Understanding the World of CFD Trading

The world of finance can be complex and intimidating, especially for newcomers. With a plethora of investment options available, it’s easy to feel overwhelmed. One financial instrument that has gained popularity in recent years is Contracts for Difference (CFDs). This guide aims to demystify CFD trading, providing a comprehensive overview of its workings, the markets it covers, and the potential risks and rewards involved.

Image: capital.com

Imagine yourself sitting at your computer, watching the stock market fluctuate live. You have a hunch that the price of Apple stock is going to rise. In the traditional stock market, you would need to purchase actual shares of Apple at the current market price. But with CFDs, you can speculate on the price movement of Apple stock without actually owning the shares. This allows you to profit from the price difference between the time you open and close your position, regardless of whether the price goes up or down.

What are CFDs?

Defining the Concept

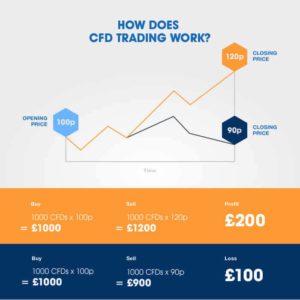

A CFD is a financial instrument that allows traders to speculate on the price movement of an underlying asset without actually owning it. The “difference” in the name refers to the difference in price between the opening and closing of a position. When you open a CFD position, you agree to pay the difference between the current price of the underlying asset and its price at the time you close your position.

A Quick History

The concept of CFDs originated in the 1990s as a way for institutional investors to manage risk and hedge their portfolios. Over time, CFDs have become increasingly popular with retail investors, attracted by their flexibility and potential for leveraged returns.

Image: www.spreadco.com

Markets Covered by CFD Trading

The beauty of CFD trading lies in its versatility. It allows traders to access a wide range of markets, covering various asset classes, including:

- Stocks: Trade shares of publicly listed companies, from blue-chip giants to smaller growth companies.

- Indices: Track the performance of major stock market indices like the S&P 500, NASDAQ, and FTSE 100.

- Forex: Trade currencies on the global foreign exchange market, profiting from fluctuations in exchange rates.

- Commodities: Invest in precious metals like gold and silver, energy sources like oil and natural gas, and agricultural commodities like coffee and sugar.

- Cryptocurrencies: Trade popular digital currencies like Bitcoin and Ethereum, capitalizing on their volatile price movements.

The Mechanics of CFD Trading

CFD trading is essentially a form of derivative trading. Unlike traditional investing, where you buy and own an asset, CFDs allow you to speculate on the price movement of an asset without actually owning it.

Going Long and Going Short

There are two main ways to trade CFDs:

- Going Long: When you believe an asset’s price will rise, you open a “long” position. If the price goes up as you predicted, you profit from the difference.

- Going Short: When you believe an asset’s price will fall, you open a “short” position. If the price falls as you predicted, you profit from the difference.

Leverage: A Double-Edged Sword

One of the key features of CFD trading is leverage. Leverage allows you to control a larger position with a smaller amount of capital. For instance, a 1:10 leverage means you can control $10,000 worth of an asset with just $1,000.

While leverage can amplify gains, it also magnifies losses. If your prediction is wrong, losses can grow quickly, potentially exceeding your initial investment. Therefore, it’s crucial to manage your risks effectively and trade with a disciplined approach.

The Recent Trends in CFD Trading

The popularity of CFD trading has been surging in recent years, fueled by several factors:

- Technological Advancements: The rise of online trading platforms and mobile trading apps has made CFD trading more accessible and convenient.

- Increased Market Volatility: The global economic landscape has become more volatile, creating more opportunities for traders to profit from price fluctuations.

- Democratization of Finance: CFD platforms have lowered the barrier to entry for individual investors, allowing them to access sophisticated trading tools and strategies.

However, the popularity of CFDs has also raised concerns about investor protection, with regulators urging platforms to implement stricter controls and educate investors about the inherent risks.

Tips and Expert Advice for CFD Trading

CFD trading is not a get-rich-quick scheme. It requires a comprehensive understanding of market dynamics, risk management, and trading strategies. Here are some tips to help you succeed in your CFD trading journey:

1. Start with a Demo Account

Most reputable CFD platforms offer demo accounts, which allow you to practice trading in a risk-free environment. This is an excellent way to familiarize yourself with the platform’s interface, explore different trading strategies, and develop your skills without risking real money.

2. Manage Your Risk Effectively

Risk management is crucial in CFD trading. Set stop-loss orders to limit potential losses, and never invest more than you can afford to lose. Diversify your portfolio by investing in different asset classes and markets to mitigate risk.

3. Do Your Research Thoroughly

Before entering any trade, conduct thorough research on the underlying asset, its market dynamics, and potential risks. Identify trends, analyze historical data, and stay updated on relevant news and events that could influence price movements.

4. Keep a Trading Journal

Maintain a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement. This will help you understand your strengths and weaknesses, improve your trading strategy, and make more informed decisions.

5. Seek Professional Guidance

If you’re new to CFD trading, consider consulting with a financial advisor or experienced trader who can provide valuable insights and guidance. They can help you develop a personalized trading plan, manage risks effectively, and make informed decisions.

Frequently Asked Questions (FAQs)

Q: Are CFDs Legal?

Yes, CFDs are legal in most countries, but regulations vary depending on the jurisdiction. Always check your local regulations before trading CFDs.

Q: Are CFDs Safe?

CFDs are generally considered safe when used responsibly and with adequate risk management. However, due to leverage, losses can exceed your initial investment. It’s crucial to understand the risks involved and trade within your risk tolerance.

Q: How Do I Choose the Right CFD Broker?

When selecting a CFD broker, prioritize factors like regulation, reputation, platform fees, trading tools, customer support, and educational resources.

Q: What are the Main Advantages of CFD Trading?

CFD trading offers several advantages, including:

- Leverage: Amplify gains and losses.

- Short Selling: Profit from price declines.

- Wide Range of Markets: Access diverse asset classes.

- Flexibility: Trade various markets with a single account.

Q: What are the Main Disadvantages of CFD Trading?

CFD trading also comes with certain drawbacks:

- Leverage: Amplifies losses as well as gains.

- High Risk: Trading involves significant risk, and losses can exceed your initial investment.

- Complex Regulations: Trading CFDs is subject to various regulations and tax implications.

Markets Cfd Trading

Conclusion

CFD trading can be a powerful tool for experienced traders, but it’s essential to approach it with caution and a well-defined strategy. Understanding the risks involved, managing your risk effectively, and seeking professional guidance can significantly increase your chances of success in the dynamic world of CFD trading.

Are you interested in learning more about CFD trading? Let us know your thoughts and questions in the comments section below!