Introduction

In the intricate world of international trade and finance, contracts play a pivotal role in mitigating risk and securing future obligations. Understanding the nuances of these contracts is essential for businesses and individuals navigating the complexities of global transactions. One crucial aspect is determining whether a particular transfer method is acceptable as an underlying for a forex forward contract. In this article, we’ll delve into the specifics of MT799 and explore its use as an underlying for forex forward contracts.

Image: 139.59.164.119

MT799: A Brief Overview

MT799 is a standardized message format defined by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). It’s specifically designed for the issuance and delivery of payment instructions between financial institutions. MT799 messages typically contain details such as the amount, currency, beneficiary, and payment purpose. Its adoption by the global banking community ensures efficient and secure transfer of funds across borders.

MT799 as Underlying for Forex Forward Contracts

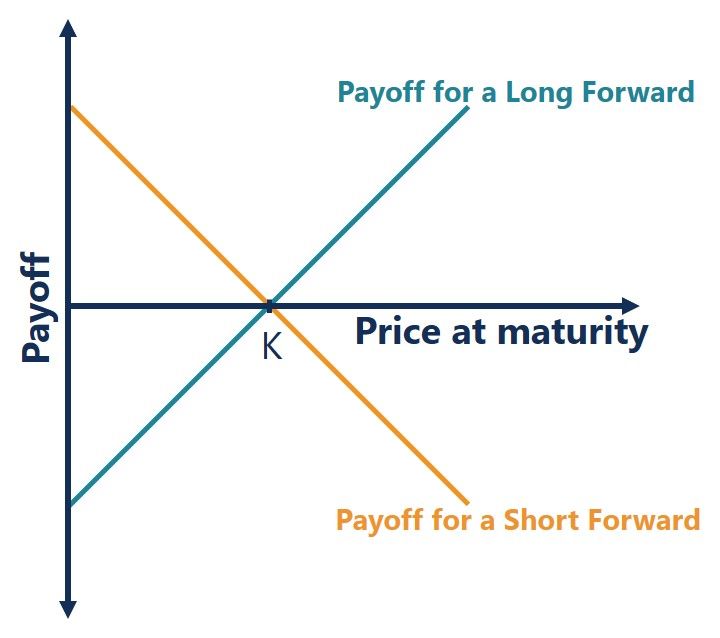

Now, let’s address the central question: is MT799 acceptable as an underlying for forex forward contracts? The answer is yes, MT799 can serve as an underlying for a forex forward contract. Forex forward contracts are derivative agreements that lock in exchange rates for a future delivery date, enabling businesses to manage currency risk.

Benefits of Using MT799 as Underlying

There are several advantages to using MT799 as an underlying for forex forward contracts:

- Automated Processing: MT799 messages are machine-readable, allowing for automated processing and reduced manual intervention. This streamlines the settlement process and minimizes errors.

- Transparent Pricing: The structure of MT799 messages allows for clear and transparent pricing. When using MT799 as an underlying, there is no ambiguity in fees or charges.

- Global Reach: MT799 is universally accepted by financial institutions worldwide. This enables seamless execution of cross-border forex forward contracts, facilitating international trade and investment.

Image: indicatorchart.com

Recent Trends and Developments

The use of MT799 as an underlying for forex forward contracts has seen notable trends in recent years. With the rise of electronic trading platforms, there has been increased adoption of automated trading tools. This has led to a growing demand for MT799-based forex forward contracts, allowing traders to automate their hedging strategies.

Additionally, regulatory changes have strengthened the need for transparency and compliance in financial transactions. MT799, with its robust data structure, supports the auditability and compliance requirements for forex forward contracts, ensuring that transactions meet regulatory guidelines.

Tips for Using MT799 as Underlying

To effectively use MT799 as an underlying for forex forward contracts, follow these tips:

- Ensure SWIFT Membership: Both parties to the forex forward contract must be members of SWIFT to send and receive MT799 messages.

- Consider Volume Requirements: Some banks may have minimum volume requirements for MT799-based forex forward contracts to ensure liquidity and reduce the risk of settlement issues.

- Negotiate Terms: Carefully review and negotiate the terms of the forex forward contract, ensuring that the underlying MT799 messages meet specific requirements related to payment dates and instructions.

FAQs on MT799 and Forex Forward Contracts

Q: Is MT799 the only acceptable underlying for forex forward contracts?

A: No, while MT799 is widely used, other underlying assets such as spot currency pairs and futures contracts can also be used.

Q: Can forex forward contracts with MT799 underlying be traded over-the-counter (OTC)?

A: Yes, OTC trading of forex forward contracts with MT799 underlying is common, allowing for flexible customization and negotiation between counterparties.

Q: Are there risks associated with using MT799 as an underlying?

A: While MT799 is secure and reliable, there may be operational risks related to settlement delays or message transmission errors. Adequate risk management and contingency measures should be in place.

Is Mt799 Acceptable As Underlying For Forex Forward Contract

Conclusion

Understanding the acceptability of MT799 as an underlying for forex forward contracts is crucial for effective risk management in international trade. By leveraging the benefits of MT799, such as automated processing, transparent pricing, and global reach, businesses can minimize currency risk and facilitate cross-border transactions with confidence.

If you found this article informative and are interested in learning more about MT799 and its use in forex forward contracts, I encourage you to continue your research. Engage with financial experts, explore online resources, and stay updated on industry trends to deepen your understanding.