Embark on a captivating journey into the enigmatic world of forex trading, where fortunes are made and lost. As you navigate this financial labyrinth, you’ll encounter a fundamental concept that can shape your trading destiny: the standard lot. Join us as we unravel the intricacies of this pivotal term, empowering you to unlock its potential and elevate your trading acumen.

Image: pargatiha.blogspot.com

Defining the Standard Lot: A Cornerstone of Forex Trading

In the vast expanse of currency markets, traders operate with standardized contract sizes known as lots. These units represent a specific number of currency units and serve as the foundation for measuring trade volume. Among these standardized sizes, the standard lot reigns supreme, embodying the benchmark against which all other lot denominations are measured.

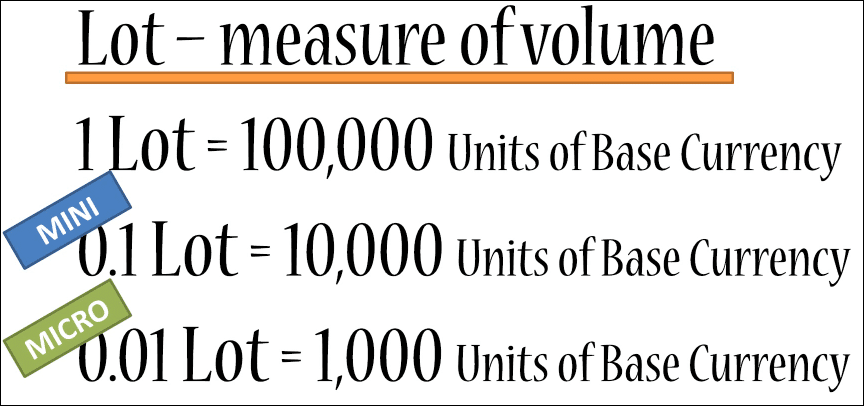

By definition, 1 standard lot in forex trading equates to 100,000 units of the base currency. This universal standard ensures consistency and facilitates global trade across multiple currencies. Whether you’re a seasoned trader or just dipping your toes into the forex waters, grasping the concept of the standard lot is paramount to understanding the dynamics of this fast-paced market.

The Symphony of Currencies: Pip Values and Profit Potential

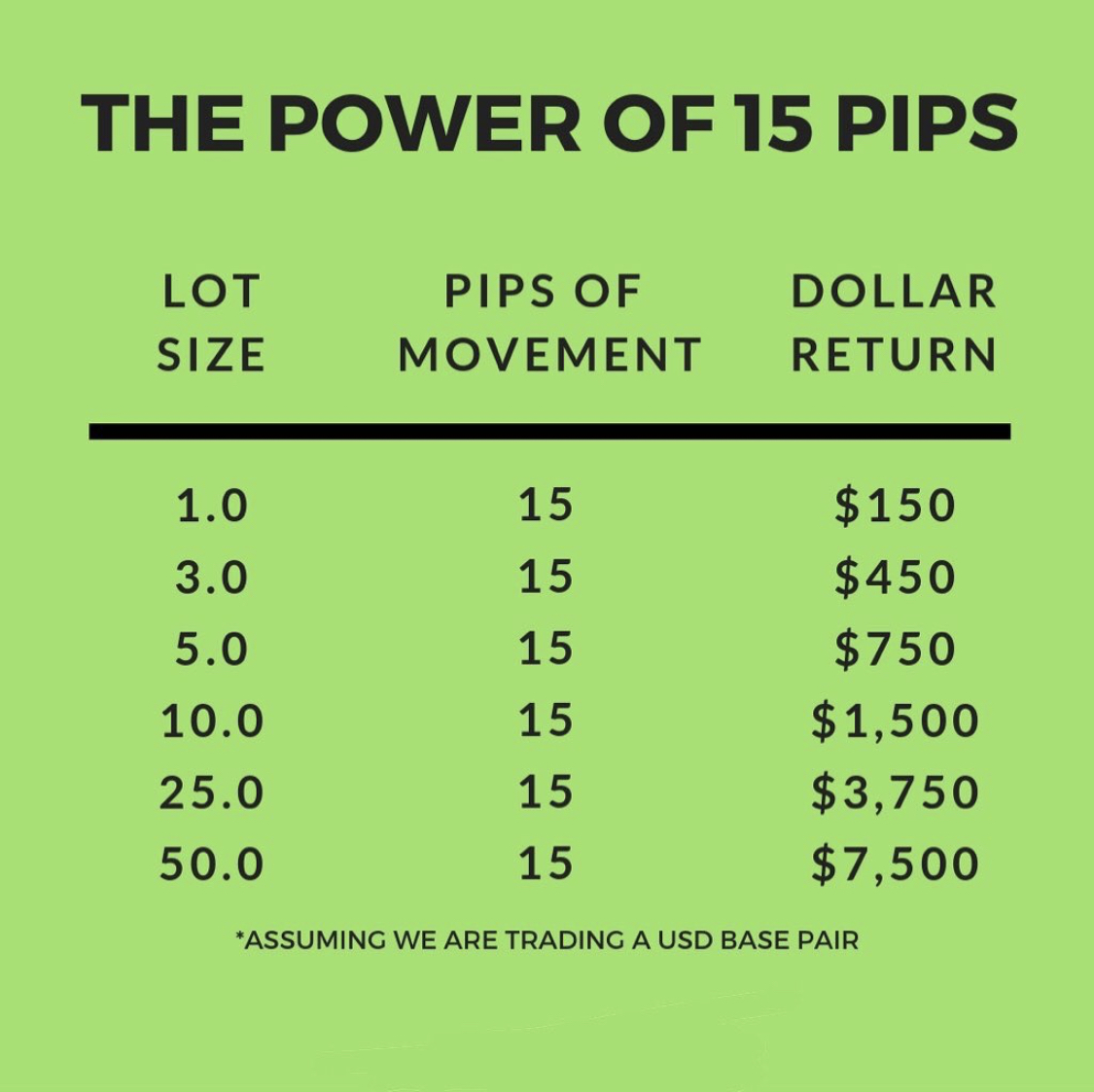

Understanding the standard lot’s significance extends beyond its numerical representation. It plays a pivotal role in determining the value of a pip (point in percentage), the fundamental unit of measurement for price fluctuations in forex trading. Pips represent the smallest possible price change for a currency pair, and their value is directly influenced by the size of the lot being traded.

Consider this: when trading 1 standard lot of EUR/USD, each pip movement equates to $10. This means that for every pip the currency pair moves in your favor, you stand to pocket a tidy profit of $10. Conversely, an unfavorable pip movement will deduct the same amount from your account balance. The larger the lot size, the higher the potential profit or loss for each pip movement, making the standard lot an optimal choice for experienced traders seeking substantial returns.

Unveiling the Nuances of Leverage: Risk and Reward Amplified

Leverage, a powerful tool in forex trading, allows traders to amplify their potential returns by magnifying their trading capital. However, it’s crucial to remember that leverage is a double-edged sword, amplifying both profits and losses.

Utilizing leverage wisely requires a thorough understanding of its mechanics and the potential risks involved. With 1 standard lot representing 100,000 units of the base currency, it’s imperative to exercise caution and trade within your risk tolerance. Remember, while leverage can enhance profits, it can also exacerbate losses if the market moves against your position.

Image: forexboat.com

Professional Insights: Navigating the Forex Market with Confidence

To truly master the art of forex trading, seek guidance from experienced traders who have weathered the market’s storms and emerged victorious. Their insights can illuminate the path to success and provide invaluable guidance as you navigate the complexities of currency exchange.

Here’s a nugget of wisdom from a seasoned forex trader: “When determining the right lot size for your trades, it’s essential to consider your risk tolerance, trading experience, and account balance. Remember, trading with 1 standard lot can be a high-stakes game, suitable for experienced traders with a strong understanding of risk management.”

Beyond the Standard: Exploring Other Lot Sizes

While the standard lot holds its own as the most prevalent lot size in forex trading, other denominations exist to cater to varying risk appetites and trading strategies. Mini lots, representing 10,000 units of the base currency, offer a scaled-down option for traders with limited capital or a lower tolerance for risk.

Micro lots, the smallest lot size available, equate to just 1,000 units of the base currency, making them suitable for ultra-conservative traders or those just starting out. Understanding the spectrum of lot sizes empowers traders to customize their trading approach and optimize their risk-to-reward ratio.

Charting Success: Unlocking the Secrets of Forex Trading

To truly excel in forex trading, mastery of technical analysis is essential. Technical analysts scrutinize currency charts, seeking patterns and trends that provide valuable insights into market behavior. By studying historical price movements, traders can make informed decisions, identifying potential trading opportunities and managing risk effectively.

Through technical analysis, traders can identify support and resistance levels, predict market reversals, and gauge the overall market sentiment. Armed with this knowledge, traders can position themselves strategically for success, enhancing their chances of reaping the rewards that forex trading has to offer.

Emotional Intelligence: The Path to Trading Mastery

In the dynamic and often volatile world of forex trading, emotional intelligence is an invaluable asset that can separate winners from losers. The ability to manage emotions, particularly fear and greed, is crucial for making sound trading decisions and avoiding costly mistakes.

Traders who succumb to fear may prematurely exit profitable positions, while those consumed by greed may overextend themselves, risking more than they can afford. Mastering emotional intelligence empowers traders to remain disciplined, adhere to their trading plans, and make rational decisions amidst市場的起起伏伏.

What Is 1 Standard Lot In Forex Trading

Conclusion: Embracing the Power of Knowledge in Forex Trading

Forex trading presents a world of possibilities, but success is reserved for those who embrace the power of knowledge and approach the market with a well-informed strategy. Understanding the intricacies of 1 standard lot, leveraging professional insights, and harnessing technical analysis empower traders to navigate this dynamic market with confidence and maximize their chances of reaping its rewards.

Remember, education is an ongoing journey in forex trading. As the market evolves, so should your knowledge. Stay abreast of the latest trends, closely monitor market news, and continually refine your trading skills. With dedication and a commitment to learning, you can unlock the full potential of forex trading and forge your path to financial success.