Ever wondered what a “lot” represents in the world of Forex trading, and how it translates into real dollars?

The concept of lot size might seem a bit intimidating at first, but understanding it is crucial for anyone looking to navigate the exciting (and sometimes volatile) waters of foreign exchange trading.

Image: ubicaciondepersonas.cdmx.gob.mx

Put simply, a lot size in Forex determines the quantity of a currency that you’re buying or selling in a particular trade. It essentially represents the “volume” of your trade. While Forex trading is famous for its high leverage and often involves dealing with relatively small capital amounts, understanding lot size is crucial for managing risk, controlling potential losses, and maximizing potential profits.

Understanding the Terminology: Deconstructing a Lot

Imagine the Forex market as a vast marketplace where you’re buying or selling currencies like the Euro, US Dollar, or Japanese Yen. The lot size is your unit of measurement – a standard way to quantify how much “currency” you’re trading. Here’s a simplified breakdown:

1. Micro Lot (0.1 Lot):

A micro lot is the smallest lot size available in Forex trading, equivalent to 1,000 units of the base currency. For instance, if you are trading EUR/USD and buy one micro lot, you are actually buying 1,000 Euros (the base currency) and selling an equivalent amount of USD (the quote currency).

2. Mini Lot (0.1 Lot):

A mini lot is slightly bigger, representing 10,000 units of the base currency. If you’re trading a mini lot of GBP/USD, you are buying 10,000 British Pounds and selling an equivalent amount of US Dollars.

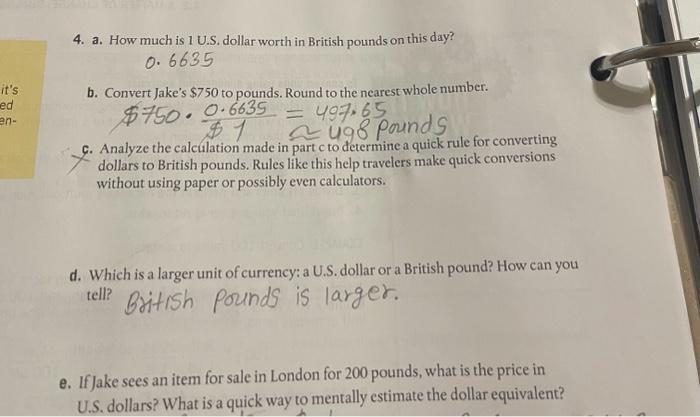

Image: www.chegg.com

3. Standard Lot (1 Lot):

This is the traditional lot size, representing 100,000 units of the base currency. Therefore, a one-lot trade in USD/JPY would involve buying 100,000 US Dollars and selling the equivalent amount of Japanese Yen.

Lot Size, Leverage, and Risk Management: The Trifecta

Understanding the interplay between lot size, leverage, and risk is crucial for success in Forex trading. Here’s a closer look at each factor, and how they impact your trading decisions:

1. Leverage: Amplifying Your Potential

Leverage in Forex allows you to control a much larger position in the market with a smaller initial investment. It essentially amplifies both your potential profits and your potential losses. For example, a 1:100 leverage means that for every $1 you invest, you can control $100 worth of currency in the market.

2. Lot Size: How Much You’re Trading

The lot size you choose reflects the amount of currency you’re buying or selling. The larger the lot size, the more money you’re putting at risk, but also the greater the potential profit. Choosing the right lot size is crucial for managing risk and ensuring your trading strategy is sustainable.

3. Risk Management: Protecting Your Capital

Risk management is all about minimizing potential losses. In Forex, this involves setting a “stop-loss” order, which automatically closes your position if the market moves against you by a certain amount. The size of your lot size will directly influence the potential losses or gains you could experience on a trade.

Calculating the Dollar Value of a Lot: A Practical Example

Let’s delve into a real-world example to understand how lot size translates into actual dollar values. Consider the GBP/USD currency pair, currently trading at 1.3000.

- 1 Micro Lot (0.1 Lot): This would equal 1,000 GBP, which at the current exchange rate, would be valued at approximately $1,300.

- 1 Mini Lot (0.1 Lot): This would equal 10,000 GBP, which at the current exchange rate, would be valued at approximately $13,000.

- 1 Standard Lot (1 Lot): This would equal 100,000 GBP, which at the current exchange rate, would be valued at approximately $130,000.

Choosing the Right Lot Size: A Balancing Act

Selecting the right lot size is not a one-size-fits-all approach. It depends on several factors, including your trading experience, risk tolerance, account balance, and trading strategy. Here are some key considerations:

1. Account Balance:

Your account balance plays a crucial role. It’s generally recommended to start with a smaller lot size that doesn’t exceed a small percentage of your total capital. This reduces the risk of wiping out your account during initial learning phases.

2. Risk Tolerance:

Your willingness to accept potential losses is another factor. A higher risk tolerance might lead you to opt for a slightly larger lot size, while a more conservative approach suggests sticking with smaller lots.

3. Trading Strategy:

Your trading style and strategy also influence lot size. Swing traders, who hold positions for a longer period, might prefer larger lot sizes, while scalpers, who focus on short-term movements, might choose smaller lots.

The Evolution of Lot Sizes: A Historical Perspective

The concept of lot sizes in Forex trading has evolved over time, driven by technological advancements and changing market dynamics. Previously, standard lots were a very common practice, but with the rise of online brokerages and the démocratisation of trading, smaller lot sizes like micro lots and mini lots became more prevalent. This evolution has made Forex trading more accessible to a wider range of investors and traders with varying levels of capital and risk appetite.

The Future of Lot Sizes: Micro Lots Take Center Stage

As online trading platforms continue to innovate and cater to diverse trader needs, micro lots are poised to play an even more prominent role in the future of Forex trading. Their small size makes them ideal for beginners, allowing them to learn the ropes with minimal risk, and for experienced traders seeking to manage their portfolios with greater precision and control.

1 Lot Size In Dollars

Key Takeaways

Understanding lot size in Forex trading is crucial for managing risk, controlling losses, and maximizing potential profits. By carefully considering your account balance, risk tolerance, trading strategy, and the current market conditions, you can make informed decisions about the appropriate lot size for your trades. Remember, choosing the right lot size is a vital step toward achieving sustained success in the exciting world of Forex trading.

Do you have any experience with Forex trading and lot size? I’d love to hear your thoughts and insights on the topic. Share your experiences and tips in the comments below! Let’s continue the conversation about navigating the dynamic world of Forex.