Imagine you’re a novice Forex trader with a limited budget. You may be drawn to the promise of substantial profits, but fear the volatility and market swings that are synonymous with currency trading. This is where micro lot trading comes into play, offering a safer and accessible gateway into the dynamic world of Forex.

Image: www.forex.academy

Micro lot trading has revolutionized Forex trading by introducing a level of precision that caters to small-scale investors. It empowers traders with the ability to execute trades involving fractional units of currency, significantly reducing the financial risk associated with standard lot transactions.

Understanding Micro Lots

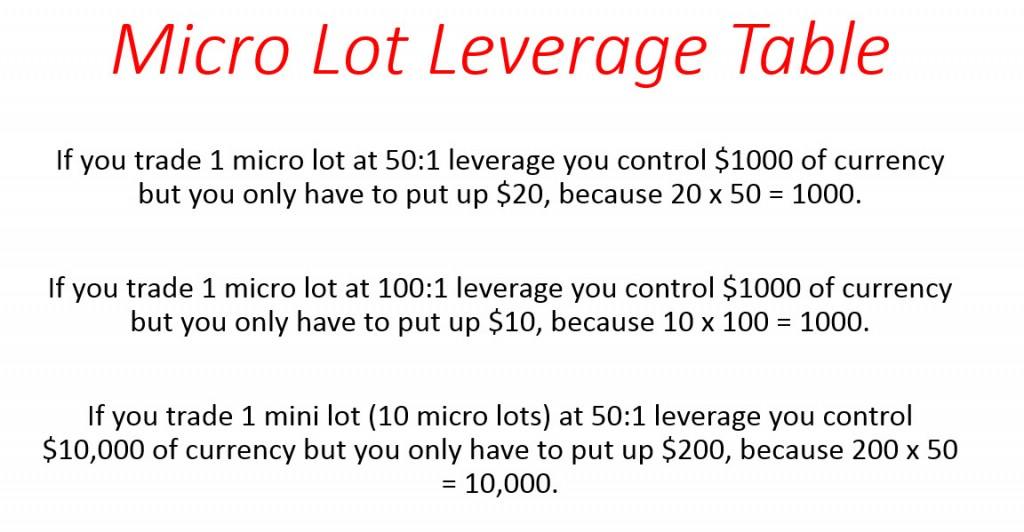

A micro lot, often denoted as “0.01 lot” or “µ-lot,” represents 1,000 base units of a particular currency. By contrast, a standard lot represents 100,000 base units. This substantial difference provides traders with greater control over their risk exposure, enabling them to trade smaller positions that align with their capital.

Consider the example of the EUR/USD currency pair. A standard lot of EUR/USD involves trading 100,000 euros (EUR), which could translate to a significant financial outlay. With micro lot trading, however, you can trade just 1,000 EUR, reducing your exposure by a factor of 100.

Benefits of Micro Lot Trading

- Reduced Risk: Micro lots minimize the potential financial loss per trade, making Forex trading more accessible and less daunting for beginners.

- Increased Flexibility: The ability to trade smaller positions allows traders to experiment with different strategies and fine-tune their risk management practices.

- Enhanced Precision: Micro lot trading provides greater precision in position sizing, enabling traders to tailor their trades to their precise risk tolerance and profit objectives.

Tips for Micro Lot Trading

To succeed in micro lot trading, consider these valuable tips:

Embrace Proper Risk Management: Despite the reduced risk compared to standard lot trading, micro lot traders should still implement sound risk management strategies to protect their capital. This includes setting appropriate stop-loss orders and adhering to a disciplined trading plan.

Understand the Impact of Spreads: Spreads, the difference between the bid and ask prices, have a more pronounced impact on micro lot traders due to the smaller position size. Therefore, it’s crucial to select a broker that offers competitive spreads.

Image: www.forexearlywarning.com

FAQs

- Q: What is the difference between a standard lot and a micro lot?

A: A standard lot is 100 times larger than a micro lot.

- Q: How small are micro lots?

A: Micro lots represent 1,000 base units of a particular currency or 1% of a standard lot.

- Q: Are micro lots suitable for beginners?

A: Yes, micro lots are particularly well-suited for beginners due to their reduced risk and increased flexibility.

What Is Micro Lot In Forex

Conclusion

In the world of Forex trading, micro lots have created a paradigm shift, empowering traders to navigate currency markets with precision and reduced financial risk. By harnessing the benefits of micro lot trading, both novice and experienced traders can capitalize on the opportunities within the Forex arena. So, embrace the world of micro lot trading and embark on an exciting journey toward Forex success!