I vividly remember the day I first started paying attention to market cap weighting. I was scouring financial news trying to understand how to diversify my investment portfolio. A term kept popping up – “market cap weighted,” but it felt like a foreign language. After spending hours researching, it finally clicked – the power of market cap weighting was clear, and I knew it was a concept I needed to deeply understand. If you’re in the same boat, don’t worry, this article will walk you through everything you need to know about market cap weighting.

Image: seekingalpha.com

It’s not just about understanding how investment funds work but also about recognizing the influence of large companies in shaping the stock market landscape. This article explores the underlying mechanics of market cap weight, its influence on investment strategies, and its implications for both individual investors and the broader market.

Understanding Market Cap Weighting: The Driving Force of Indexes

Defining Market Cap Weighting

In essence, market cap weighting determines the representation of a company within an index based on its market capitalization. Market capitalization (or “market cap”) is simply the total value of a company’s outstanding shares. It’s calculated by multiplying the company’s current share price by the number of outstanding shares.

For example, if a company has 100 million shares outstanding and each share trades at $50, its market cap would be $5 billion (100 million shares x $50/share). The larger its market cap, the bigger its influence on the index’s performance. A company with a market cap of $5 billion will have a bigger weight than a smaller company with a market cap of $1 billion, even if the smaller company experiences a larger percentage gain. This principle forms the backbone of many well-known stock market indices, particularly the S&P 500.

Real-world Implications of Market Cap Weighting

Market cap weighting has a significant impact on various aspects of the financial world. Here are some key points to consider:

- **Index Composition**: Market cap weighting directly shapes the composition of stock market indices. The companies with the largest market caps, like Apple, Microsoft, and Amazon, tend to dominate the S&P 500, while smaller companies with lower market caps have a less significant impact on the index’s overall performance.

- **Mutual Funds and ETFs**: Many investment funds, particularly index mutual funds and exchange-traded funds (ETFs), are designed to track the performance of specific indices. They allocate their assets based on the market cap weighting of the index, meaning a large portion of their holdings will be concentrated in the largest companies.

- **Market Performance**: When a large market cap company experiences significant price fluctuations, it can significantly impact the performance of the overall market index. This is due to the heavy weighting of these companies in the index.

Image: propelfinancialadvisors.com

Historical Evolution and Significance

The concept of market cap weighting arose as a natural response to the need for a representative and objective method for selecting and ranking companies within an index. Early stock market indices were often based on subjective criteria, but market cap weighting provided a more transparent and data-driven approach. It offered a relatively simple way to reflect the prevailing market sentiment by giving more weight to companies that investors deemed more valuable based on their market capitalization. As investment strategies evolved, market cap weighting became a cornerstone for index funds and ETFs, providing both investors and portfolio managers with a standardized and easily replicable method for tracking market performance.

Market Cap Weighting in Action: Examples and Applications

The S&P 500: A Prime Example of Market Cap Weighting

One of the most prominent examples of market cap weighting is the S&P 500. This index represents a broad selection of 500 large-cap U.S. companies across various sectors. The weight of each company within the index is directly proportional to its market cap. As a result, the S&P 500 is heavily influenced by the performance of the largest companies in the index, known as “mega-caps.”

Beyond the S&P 500: Different Weights for Different Indexes

While market cap weighting is widely used, it’s essential to understand that different indices can have different weighting schemes. Some indices may use equal weighting, where each company receives an equal proportion of the index, regardless of its market cap. Others may use a combination of market cap weighting and other factors, such as fundamental value or specific sector exposure. For instance, the Dow Jones Industrial Average uses a price-weighted scheme, where companies with higher stock prices contribute more to the index’s overall value.

Navigating the Landscape: The Impact of Market Cap Weighting on Investment Strategies

The Pros and Cons of Market Cap Weighting

Understanding the strengths and weaknesses of market cap weighting can be crucial to making informed investment decisions. Here’s a breakdown:

- Pros

- Simplicity and Transparency: Market cap weighting is straightforward and readily understood, providing a transparent method for determining representation within an index.

- Efficiency and Scale: Index funds and ETFs based on market cap weighting offer investors a cost-effective and scalable way to diversify their portfolios.

- Objectivity: Market cap weighting removes subjective biases from index construction, relying solely on market data to determine weighting.

- Cons

- Concentration Risk: Market cap weighting often leads to excessive concentration in a few large companies, potentially increasing investor risk if these companies experience significant performance downturns.

- Value Traps: Overvalued and unsustainable growth companies can have large market caps, disproportionately influencing the index despite potential future decline in value.

- Limited Growth Potential: Large-cap companies usually have slower growth rates compared to smaller companies, potentially limiting the upside potential of market cap-weighted portfolios.

Strategies for Managing Market Cap Weighting

For savvy investors, understanding the implications of market cap weighting can help refine portfolio strategies. Consider these approaches:

- Diversification: Don’t solely rely on market cap-weighted indices. Diversify your portfolio by including other asset classes and sector-specific indices that may have different weighting schemes.

- Active Management: Consider actively managing your investments to reduce reliance on market cap weighting. Research individual companies and identify potential value opportunities that may be overlooked by market cap-weighted investment funds.

- Factor-Based Investing: Explore factor investing strategies that consider factors beyond market cap, such as profitability, momentum, and value, to potentially uncover hidden gems and outperform market cap-weighted benchmarks.

Trends and Developments in Market Cap Weighting

Market cap weighting remains a dominant factor in shaping investment landscapes. However, recent trends indicate a growing awareness of its limitations and the emergence of alternative weighting strategies.

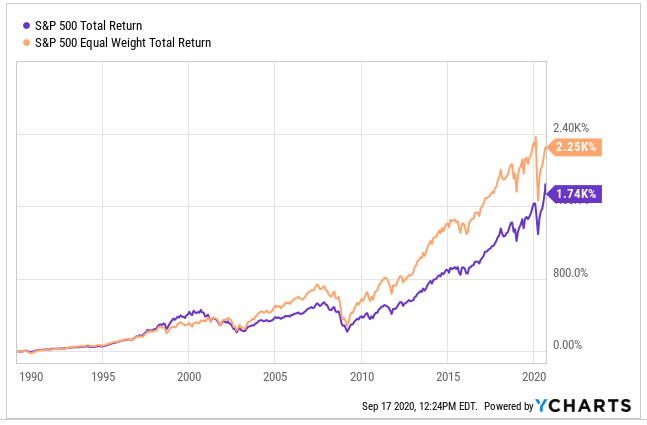

The Rise of Equal Weighting

Equal weighting strategies are gaining popularity as investors seek to reduce the influence of large companies and diversify their portfolios more evenly. In equal weighting, each company, regardless of its market cap, receives an equal proportion of the index. This approach aims to capture growth potential from smaller companies that may be underrepresented in market cap-weighted indices.

Factor-Based Indexing

Factor-based indexing integrates fundamental factors like profitability, value, and momentum into the index construction process. These strategies attempt to capitalize on market anomalies and identify companies with strong intrinsic value. By incorporating these factors, factor-based indices can potentially outperform market cap-weighted benchmarks over time.

Smart Beta Investing

Smart beta investing, also known as “strategic beta” investing, utilizes rule-based strategies that incorporate various factors beyond market cap. These strategies aim to deliver enhanced risk-adjusted returns by selecting and weighting assets based on specific investment criteria. Some popular smart beta strategies include fundamental indexing, volatility weighting, and equal weighting.

Expert Tips and Advice for Investors Navigating Market Cap Weighting

Understanding market cap weighting can empower investors to make more informed decisions. Here’s some expert advice:

- Don’t be solely reliant on market cap weighting: While it offers a quick and easy way to measure a company’s size, it doesn’t always reflect its long-term value or growth potential.

- Consider alternative weighting schemes: Research different index construction methods, including equal weighting and factor-based investing. This can diversify your portfolio and potentially generate better returns.

- Don’t be afraid to invest in smaller companies: Small-cap companies may offer higher growth potential compared to their larger counterparts. Look beyond just market cap to assess their value and long-term potential.

- Stay informed about market trends: Be aware of the ongoing developments in market cap weighting and the emergence of alternative strategies. This will help you make informed decisions about your portfolio.

These tips can provide a foundation for navigating the ever-evolving landscape of market cap weighting and making informed investment choices tailored to your goals.

Frequently Asked Questions (FAQs)

Q: Is market cap weighting always the best approach?

A: Market cap weighting is a common and often effective approach, but it’s not always the ideal solution. The concentration of holdings in large companies can create risks, and alternative weighting schemes like equal or factor-based weighting may offer better returns.

Q: How can I assess the impact of market cap weighting on my investments?

A: You can compare the performance of market cap-weighted index funds or ETFs with those using alternative weighting strategies. This can provide insights into the potential benefits and drawbacks of different approaches.

Q: Is it possible to invest in smaller companies despite market cap weighting?

A: Yes, you can invest in smaller companies through dedicated small-cap index funds or ETFs. Alternatively, you can choose actively managed funds that focus on smaller companies or engage in individual stock selection.

Q: How can I learn more about alternative weighting schemes?

A: Start by researching concepts like equal weighting and factor-based investing. Numerous financial resources, including online articles, books, and educational platforms, provide comprehensive explanations of these concepts.

Market Cap Weighted

https://youtube.com/watch?v=jWEfYTh3o50

Conclusion

Understanding Market Cap Weighting is a critical aspect of smart investing. It shapes stock market indices, influences fund management strategies, and ultimately impacts your investment outcomes. Remember, market cap weighting is only one factor to consider. Explore alternative weighting schemes, consider actively managed investments, and stay informed about evolving market trends. Ultimately, by appreciating the power of market cap weighting and utilizing diverse investment approaches, you can navigate the market with greater confidence and potentially achieve better returns.

Are you interested in learning more about Market Cap Weighting and its influence on investing? Share your thoughts and questions in the comments below!