Preamble: Navigating the Evolving Forex Landscape

In the ever-evolving forex market, successful traders rely on technical analysis tools to gain an edge. Among these tools, Exponential Moving Averages (EMA) stand out as a versatile indicator for identifying trends, support and resistance levels, and potential trading opportunities. However, with a plethora of EMA settings available, finding the optimal combination can be a daunting task. This comprehensive guide aims to simplify the decision-making process by exploring the key parameters of EMA and presenting the most effective settings for various trading styles and market conditions.

Image: www.alphaexcapital.com

Exploring EMA: A Moving Average with Exponential Weight

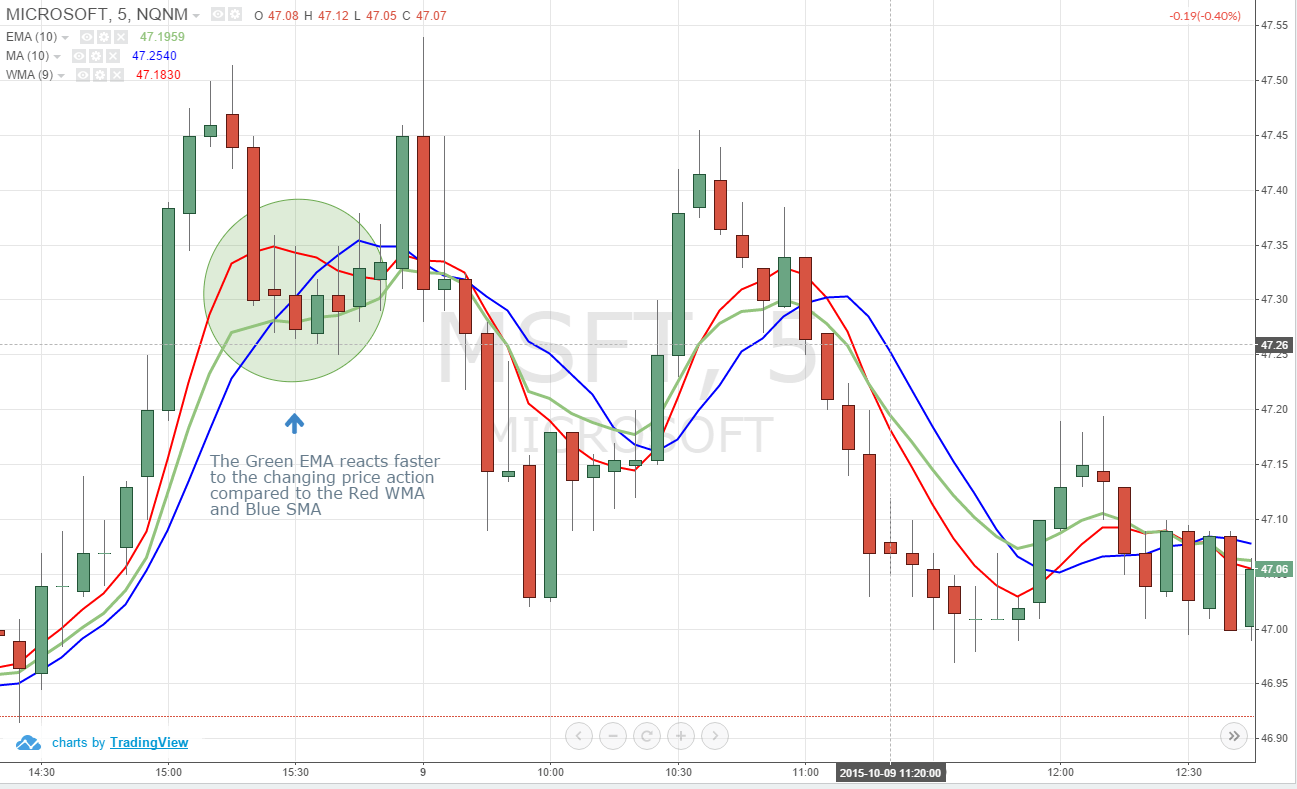

EMA, a variation of the traditional Simple Moving Average (SMA), assigns greater weight to recent price data. This characteristic allows EMA to respond more quickly to price changes, making it a more accurate and dynamic indicator for identifying market trends. By assigning exponential weight to recent data, EMA places more emphasis on the current price action, providing traders with a more responsive and reliable representation of the underlying trend.

Customization Unveiled: Decoding EMA Settings

To harness the full potential of EMA, traders must delve into its customizable settings, which include the time period and the source. The time period determines the number of price data points used in the EMA calculation. A shorter time period results in a more responsive EMA, while a longer time period creates a smoother indicator. The source, on the other hand, refers to the price data used. Commonly used sources include the closing price, opening price, high price, and low price.

Choosing the Ideal EMA Time Period: A Balancing Act

Finding the optimal EMA time period requires a balance between responsiveness and stability. For scalpers and day traders seeking quick market movements, shorter time periods, such as 9, 12, or 20, are recommended. These settings enable traders to rapidly identify trend reversals and capitalize on short-term price fluctuations. For swing traders aiming to capture medium-term trends, intermediate time periods, such as 50 or 100, provide a more balanced approach. Lastly, position traders seeking long-term trends may opt for longer time periods, such as 200 or 300, to filter out market noise and focus on dominant market directions.

Image: www.tradingsim.com

Source Selection: Pinpointing EMA Sensitivity

The choice of source for EMA calculation influences the sensitivity of the indicator to price changes. The closing price, a commonly used source, provides a comprehensive daily overview of price action. The opening price, on the other hand, offers insights into market sentiment at the start of the trading day. The high and low prices expand the EMA’s scope by incorporating extreme price fluctuations. Traders should select the source that best aligns with their trading style and the specific market conditions.

Advanced EMA Techniques: Unveiling Hidden Market Dynamics

Beyond the basic settings, traders can explore advanced EMA techniques to refine their analysis and gain a deeper understanding of market dynamics. One such technique involves combining multiple EMAs, with each having a different time period, to create a multi-EMA strategy. By analyzing the interactions and crossovers of these EMAs, traders can discern more complex price patterns and identify trading opportunities. Another technique involves using the EMA as a dynamic support and resistance level. By observing price reactions at specific EMA levels, traders can gauge the strength of the underlying trend and adjust their trading strategies accordingly.

What The Best Ema To Use In Forex

https://youtube.com/watch?v=EmA-nbgvK54

Conclusion: Harnessing EMA’s Power for Informed Forex Trading

EMA, with its dynamic nature and customizable settings, equips traders with a powerful tool for navigating the forex market. By understanding the key parameters of EMA and selecting the optimal settings based on their trading style and market conditions, traders can leverage EMA’s capabilities to identify trends, support and resistance levels, and potential trading opportunities with greater precision. Embracing advanced EMA techniques further enhances the utility of this versatile indicator, empowering traders to gain a deeper understanding of market dynamics and make informed trading decisions.