In the realm of investing, the allure of forex and stocks beckons novice investors with promises of lucrative returns. However, navigating this labyrinthine landscape can prove daunting, leaving many perplexed about which avenue to pursue. This comprehensive guide will illuminate the intricate differences between forex and stocks, empowering you to make an informed decision that aligns with your financial aspirations and risk tolerance.

Image: www.sapeople.com

Currencies vs Companies: A Tale of Two Kingdoms

At the heart of forex, the foreign exchange market, lies the trading of currencies. From the pulsating streets of New York to the teeming avenues of Tokyo, forex brokers facilitate the conversion of one currency to another, perpetually seeking arbitrage opportunities in the global marketplace.

Stocks, on the other hand, represent ownership in publicly traded companies. When you purchase a stock, you essentially become a shareholder, entitled to a portion of the company’s profits and assets. This nuanced distinction fundamentally separates forex and stocks, shaping their respective risks and rewards.

Liquidity: The Bloodline of Market Access

Liquidity, the lifeblood of financial markets, measures the ease with which an asset can be bought or sold. Forex reigns supreme in this regard, boasting the highest liquidity of all financial instruments. This abundance of willing buyers and sellers ensures that trades can be executed swiftly and efficiently, minimizing price volatility and slippage.

Stocks, while generally less liquid than forex, still present ample opportunities for trading, particularly for blue-chip companies with proven financial stability. However, it’s essential to note that liquidity can vary dramatically between different stocks, with some emerging market stocks exhibiting lower liquidity levels than others.

Market Hours: The Chronoarchitecture of Trading

The forex market is a nocturnal beast, operating 24/5, spanning every continent and time zone. This ceaseless rhythm caters to global investors, empowering them to capitalize on market movements at all hours of the night and day.

Stocks, on the other hand, typically follow the business hours of their respective exchanges. This limited trading window can be both an advantage and a constraint, depending on your availability to monitor and manage your investments.

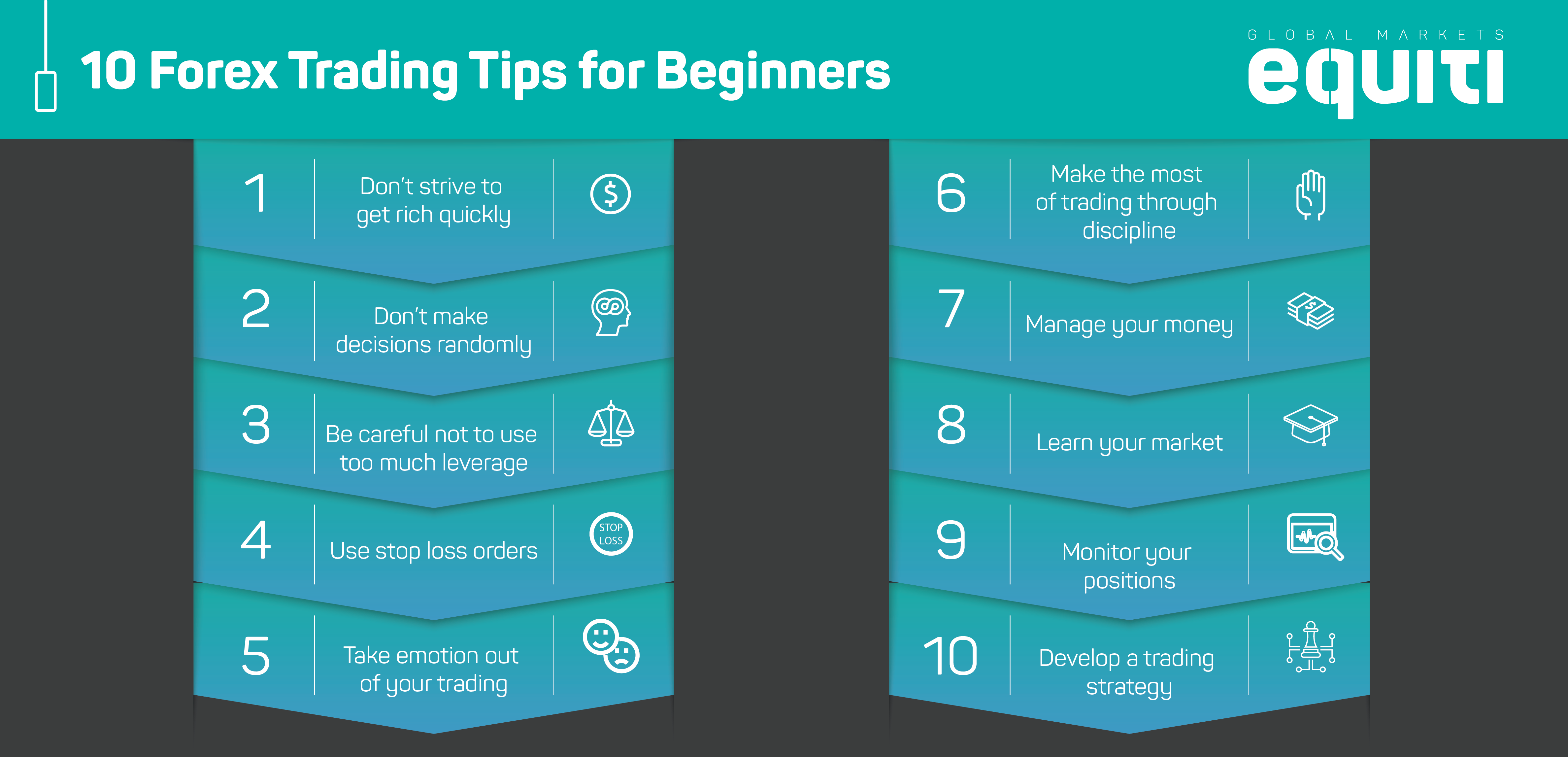

Image: www1.equiti.com

Leverage: A Double-Edged Sword of Magnification

Forex trading often incorporates leverage, a tool that amplifies both profits and losses. By employing leverage, traders can control a larger position with a smaller initial investment, potentially maximizing returns. However, this magnifier can also intensify losses, requiring prudent risk management and stop-loss orders as essential safeguards.

Stocks generally do not offer the same degree of leverage, minimizing the potential for outsized gains and losses. This reduced leverage can be a boon for risk-averse investors seeking more stability in their portfolios.

Volatility: The Pulse of Market Moods

In the unforgiving arena of investing, volatility reigns as the arbiter of market sentiment. Forex exhibits significant volatility, experiencing wide price swings throughout the day and night. This inherent volatility can create both opportunities and pitfalls for traders, rewarding swift decision-making and punishing ill-timed trades.

Stocks, while less volatile than forex, are still subject to the whims of supply and demand, economic conditions, and geopolitical events. The volatility of individual stocks can vary widely, with high-growth technology stocks often exhibiting greater volatility than stable utilities or consumer staples.

Transaction Costs: The Invisible Hand of Trading

Every trade, a ripple in the fabric of the financial markets, carries a cost. Forex transactions typically entail a spread, the difference between the bid price (selling price) and the ask price (buying price). While spreads can vary depending on currency pair and market conditions, they generally remain competitive in the forex market.

Stocks incur transaction costs in the form of brokerage fees, which may vary depending on the broker and the size of the trade. It’s crucial to consider these transaction costs in your investment calculations, as they can impact your overall profitability.

Which Is Easier Forex Or Stocks

Which Path Embarks for You: A Personal Pilgrimage

In choosing between forex and stocks, there is no right or wrong answer, only the path that aligns with your financial goals and risk tolerance. Forex, with its unparalleled liquidity, 24/5 trading hours, and potential for leveraging profits, beckons to seasoned traders and those seeking short-term returns.

Stocks, while offering less volatility and leverage, provide investors with a tangible stake in the performance of publicly traded companies. Dividends, capital appreciation, and long-term growth potential add to their allure. Whether you venture into the enigmatic realm of forex or the familiar landscape of stocks, embark on your investment journey with prudence, education, and a steadfast resolve.

Remember, the investment labyrinth is ever-evolving, its paths constantly shifting. Invest in knowledge, cultivate your skills, and seek guidance from reputable sources to navigate the complexities of the financial markets with confidence. With determination and a clear understanding of the forces that shape these two investment arenas, you can forge a path to financial success, one step at a time.