In the ever-evolving world of financial markets, understanding the intricacies of different trading instruments is crucial for informed decision-making. Contracts for Difference (CFDs) have emerged as a popular derivative instrument, offering traders a unique opportunity to capitalize on market movements without actually owning the underlying asset. This article aims to provide a comprehensive guide to CFDs, empowering you with the knowledge to confidently navigate this financial instrument.

Image: vladimirribakov.com

Understanding CFDs: A Financial Instrument with High Potential

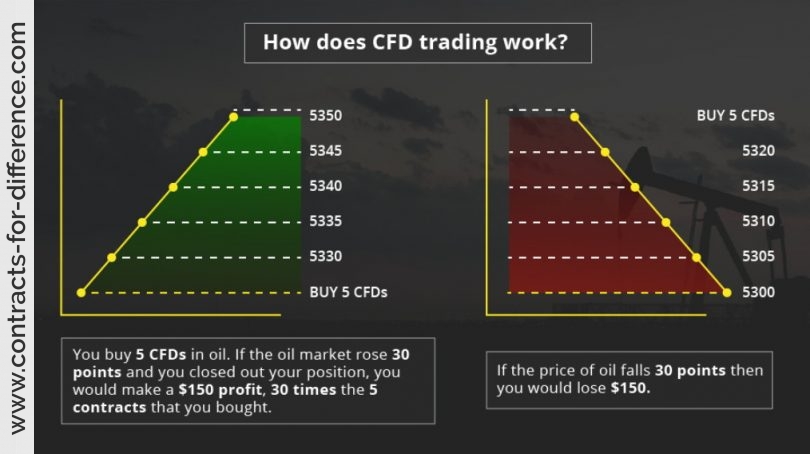

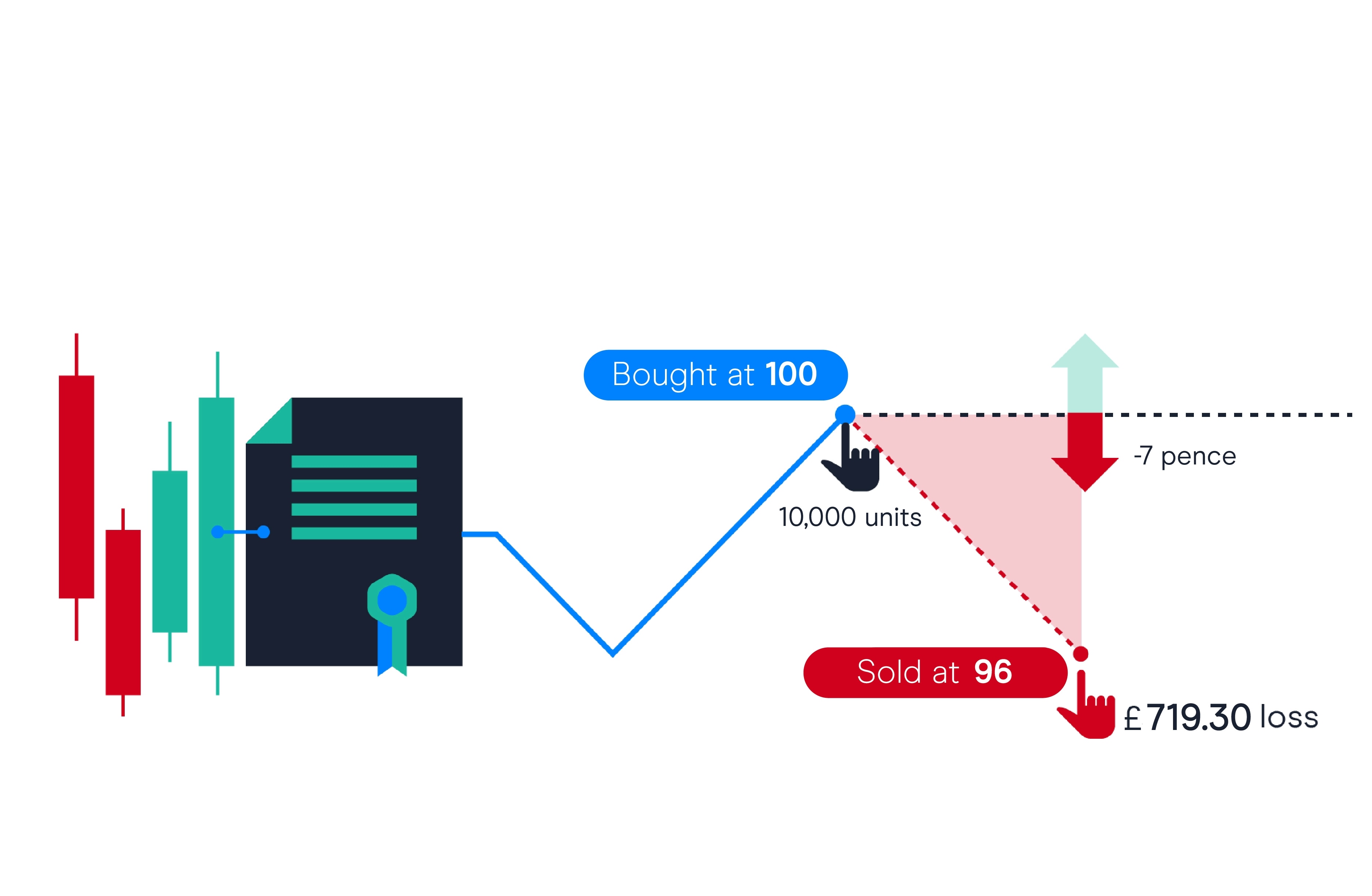

At its core, a CFD is a financial agreement between two parties to exchange the difference in the value of an underlying asset over a defined period. Instead of buying or selling the asset directly, CFDs allow traders to speculate on its price movements. This flexibility makes CFDs accessible to a broader range of traders, from seasoned veterans to those just starting their financial journey.

CFDs are traded on margin, meaning traders only need to deposit a small percentage of the contract’s value. This leverage can magnify profits but also amplify potential losses, making it crucial to manage risk carefully.

Types of CFDs and Underlying Assets

CFDs encompass a diverse range of underlying assets, catering to traders with varying market preferences. Common CFDs include:

- Stock CFDs: Represent contracts based on the price movements of individual stocks.

- Index CFDs: Track the performance of stock market indices such as the S&P 500 or FTSE 100.

- Commodity CFDs: Follow the price fluctuations of commodities like oil, gold, and wheat.

- Currency CFDs (Forex): Allow traders to speculate on exchange rate movements between different currencies.

Benefits of Trading CFDs

CFDs offer several advantages that make them attractive to traders:

- Leverage: Provides traders with the ability to control larger positions with less capital.

- Flexibility: Enables speculation on both rising and falling markets.

- Diversification: Diversify investment portfolios by trading various underlying assets.

- Hedging: Can be used to offset the risk of existing positions in the underlying asset.

Risks Associated with CFDs

While CFDs present opportunities, it’s essential to acknowledge the risks involved:

- Leverage: Amplifies both profits and losses, increasing the risk of substantial capital loss.

- Market Volatility: Price fluctuations can be unpredictable, leading to sudden gains or losses.

- Transaction Costs: Trading CFDs involves spreads, commissions, and other fees that can impact profitability.

- Complexity: CFDs are derivative instruments that require a thorough understanding of their mechanisms.

Conclusion: Empowering Traders with CFDs

Contracts for Difference (CFDs) are a versatile financial instrument offering unique opportunities for traders to speculate on market movements without direct ownership of the underlying asset. With the potential for significant profits and the flexibility to diversify portfolios, CFDs have become a widely recognized tool in the financial markets.

However, it’s crucial to approach CFD trading with caution, fully understanding the risks involved and implementing appropriate risk management strategies. By leveraging CFDs wisely, traders can enhance their financial strategies and potentially achieve their investment aspirations.

Image: www.cmcmarkets.com

What Are Cfds