My journey into the world of trading began with a captivating account of synthetic indices on the MT5 platform. Intrigued by their ability to mirror real-world indices without exposure to underlying assets, I delved deep into exploring the potential they held.

Image: synthetics.info

Synthetic indices, born out of the collaboration between liquidity providers and brokers, offer a unique synthetic trading environment. They mimic the movements of established market indices, such as the FTSE 100 or S&P 500, providing traders with access to market trends without the complexities of traditional index trading.

Unveiling MT5 Synthetic Indices Account: A Gateway to Diversified Trading

The MT5 synthetic indices account empowers traders with a comprehensive suite of trading tools and features. Its user-friendly interface and advanced charting capabilities make it an ideal platform for traders of all levels.

One of the key advantages of MT5 synthetic indices account lies in its ability to simulate real-world market behavior. This feature allows traders to test their trading strategies in a realistic environment before deploying them in live markets. The platform also offers a wide range of order types, including market, limit, and stop orders, providing traders with the flexibility they need to execute their trades.

Deciphering the Mechanics of MT5 Synthetic Indices Account

Synthetic indices are not directly linked to the underlying assets of the indices they represent. Instead, they are priced based on the liquidity providers’ proprietary models and algorithms. This unique pricing mechanism eliminates the impact of external factors such as dividends and stock splits, enabling traders to focus solely on price movements.

The synthetic indices account also offers traders the benefit of leverage. By utilizing leverage, traders can amplify their potential profits while also increasing their risk exposure. It’s important to exercise caution when using leverage, as excessive leverage can lead to substantial losses.

Harnessing the Power of MT5 Synthetic Indices Account

Trading synthetic indices on the MT5 platform unlocks a world of opportunities for traders. Its unique features and advantages make it an ideal platform for both experienced traders seeking to diversify their portfolios and novice traders looking to gain exposure to market trends without the complexities of traditional investments.

Traders can capitalize on the volatility of synthetic indices to generate profits. The platform’s advanced charting capabilities allow traders to identify potential trading opportunities and make informed decisions. Additionally, the ability to test trading strategies in a simulated environment reduces the risks associated with live trading.

Image: synthetics.info

Navigating the Evolving Landscape of MT5 Synthetic Indices

The world of MT5 synthetic indices is constantly evolving, with new developments and updates emerging regularly. Staying abreast of these changes is crucial for traders seeking to stay ahead of the curve.

Industry forums and social media platforms serve as valuable resources for traders to connect with peers, exchange ideas, and gain insights into the latest trends. Monitoring news sources and updates from liquidity providers is equally important to stay informed about changes in market conditions and platform functionality.

Expert Tips and Practical Advice

As a seasoned trader, I have amassed valuable insights that can help aspiring traders navigate the intricacies of MT5 synthetic indices trading:

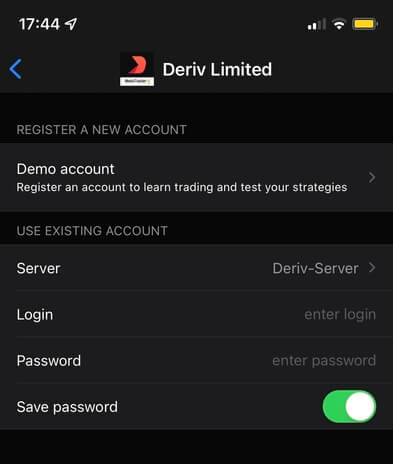

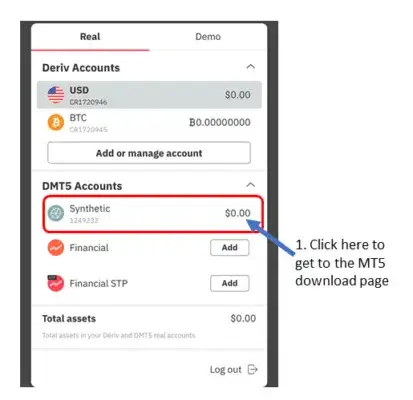

- Start with a demo account: Familiarize yourself with the platform and practice your strategies before venturing into live trading.

- Choose a reliable broker: Select a reputable broker that offers a stable trading environment and competitive spreads.

- Manage risk wisely: Leverage can be a double-edged sword; use it cautiously and define clear risk management parameters.

- Stay updated: Keep up with the latest developments in the industry to make informed trading decisions.

- Seek professional guidance: Consider consulting with experienced traders or financial advisors for personalized advice.

Remember that trading involves inherent risks, and losses are a part of the game. It’s essential to approach synthetic indices trading with a well-informed and disciplined mindset.

Mt5 Synthetic Indices Account

FAQ: Empowering Your Synthetic Indices Journey

Q: What is the difference between synthetic indices and traditional indices?

A: Synthetic indices are not linked to underlying assets and are priced