Unveiling the Exponential Power: Finding the Optimal EMA Periods for Forex Trading Success

Image: www.litefinance.org

In the ever-evolving landscape of forex trading, mastering technical analysis tools is paramount for maximizing profitability. One such tool, the exponential moving average (EMA), stands out for its ability to identify market trends and generate valuable trading signals. However, determining the optimal EMA period can be a daunting task, requiring a deep understanding of the underlying principles and extensive backtesting. In this comprehensive guide, we will delve into the intricacies of EMA best periods, unlocking the key to unlocking consistent profits in the forex market.

Understanding the Exponential Moving Average (EMA)

The EMA is a technical indicator that calculates the average price of an asset over a specified period, weighted more heavily towards recent prices. This weighting mechanism gives the EMA a faster response time to price changes compared to the traditional simple moving average (SMA). As a result, the EMA is more effective in identifying the current trend and potential trading opportunities.

Determining the Best EMA Periods

Identifying the optimal EMA period depends on the trading style, time frame, and volatility of the market. While there is no one-size-fits-all solution, certain periods have been consistently effective across different conditions. Here’s a breakdown of some popular EMA periods and their applications:

- Very Short-Term Trading: EMA periods of 5, 10, and 15 are suitable for scalping and day trading strategies. These periods provide a responsive indicator of price action, allowing traders to capitalize on quick price fluctuations.

- Short-Term Trading: EMA periods of 30, 50, and 100 are commonly used for short-term trading strategies. These periods strike a balance between responsiveness and stability, providing traders with clear trading signals in volatile markets.

- Medium-Term Trading: EMA periods of 200, 250, and 300 are ideal for medium-term trading strategies. These periods offer a broader perspective on price action, focusing on larger market trends and swing trading opportunities.

- Long-Term Trading: EMA periods of 500, 1000, and 2000 are appropriate for long-term trading strategies. These periods provide a strong indication of the long-term price direction, supporting traders’ decisions in investing and holding positions.

Using the EMA to Enhance Trading

Once you’ve selected the appropriate EMA period, you can use it in various trading strategies to enhance your profitability. Here are some proven trading techniques that utilize the EMA effectively:

- Trend Trading: The EMA can identify the current market trend. When the EMA slopes upward, it indicates an uptrend, while a downward-sloping EMA signifies a downtrend. Traders can take long positions when the EMA is rising and short positions when the EMA is falling.

- Support and Resistance: The EMA can act as a dynamic support or resistance level. When an asset’s price approaches the EMA from below, it often serves as a support level. Conversely, if the price approaches the EMA from above, it may act as a resistance level.

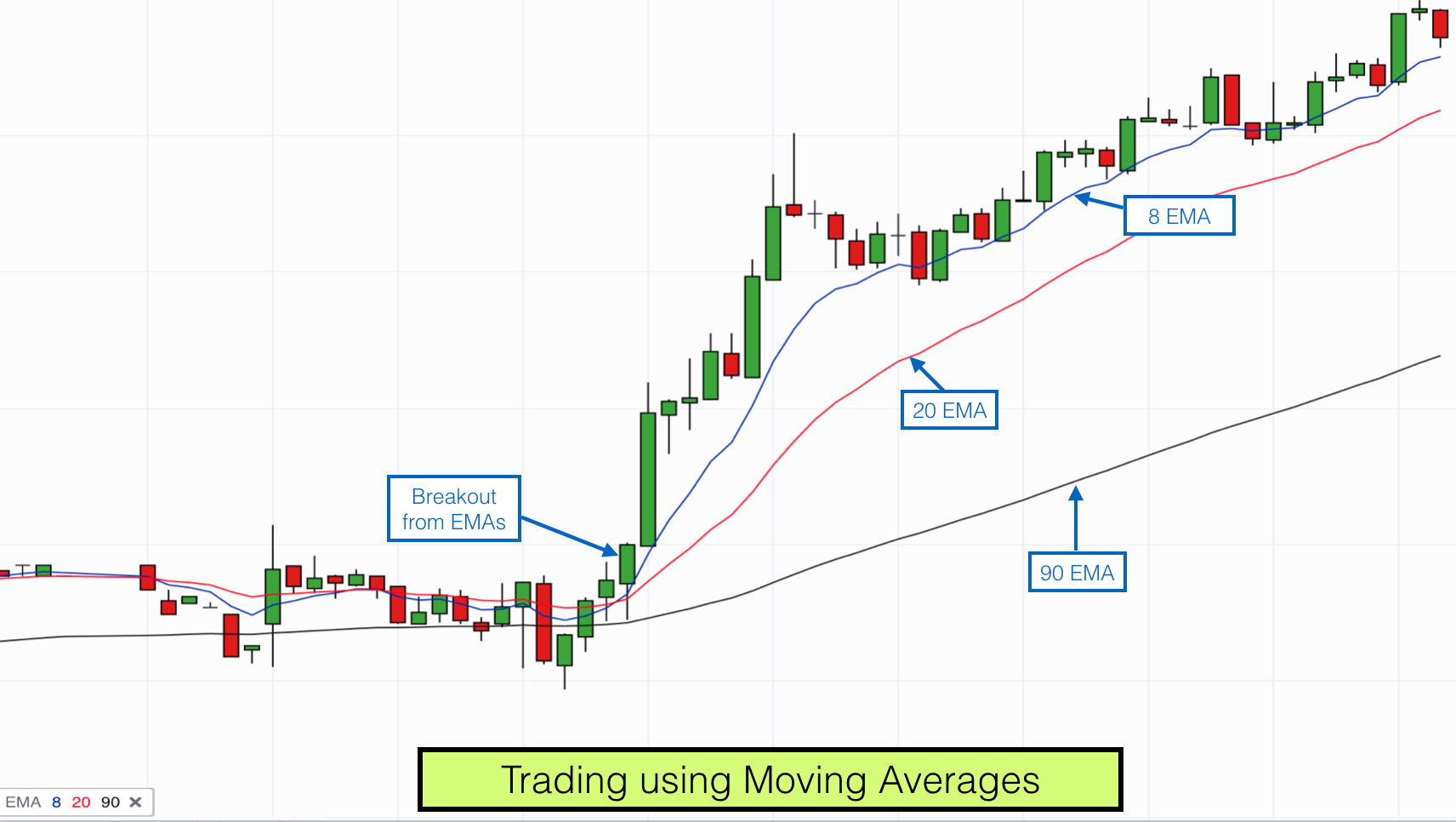

- Crossovers: EMA crossovers can generate buy or sell signals. When a shorter-period EMA crosses above a longer-period EMA, it’s usually a buy signal. When a shorter-period EMA crosses below a longer-period EMA, it’s often a sell signal.

Conclusion

Mastering the exponential moving average (EMA) is a crucial skill for successful forex trading. By understanding the concept of weighted averages and choosing the optimal EMA periods for your trading style, you can unlock valuable trading opportunities. Whether you’re a beginner or an experienced trader, incorporating the EMA into your trading arsenal will significantly enhance your ability to navigate market fluctuations and achieve consistent profitability. Remember, in the competitive world of forex trading, knowledge is power, and using the EMA effectively will give you a substantial edge over the competition.

Image: excellenceassured.com

Moving Average Exponential Best Periods For Forex Trading

https://youtube.com/watch?v=235nioN_8gE