The burgeoning realm of foreign exchange trading, also known as forex, is a dynamic marketplace transacting trillions of dollars daily. Amidst this financial labyrinth, an array of contracts governs the seamless execution of these trades. Delving into their intricacies unravels a world of investment opportunities, risk management tools, and profound implications in understanding the heartbeat of the global economy.

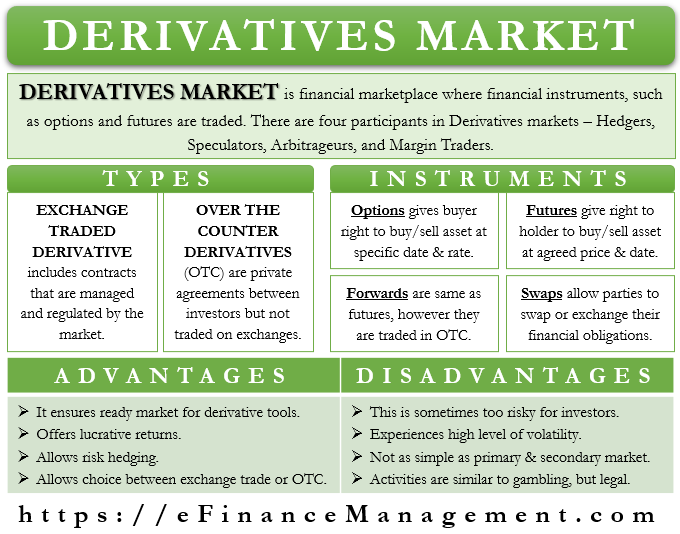

Image: efinancemanagement.com

Contracts in forex trading serve as binding agreements between parties, establishing the parameters for exchanging currencies. They provide a framework outlining key aspects such as the type of currencies involved, the exchange rate, the volume, the settlement date, and often, leverage multiples. This article will delve into the fundamental contracts in forex, their types, applications, and the profound role they play in shaping the forex landscape.

Types of Forex Contracts

-

Spot Contracts: Spot contracts, also known as cash market contracts, are ubiquitous in the forex market. They stipulate the immediate purchase or sale of currencies at the prevailing market rate. These contracts are settled within two business days, facilitating rapid transactions in response to real-time market fluctuations.

-

Forward Contracts: Forward contracts, in contrast to their spot counterparts, lock in an exchange rate for a future date, even in the face of fluctuating market conditions. This hedging mechanism allows market participants to mitigate potential losses stemming from adverse price movements.

-

Futures Contracts: Futures contracts resemble forward contracts in their hedging intent, yet they trade on standardized exchanges, fostering greater transparency. These contracts are highly regulated and subject to strict rules, ensuring reliability and minimizing counterparty risk.

-

Currency Options: Currency options empower traders with the right, but not the obligation, to buy or sell currencies at a predefined price on or before a specified date. This flexibility affords traders with further customization in their hedging strategies, allowing them to capitalize on favorable market movements or protect against potential losses.

Applications of Forex Contracts

The contracts traded in the forex market serve multipurpose functions, catering to a broad spectrum of needs:

-

Currency Trading: Forex contracts facilitate the very essence of forex trading, enabling the exchange of currencies for profit or hedging purposes. Major currency pairs like EUR/USD or USD/JPY dominate trading volumes.

-

Investment Management: Institutions and fund managers utilize forex contracts to diversify portfolios and manage risk. Leveraged Contracts for Difference (CFDs) offer them avenues for speculative trading and accessing higher returns.

-

International Trade: Entities engaged in international commerce rely on forex contracts to convert currencies, ensuring seamless flow of funds across borders.

-

Hedging Risks: Forward and futures contracts empower businesses to shield themselves against currency fluctuations. Importers, for example, can protect against adverse exchange rate movements that could erode their profit margins.

Understanding Contractual Terms

Navigating forex contracts necessitates a clear grasp of contractual terms:

-

Exchange Rate: The exchange rate is the pivotal aspect, reflecting the value of one currency relative to another. Understanding how exchange rates are determined is paramount for successful forex trading.

-

Contract Size: The contract size establishes the number of currency units underlying the contract. This value varies across contracts, impacting trade volume and investment decisions

-

Settlement Date: The settlement date specifies the date when the exchange of currencies and payment occur. It’s crucial to be aware of settlement deadlines to avoid penalties or missed obligations.

Image: forexeareal.blogspot.com

The Significance of Forex Contracts

Forex contracts play a profound role in shaping the global economy:

-

Global Economic Interdependence: Forex contracts facilitate the flow of capital across borders, fostering interconnectedness and interdependence among world economies.

-

Currency Stability: Forward and futures contracts contribute to currency stability by allowing market participants to hedge against risk, reducing volatility and maintaining orderly markets.

-

Business and Economic Growth: Seamless foreign exchange transactions support international trade, investment, and economic expansion. Forex contracts grease the wheels of these activities.

Meaning Of Contracts Traded In Forex Market

Conclusion

Contracts in forex trading form the cornerstone of currency exchange, risk management, and global economic transactions. By grasping their fundamental principles, market participants can navigate the ever-evolving forex landscape with confidence and exploit the lucrative opportunities it presents. Forex contracts, with their diverse applications and far-reaching significance, continue to drive the pulse of international trade and shape the financial landscape worldwide.