Have you ever pondered over the dynamic world of financial markets and the alluring prospect of profiting from currency fluctuations? If so, spread betting forex might just be the avenue you’ve been seeking. Dive into this comprehensive guide to unravel the essence of spread betting forex, its mechanics, the advantages it offers, and invaluable tips to embark on your trading journey with confidence.

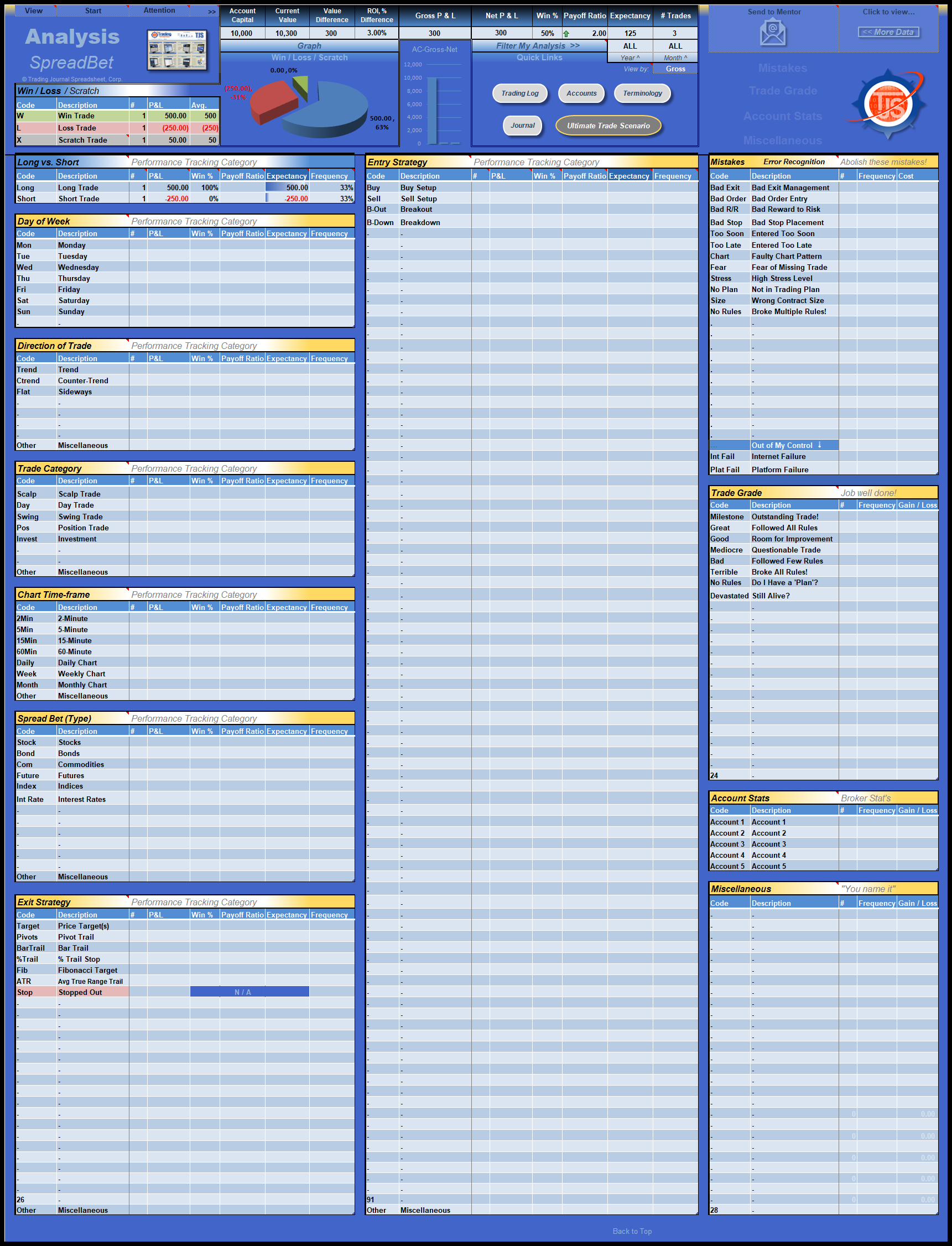

Image: forexstrategiesdownload.blogspot.com

Spread betting forex, in its simplest form, is the practice of speculating on the price movements of currency pairs without actually owning the underlying assets. It involves entering into contracts with a spread betting provider, where the trader predicts the future direction of a currency pair’s exchange rate. If the prediction aligns with market movements, the trader stands to make a profit; if not, they incur a loss.

Understanding Spread Betting Forex

Understanding the fundamentals of spread betting forex is pivotal for aspiring traders. Unlike traditional currency trading, spread betting forex does not involve the physical exchange of currencies. Instead, it revolves around the concept of “spreads.” A spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a currency pair.

In spread betting forex, traders speculate on the direction of the spread rather than the absolute price of the currency pair. If they anticipate the spread to widen, they place a “buy” bet; if they expect it to narrow, they place a “sell” bet. The profit or loss is determined by the difference between the spread at the time of entering the contract and the spread at the time of closing it.

Leverage and Margin

One of the key advantages of spread betting forex is the ability to trade with leverage. Leverage allows traders to control a larger position size than their account balance permits. However, leverage is a double-edged sword. While it can amplify potential profits, it can also magnify losses if the market moves against the trader’s position.

Margin is the amount of capital required to cover potential losses on leveraged positions. Spread betting providers typically set margin requirements for different currency pairs, ensuring that traders have sufficient funds to withstand adverse market conditions.

Benefits of Spread Betting Forex

Spread betting forex offers several benefits that attract traders, including:

- Flexibility: Spread betting forex allows traders to speculate on currency movements without owning the underlying assets, providing greater flexibility compared to traditional currency trading.

- Leverage: Leverage enables traders to amplify their profits, potentially generating substantial returns on relatively small capital investments.

- Tax advantages: Spread betting forex is generally considered a form of gambling in many jurisdictions, resulting in potential tax advantages compared to traditional investments.

Image: www.ig.com

Tips for Successful Spread Betting

Embarking on spread betting forex requires a well-thought-out approach. Here are some expert tips to enhance your chances of success:

- Research and Education: Gain a comprehensive understanding of financial markets, currency pairs, and spread betting mechanics. Develop a solid trading plan based on thorough research.

- Risk Management: Implement effective risk management strategies, such as setting stop-loss orders and managing leverage prudently. Never risk more than you can afford to lose.

- Emotional Discipline: Control your emotions and avoid impulsive trading decisions. Stick to your trading plan and avoid letting fear or greed cloud your judgment.

FAQ on Spread Betting Forex

Here are answers to some frequently asked questions about spread betting forex:

- Q: Is spread betting forex legal?

A: Spread betting forex is legal in many jurisdictions, including the United Kingdom and Australia. However, it’s essential to check the regulations in your specific country. - Q: What are the risks of spread betting forex?

A: The risks of spread betting forex include leverage, market volatility, and the potential loss of capital. - Q: How do I start spread betting forex?

A: To start spread betting forex, you need to open an account with a reputable spread betting provider. Fund your account and start placing bets on currency pairs.

What Is Spread Betting Forex

Conclusion

Spread betting forex offers an exciting opportunity for traders to speculate on currency movements and potentially generate profits. However, it’s crucial to approach spread betting forex with education, discipline, and a sound understanding of the risks involved. By embracing the tips and expert advice shared in this guide, you can enhance your chances of success in the dynamic world of spread betting forex.

Are you intrigued by the alluring prospects of spread betting forex? Embark on this exciting journey today and discover the potential to harness the power of currency markets.