Introduction

Investing in foreign exchange (forex) can be a lucrative but daunting task, especially for beginners. Spread betting offers an accessible and potentially rewarding alternative to traditional trading. In this comprehensive guide, we’ll delve into the world of spread betting and unravel the secrets to success in this exhilarating arena.

Image: tradersbulletin.co.uk

Forex spread betting allows you to wager on the future direction of currency pairs without actually owning the underlying assets. This unique characteristic opens up a world of possibilities for investors seeking to capitalize on currency fluctuations. Whether you’re a seasoned veteran or a novice eager to explore new horizons, this article will equip you with the essential knowledge to navigate the dynamic waters of spread betting forex.

Understanding Forex Spread Betting

Spread betting is a derivative trading method where you speculate on the movement of currency pairs without taking ownership of the underlying assets. Instead, you place a wager on the difference (or spread) between the bid and ask prices of a currency pair. If your prediction aligns with the market’s movement, you profit from the difference; if not, you incur losses.

The key advantage of spread betting is the potential for high returns with relatively small outlays. This leverage can magnify your profits, but it also amplifies potential losses, making risk management crucial.

Core Concepts of Forex Spread Betting

-

Currency Pairs: Forex spread betting involves pairs of currencies, such as EUR/USD or GBP/JPY. You speculate on the rise or fall of one currency against the other.

-

Spread: The spread is the difference between the bid (buy) price and the ask (sell) price of a currency pair. Spread betting profits and losses are based on the spread movement.

-

Pip: A point in percentage (pip) measures the smallest price movement in a currency pair. Most currency pairs have a pip value of 0.0001, except for pairs containing the Japanese Yen (JPY), which have a pip value of 0.01.

-

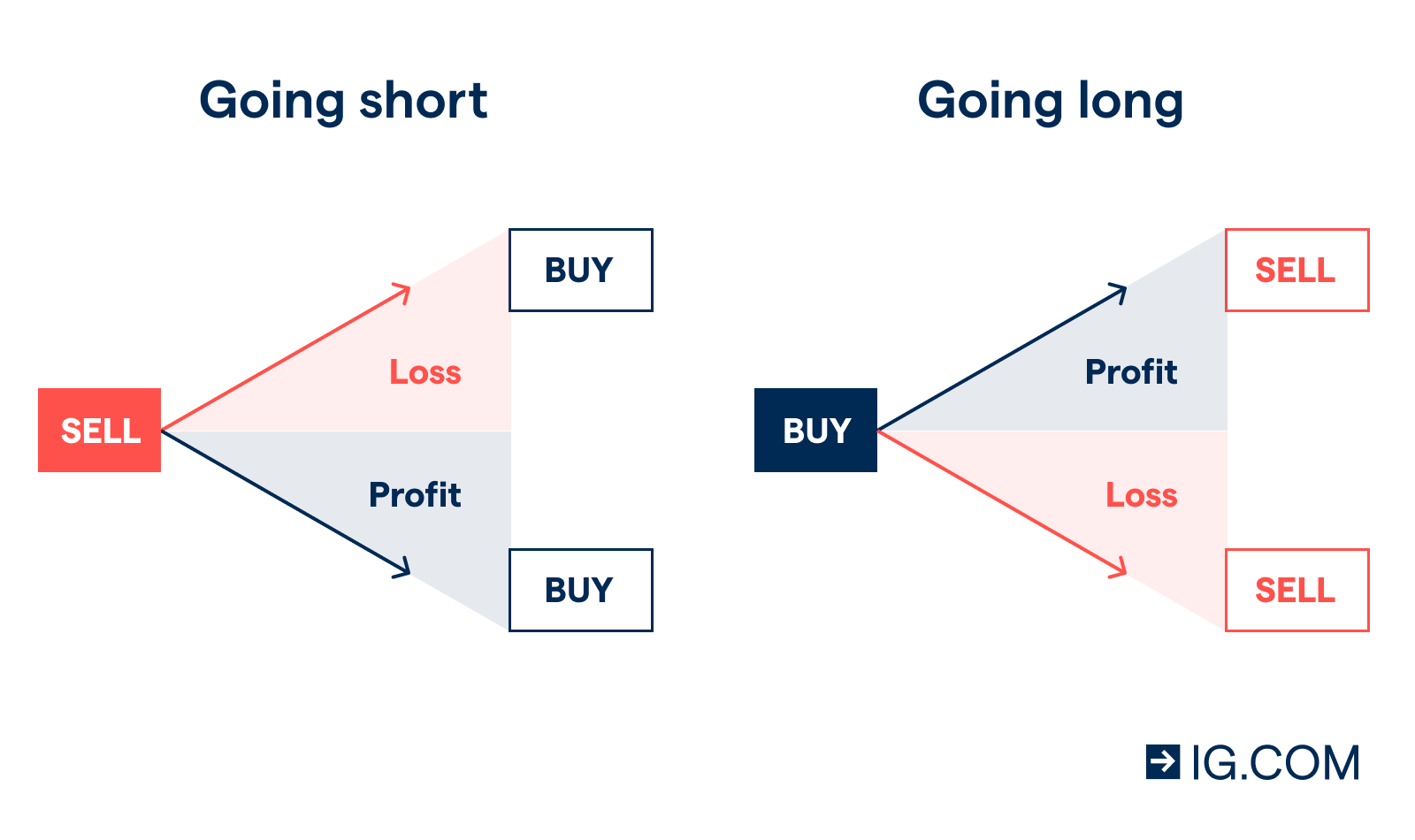

Long and Short Positions: In spread betting, you can take a ‘long’ position if you believe a currency pair will rise in value or a ‘short’ position if you believe it will fall.

-

Leverage: Spread betting involves leverage, meaning you can control a larger position with a smaller deposit. Remember, leverage magnifies both profits and losses.

How to Get Started with Forex Spread Betting

-

Choose a reputable broker: Select a regulated and trustworthy spread betting provider with competitive spreads and trading conditions.

-

Open an account: Provide personal details and funding to establish your spread betting account. Demo accounts are typically available for practice.

-

Learn the platform: Familiarize yourself with the trading platform’s features, charts, and order execution process.

-

Develop a trading plan: Define your trading strategy, risk tolerance, and profit targets before placing trades.

-

Manage risk: Implement stop-loss and take-profit orders to limit potential losses and secure profits.

Image: www.ig.com

Tips for Successful Spread Betting Forex

-

Educate yourself: Understand the financial markets, technical analysis, and risk management principles before trading.

-

Practice with a demo account: Test your strategies and gain confidence in a risk-free environment before trading with real money.

-

Analyze the market: Study macroeconomic data, news events, and technical charts to identify trading opportunities.

-

Control your emotions: Avoid impulsive trading and adhere to your trading plan. Greed and fear can cloud your judgment.

-

Manage risk: Set realistic profit targets and use leverage wisely. Remember, higher leverage amplifies both profits and losses.

How To Spread Bet Forex

Conclusion

Spread betting forex offers a thrilling opportunity for investors to capitalize on currency fluctuations. By understanding key concepts, selecting a reliable broker, and implementing a sound trading plan, you can navigate the complexities of spread betting and unlock its potential rewards. Remember, the financial markets are ever-changing, so continuous learning and risk management are essential for long-term success. Embrace the challenge, embrace the excitement, and embark on your journey to conquer the dynamic world of spread betting forex.