Understanding the Importance of Lot Size in Forex Trading

Imagine this: you’re eager to dive into the world of forex trading, ready to capitalize on market fluctuations. But you’re faced with a daunting question: how much money should you risk on each trade? This is where the concept of lot size comes into play. Lot size refers to the unit of measurement used to determine the size of your trade positions. It directly impacts your potential profit or loss, making it a critical factor in managing risk and maximizing returns.

Image: leonaamanda.blogspot.com

In the realm of forex, lot sizes are standardized, with a standard lot representing 100,000 units of the base currency. For instance, if you trade a standard lot of EUR/USD, you’re essentially buying or selling 100,000 euros. However, the leverage offered by brokers allows traders to control larger positions with smaller capital investments. That’s where the MT5 lot size calculator comes into the equation, providing a crucial tool for calculating the appropriate lot size based on your risk appetite and account balance.

The Power of the MT5 Lot Size Calculator: Demystifying Trading Risks

Delving into the Mechanics of the Lot Size Calculator

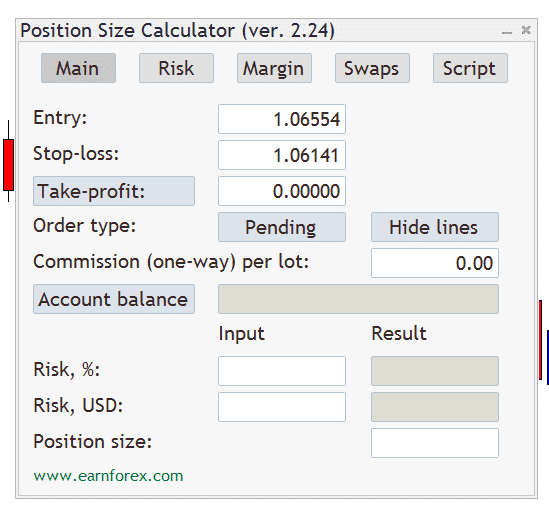

The MT5 lot size calculator is an indispensable tool for forex traders, allowing them to determine the ideal lot size for each trade. It leverages key parameters such as your account balance, desired risk percentage, and the current stop-loss level to calculate the appropriate lot size. This process ensures you maintain a calculated risk exposure, minimizing the potential for significant losses while maximizing your trading potential.

The calculator works by translating your risk tolerance and account balance into quantifiable lot sizes. By setting your desired risk percentage, you’re essentially determining the maximum percentage of your account balance you’re willing to lose on a single trade. For example, if you have a $10,000 account and set a 2% risk limit, the calculator will calculate the maximum lot size that aligns with this risk threshold. This empowers you to manage your risk effectively, preventing substantial losses that could derail your trading journey.

Calculating Lot Size in MT5: A Step-by-Step Guide

Navigating the MT5 lot size calculator is straightforward, even for novice traders. Here’s a step-by-step breakdown of the calculation process:

- Determine your account balance: Begin by identifying the current balance in your MT5 trading account. This forms the basis for calculating the appropriate lot size.

- Define your risk percentage: Decide the maximum percentage of your account balance that you’re willing to risk on any single trade. Ensure this percentage aligns with your risk tolerance and trading strategy.

- Set your stop-loss level: Determine the stop-loss level for your trade, which represents the point at which you’ll exit the trade if the market moves against you. This stop-loss level plays a crucial role in managing potential losses.

- Input the values into the MT5 lot size calculator: Enter your account balance, risk percentage, and stop-loss level into the calculator. The calculator will then automatically calculate the optimal lot size for your trade.

- Interpret the results: The MT5 lot size calculator will display the calculated lot size, which represents the appropriate trade size based on your input parameters.

Image: mappingmemories.ca

Beyond Basic Calculations: Optimizing Lot Size for Maximum Returns

While the MT5 lot size calculator provides a solid foundation for managing risk, it’s crucial to consider additional factors to optimize your lot size strategy. The market volatility and trade duration can influence your profit or loss potential, making it essential to fine-tune your lot size accordingly. For volatile markets with short-term trades, it might be prudent to opt for smaller lot sizes to minimize risk exposure. Conversely, in stable markets with longer-term trades, you might consider larger lot sizes to capitalize on potential gains.

Moreover, it’s essential to assess the leverage offered by your broker. Higher leverage can amplify your potential profits, but it also magnifies your potential losses. It’s critical to exercise caution with leverage and utilize it strategically to manage your risk effectively. Remember, responsible trading involves understanding the risks involved and taking calculated steps to mitigate potential losses.

Navigating the Nuances of Trading with an MT5 Lot Size Calculator

Harnessing the Power of the Lot Size Calculator: Tips for Success

The MT5 lot size calculator isn’t a one-size-fits-all solution. To leverage it effectively, consider these key tips:

- Start Small: When embarking on your forex trading journey, begin with smaller lot sizes to gain experience and test your strategies. This approach allows you to learn the intricacies of the market without exposing yourself to significant risks.

- Adjust as Needed: The market is constantly evolving, and your trading strategies may need to adapt accordingly. Monitor your trades, analyze your performance, and adjust your lot sizes based on market conditions and your trading experience.

- Embrace a Disciplined Approach: Discipline is paramount in forex trading. Adhere to your pre-determined risk percentage and avoid emotional trading decisions that can lead to impulsive lot size adjustments.

- Continuously Learn and Refine: Forex trading is a dynamic field, requiring ongoing learning and adaptation. Stay updated on market trends, refine your strategies, and seek opportunities to enhance your understanding of lot size management.

Expert Advice: Mastering the Art of Lot Size Management

Experienced forex traders often emphasize the importance of consistent risk management and a disciplined approach to lot size determination. It’s crucial to understand that the pursuit of larger profits shouldn’t overshadow the importance of managing risk effectively. By adhering to a calculated risk approach, you can safeguard your capital while maximizing your trading potential.

Furthermore, seasoned traders recommend using the MT5 lot size calculator in conjunction with other risk management tools. This integrated approach ensures that you’re not solely reliant on the calculator and are employing a holistic strategy to manage your trading risks. Diversifying your risk management techniques can provide a robust framework for navigating the uncertainties of the forex market.

FAQs about MT5 Lot Size Calculation

Q: What is the best lot size for a beginner?

A: As a beginner, it’s advisable to start with a micro lot size (0.01 lot) or a mini lot size (0.1 lot). This approach allows you to gain experience while limiting your risk exposure. As you gain confidence and refine your trading strategies, you can gradually increase your lot size.

Q: How can I adjust the lot size calculator for different trading styles?

A: The MT5 lot size calculator provides flexibility in adjusting parameters like risk percentage and stop-loss level. You can fine-tune these inputs based on your trading style. For scalping, where you aim for quick profits, consider using smaller lot sizes to capitalize on small price movements. For swing trading, with longer holding periods, you might choose larger lot sizes to leverage potential price swings.

Q: Is it possible to set an automated lot size calculation in MT5?

A: Yes, MT5 allows you to set up automated trading strategies using Expert Advisors (EAs). You can program an EA to incorporate the logic behind the lot size calculator, automatically calculating and adjusting lot sizes based on predefined rules. However, it’s essential to ensure the EA is thoroughly tested and validated before implementing it in live trading.

Q: What are the potential consequences of using an inappropriate lot size?

A: Using an inappropriate lot size can have significant consequences. If you use lot sizes that are too large, you could face substantial losses exceeding your risk tolerance. Conversely, using lot sizes that are too small might limit your profit potential and fail to capitalize on market opportunities. It’s crucial to strike a balance between risk and reward by using the appropriate lot sizes for your trading style and risk appetite.

Lot Size Calculator Mt5

Conclusion

The MT5 lot size calculator is an essential tool for forex traders of all levels, empowering them to manage risk effectively and optimize their trading strategies. By carefully considering your account balance, risk tolerance, and trade parameters, you can leverage the calculator to calculate the appropriate lot size for each trade, ultimately maximizing your trading potential while safeguarding your capital.

Are you ready to unlock the power of the MT5 lot size calculator and elevate your forex trading journey? Start exploring the calculator’s capabilities and embrace a disciplined approach to risk management for a more rewarding trading experience.