Unlock Global Convenience and Financial Flexibility

Managing multiple forex cards can be a hassle, especially if you’re on the move. HDFC NetBanking offers a convenient solution: linking your forex cards, streamlining your financial transactions. This guide will provide a step-by-step walkthrough, expert insights, and tips to unlock the benefits of connecting two or more forex cards in HDFC NetBanking.

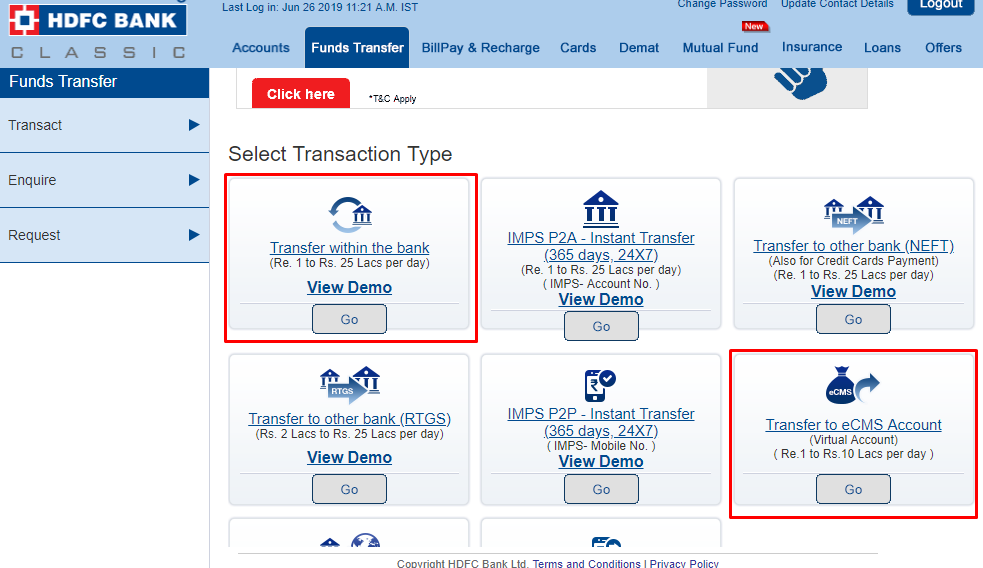

Image: support.zerodha.com

To link multiple forex cards within HDFC NetBanking, you must first log in to your account and navigate to the ‘Forex’ tab. Subsequently, from the drop-down menu under ‘Add Money,’ select ‘Link HDFC ForexPlus Card.’ Enter the 16-digit forex card number and the corresponding expiry date and CVV. Once verified, your forex card will be successfully linked to your HDFC NetBanking account. Now, you can manage your forex expenses effortlessly.

Managing multiple forex cards in HDFC NetBanking offers an array of advantages. Firstly, it empowers you to control expenses conveniently, monitoring all forex transactions from a single platform. Secondly, linking forex cards eliminates the need for carrying multiple cards, reducing the risk of loss or theft. Additionally, you can enjoy the convenience of seamless online transactions and global accessibility, enabling effortless spending abroad.

Unlocking the Power of Linked Forex Cards

Linking your HDFC ForexPlus Cards in HDFC NetBanking unlocks a myriad of benefits:

- Centralized Management: Manage multiple forex cards effortlessly, eliminating the hassle of tracking expenses across different platforms.

- Enhanced Security: Reduce the risk of fraud and unauthorized transactions by consolidating your forex cards under one umbrella.

- Convenience and Flexibility: Enjoy the ease of online transactions, enabling swift and secure payments from anywhere, anytime.

- Global Acceptance: Benefit from wide acceptance at merchant establishments and ATMs worldwide, empowering global mobility and financial ease.

Tips for Maximizing Forex Card Management

Maximize the benefits of linked forex cards by following these expert tips:

Monitor Transactions Regularly: Regularly check your HDFC NetBanking account to track forex expenses and identify any unusual activities.

Activate SMS/Email Alerts: Stay informed about all forex transactions with real-time alerts delivered via SMS or email.

FAQs on Linking Forex Cards in HDFC NetBanking

- Q: What are the eligibility criteria for linking ForexPlus Cards with HDFC NetBanking?

A: You must have an active HDFC ForexPlus Card and an HDFC NetBanking account linked to your primary savings account. - Q: Can I link forex cards issued by other banks in HDFC NetBanking?

A: No, you can only link HDFC ForexPlus Cards with HDFC NetBanking. - Q: Is there any limit to the number of forex cards I can link to HDFC NetBanking?

A: No, you can link multiple HDFC ForexPlus Cards to your HDFC NetBanking account for convenient management.

Image: venamacment.hatenadiary.com

How To Link Two Forex Cards In Hdfc Netbanking

Conclusion: Embracing Financial Flexibility

Linking forex cards in HDFC NetBanking is a game-changer for travelers and those who frequently transact in foreign currencies. It empowers you with centralized control, enhanced security, and unmatched convenience. By following this comprehensive guide and embracing the expert tips, you can unlock the full potential of your HDFC ForexPlus Cards and navigate the world of global finance with ease.

Are you ready to streamline your forex card management and embark on a journey of financial flexibility? Link your HDFC ForexPlus Cards today and experience the world of effortless global transactions.