In the vast realm of financial markets, understanding the concept of “a lot” in Forex trading is crucial. Grasping this fundamental aspect will empower you to navigate the Forex arena with confidence and precision.

Image: www.cashbackforex.com

Forex, an acronym for foreign exchange, involves trading currencies in pairs. When you buy one currency, you simultaneously sell another, hoping to profit from fluctuations in their exchange rates. The standard unit of measurement in Forex is a lot, and knowing its significance is paramount.

What is a Lot?

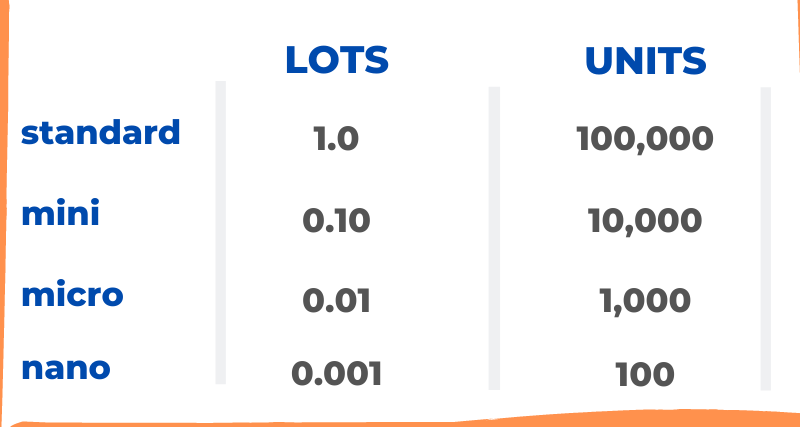

A lot in Forex represents a standardized contract size, signifying the quantity of a base currency traded against a counter currency. The most common lot sizes are the standard lot (100,000 units), the mini lot (10,000 units), and the micro lot (1,000 units). Each lot size corresponds to a specific value in the base currency.

Understanding Lot Sizes

The standard lot, the largest and most widely traded, has a value of $100,000 in the base currency. A mini lot, one-tenth the size of a standard lot, is worth $10,000, while a micro lot, the smallest size, equates to $1,000. The appropriate lot size for your trades depends on your account balance, risk appetite, and trading strategy.

Latest Trends in Lot Sizes

In recent years, there has been a trend towards smaller lot sizes, particularly micro lots. This shift is driven by the increasing accessibility of Forex trading to retail traders with smaller account balances. Micro lots allow traders to participate in the Forex market with a lower capital investment, mitigating risk and enhancing flexibility.

Image: www.mitrade.com

Expert Advice on Lot Size Selection

- Start small: Begin with a lot size that aligns with your account balance and risk tolerance.

- Consider your risk: The larger the lot size, the greater the potential gains and losses.

- Adjust as needed: As your trading skills develop, you can adjust the lot size to match your evolving strategy and capital.

- Use leverage wisely: Leverage can magnify both profits and losses, so use it cautiously and understand its implications.

FAQ on Lot Sizes

- Q: What is the smallest lot size in Forex?

A: Micro lot (1,000 units). - Q: What factors should I consider when choosing a lot size?

A: Account balance, risk tolerance, trading strategy. - Q: Can I trade larger lot sizes than my account balance?

A: Yes, through leverage, but exercise caution as it magnifies both profits and losses. - Q: What is the standard lot size in Forex?

A: 100,000 units.

How Much Is A Lot In Forex

Conclusion

Comprehending the significance of a lot in Forex is essential for successful trading. By selecting an appropriate lot size and following expert advice, traders can optimize their risk management and capitalize on market opportunities. Remember, Forex trading involves inherent risks, so it’s imperative to approach it with prudence and a thorough understanding of its complexities.

Are you intrigued by the world of Forex and eager to delve deeper into the intricacies of lot sizes? Join the conversation and share your thoughts and experiences.