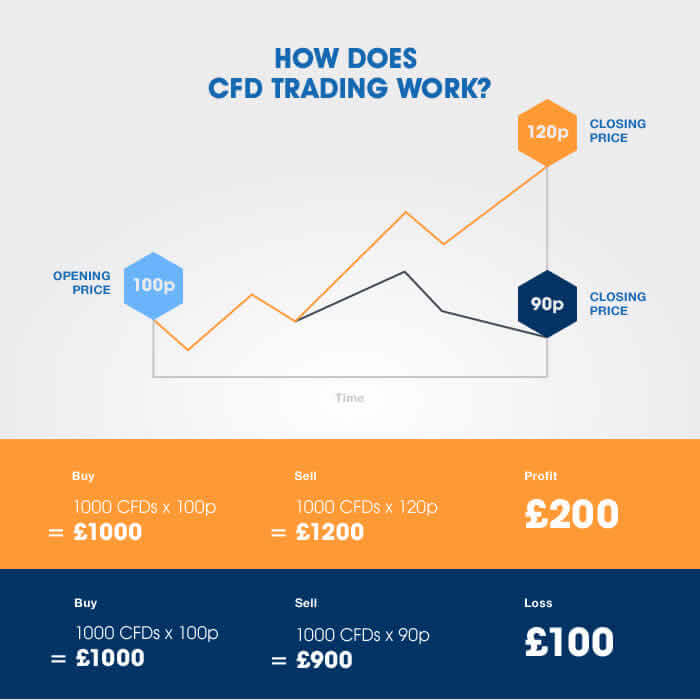

Have you ever wondered how you could amplify your trading potential while navigating the dynamic financial markets? In the realm of online finance, a popular and often-discussed tool is the Contract for Difference (CFD). It’s all about leveraging, a strategy that allows traders to participate in market movements with a smaller initial investment. This approach can boost gains, but it also magnifies potential losses.

Image: www.spreadco.com

This comprehensive guide will dive deep into CFD trading in the US, shedding light on its intricacies, regulatory landscape, and potential benefits and risks. Whether you are a seasoned investor or a curious newbie, this article aims to equip you with the understanding required to make informed decisions in the world of CFDs.

What are CFDs?

A CFD is a financial instrument that lets you speculate on the price movements of an underlying asset without owning the asset itself. Instead of buying or selling the asset directly, you are essentially entering into an agreement with a broker to exchange the difference in the asset’s price at the start and end of the contract.

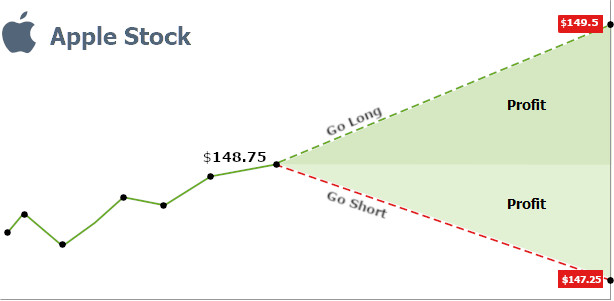

Think of it like this: Imagine you believe the price of Apple stock is going to rise. Instead of buying shares of Apple, you could enter into a CFD contract with your broker. You’d agree to pay a certain amount if the price of Apple shares increases by the end of the contract, and your broker would pay you if the price falls. In essence, you are profiting from the price fluctuation without needing to physically own the shares.

Why Trade CFDs in the US?

CFDs offer numerous advantages that have made them popular among traders in the US:

- Leverage: This is the most significant draw of CFDs, allowing you to control a larger position with a smaller initial investment. The leverage ratio can vary depending on the broker and the asset, but it can amplify gains (and losses).

- Short Selling: CFDs enable you to take advantage of declining market conditions by short selling. This means you can profit if the price of an asset falls. Short selling is not always possible with traditional trading methods.

- Wide Range of Assets: CFDs cover a diverse range of assets, including stocks, indices, currencies, commodities, and even cryptocurrencies. This versatility allows you to diversify your portfolio and exploit opportunities across various markets.

- Accessibility: CFD trading platforms are typically user-friendly, making them attractive to both novice and experienced traders. Many brokers offer educational resources and demo accounts to help you familiarize yourself with the process.

How CFD Trading Works in the US

Understanding the mechanics of CFD trading is crucial for making informed decisions:

Image: www.ifcm.co.uk

1. Choose a Regulated Broker:

It is essential to select a reputable and regulated CFD broker in the US. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) are the primary regulatory bodies overseeing CFD trading in the US. These bodies ensure brokers adhere to specific standards, including financial transparency and client asset protection.

2. Open a CFD Trading Account:

Once you’ve chosen a broker, you’ll need to open a trading account. The account opening process typically involves identity verification and providing your financial information. You may need to deposit funds into your account to begin trading.

3. Choose Your Asset and Leverage:

Select the asset you want to speculate on. This can be anything from shares of a specific company to an index like the S&P 500 or a currency pair like USD/EUR. You need to decide on the leverage you want to use, understanding that the higher the leverage, the greater the potential gains and losses.

4. Place Your Trade:

Once you’ve selected your asset and leverage, you can place your trade. CFD trading platforms offer various order types, such as market orders, limit orders, and stop-loss orders. A market order executes immediately at the current market price, whereas limit orders allow you to set a specific price at which you want to buy or sell. Stop-loss orders help limit potential losses by automatically closing your position if the price reaches a predetermined level.

5. Manage Your Trade:

After placing your trade, you need to actively monitor your position and adjust it as necessary. Market conditions can change rapidly, so it’s important to be aware of potential risks and have a clear trading strategy.

6. Close Your Trade:

You can choose to close your position when you believe the asset has reached the desired level or when you’re ready to take profit or limit losses. Closing your position means buying back the CFD if you’ve sold it or selling it if you’ve bought it.

CFD Trading Risks and Considerations

While CFDs can be a rewarding investment tool, they also carry inherent risks:

- Margin Calls: Leverage can work against you if the market moves in the wrong direction. If the value of your position falls below the margin requirement, your broker may issue a margin call, demanding you deposit additional funds to maintain your position. If you fail to meet the margin call, your position may be liquidated, resulting in significant losses.

- High Volatility: CFDs are highly volatile instruments, which can magnify potential gains and losses. You need to be aware of the potential risk of losing more than your initial investment, particularly in leveraged positions.

- Trading Fees: Brokers charge fees for using their platform, which can include commissions, spreads, and overnight financing charges. These fees can eat into your profits, so it’s crucial to factor them into your trading strategy.

- Complexity: CFD trading can be complex, particularly for novice traders. You need to have a good understanding of financial markets, risk management, and trading strategies to navigate this complex environment successfully.

The Current State of CFD Trading in the US

Over the past decade, CFD trading has experienced significant growth in the US. Market liberalization and technological advancements have created an accessible environment for traders to engage with this trading instrument. However, this has also led to increased regulatory scrutiny, aiming to ensure consumer protection and fair market practices.

In recent years, the CFTC has taken steps to tighten regulations around CFD trading. This includes requiring brokers to provide more transparent risk disclosures and to ensure that their clients fully understand the risks associated with leveraged trading. These regulations are enforced to prevent predatory practices and excessive leverage that could lead to significant losses for retail traders.

The Future of CFD Trading in the US

The US CFD market is expected to continue growing, driven by factors like technological advancements, increasing investor interest in alternative trading instruments, and the growing accessibility of financial markets for individuals. We can anticipate that the regulatory landscape will continue to be refined, with an emphasis on transparency, investor education, and protection from excessive risk.

The rise of automated trading platforms and artificial intelligence (AI) is likely to further shape the landscape of CFD trading. These technologies are leading to more sophisticated trading algorithms and sophisticated risk management tools, which can help traders capitalize on market opportunities and potentially reduce their risk exposures.

Cfd Trading Us

Conclusion

CFD trading in the US offers a potentially rewarding avenue for investors seeking to leverage their capital and gain exposure to diverse markets. However, it’s crucial to approach CFD trading with caution, understanding its unique risks and complexities. Choosing a reputable and regulated broker, managing risk effectively, and staying informed about market dynamics are essential steps to navigate this exciting world of leveraged trading.

For those interested in delving deeper into the world of CFD trading, consider seeking guidance from qualified financial advisors, exploring broker educational resources, and engaging in thorough research. Remember, knowledge is power in the world of finance, and informed decisions are the foundation of successful trading.