The New York Close, a time-honored benchmark in the foreign exchange market, holds immense significance for traders seeking to grasp market sentiment and position their strategies accordingly. This article delves into the intricacies of the New York Close, exploring its historical evolution, practical implications, and impact on global forex trading. Whether you are a seasoned professional or a budding enthusiast, understanding the New York Close will empower you to make informed decisions and navigate the dynamic forex landscape.

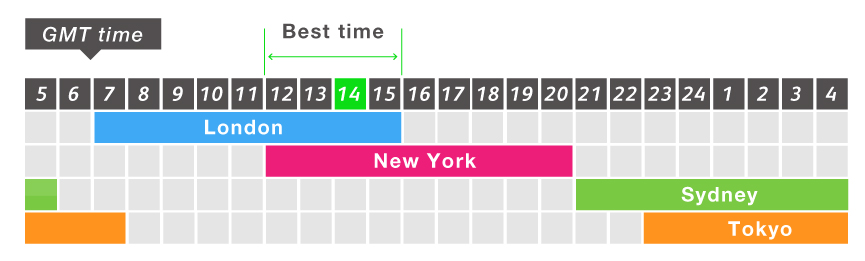

Image: tradingsitus.blogspot.com

A Historical Perspective: The Origins of the New York Close

The New York Close, a financial convention with enduring roots, emerged as a way to standardize the end-of-trading-day calculations for the foreign exchange market. The practice can be traced back to the early days of forex trading, when global financial centers maintained their own unique operating hours. The lack of synchronization among these centers posed challenges for traders seeking to compare prices and execute transactions across different time zones.

In response to this need for harmonization, the global forex market adopted a common closing time, coinciding with the end of the trading day in New York, the world’s preeminent financial hub. The New York Close was established as the pivotal moment when daily forex rates are officially set, serving as a critical reference point for market participants worldwide.

Practical Implications: Impact on Forex Trading

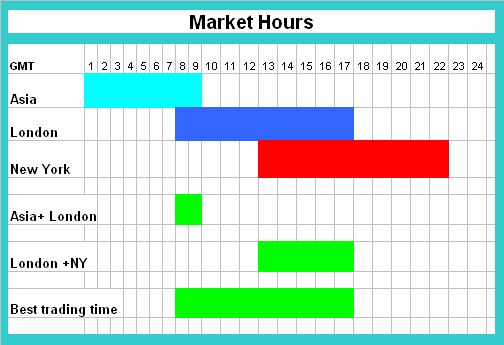

The New York Close, occurring at 5:00 PM Eastern Standard Time (EST), has profound implications for forex traders. As the global forex market transitions from its busiest hours to the relative quiet of after-hours trading, the New York Close serves as a crucial time for assessing market sentiment and recalibrating trading strategies.

For many traders, the New York Close represents an opportune moment to lock in profits or adjust positions before the onset of overnight market activity. The convergence of global market participants at this specific juncture facilitates price discovery, enhances liquidity, and provides traders with valuable insights into potential market direction.

Global Influence: Shaping Market Sentiment Worldwide

The New York Close extends its influence well beyond the financial epicenter of Manhattan. It serves as a critical determinant of forex market sentiment for traders and investors across the globe. The reason for this global impact lies in the sheer volume of forex transactions processed through financial institutions in New York.

When traders in New York conclude their trading day, their collective actions generate a ripple effect that reverberates throughout the global financial system. Market participants in other financial centers, from London to Tokyo, closely monitor the New York Close to gauge overall market sentiment and make informed trading decisions.

Image: camupay.web.fc2.com

Recent Developments: Technological Advancements and Regulatory Changes

The advent of electronic trading platforms and technological advancements in the forex market have significantly influenced the dynamics of the New York Close. Instantaneous order execution and real-time market data have accelerated the pace of trading, allowing participants to respond to market movements with unprecedented speed.

Regulatory changes have also shaped the landscape of the New York Close. Enhanced transparency and increased oversight have contributed to a more stable and orderly end-of-day process. This regulatory framework has bolstered trader confidence and further cemented the New York Close as a cornerstone of the global forex ecosystem.

Best Practices for Navigating the New York Close

To harness the full potential of the New York Close, traders are advised to adopt a proactive and strategic approach. Here are some essential best practices to consider:

- Stay Informed: Keep abreast of economic news and geopolitical events that may impact market sentiment leading up to the New York Close.

- Monitor Market Data: Track key currency pairs, liquidity levels, and market depth to identify potential trading opportunities.

- Manage Risk: Establish clear risk parameters and position sizing strategies to mitigate potential losses during the volatile end-of-day period.

- Execute Discipline: Adhere to a disciplined trading plan and avoid impulsive decisions based on short-term market fluctuations.

New York Close Time Forex

Conclusion: The New York Close – A Compass in the Forex Market

The New York Close remains a pivotal touchstone in the global forex market, providing traders with a daily snapshot of market sentiment and a basis for informed decision-making. By comprehending the historical significance, practical implications,