The New York forex session, also known as the American session, is the most liquid and active trading period in the forex market. It takes place from 8:00 AM to 12:00 PM Eastern Standard Time (EST) and overlaps with the London session, creating a period of high volatility and trading volume. In this comprehensive guide, we will delve into everything you need to know about the New York forex session, including its unique characteristics, trading opportunities, and strategies for success.

Image: us.coinmaster.gratis

**Understanding the New York Forex Session**

The New York forex session is dominated by large institutional investors, including banks, hedge funds, and pension funds. These participants make up the majority of trading volume and create a market environment characterized by deep liquidity, tight spreads, and fast price movements. As a result, the New York session offers significant opportunities for traders of all experience levels.

**Volume and Liquidity**

The New York session boasts the highest volume of trading in the forex market. This is due to the large number of participants and the global economic activity that takes place during this time. The increased volume creates a more liquid market, which makes it easier to enter and exit trades with minimal slippage.

**Volatility**

The New York session is also known for its high volatility. The combination of high volume, large orders, and diverse participants leads to frequent price swings and rapid market movements. This volatility can present both opportunities and risks for traders, and it requires a sound understanding of risk management and quick decision-making.

Image: www.forexmarkethours.com

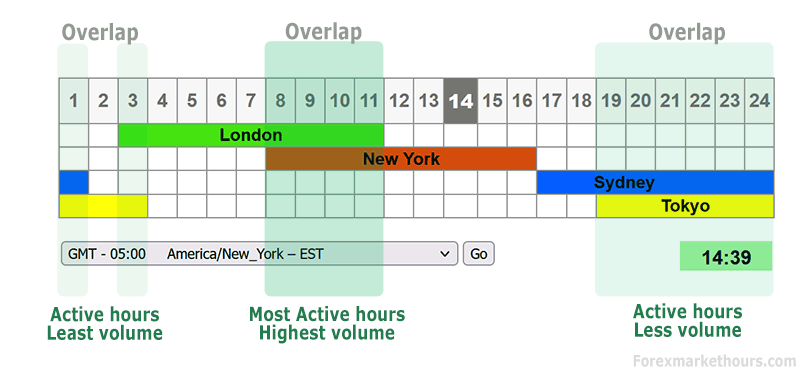

**Overlapping Sessions**

The New York session overlaps with the London session, which is the second most active trading period. This overlap creates a period of extended liquidity and allows traders to participate in the market for a longer period of time.

**Trading Opportunities in the New York Session**

The New York forex session offers a wide range of trading opportunities due to its high volume, liquidity, and volatility. Some of the most popular trading strategies include:

**Trend Trading**

Trend traders aim to identify and capitalize on long-term price trends. The deep liquidity and high volatility of the New York session make it ideal for this strategy. Traders can use technical indicators such as moving averages and trend lines to identify trend reversals and place trades accordingly.

**Scalping**

Scalping involves executing multiple small trades within a short time frame, typically within minutes or seconds. The fast price movements and high volume of the New York session provide numerous opportunities for scalpers to take advantage of small profit margins.

**Range Trading**

Range traders focus on trading within defined price ranges. They identify support and resistance levels and look for trading opportunities when the price touches these levels. The New York session’s frequent price swings create multiple range trading opportunities throughout the day.

**Tips and Expert Advice for New York Forex Trading**

To successfully trade during the New York forex session, it is essential to follow these tips and expert advice:

**Understanding Market News**

The New York session is heavily influenced by economic and political news events. Traders should monitor news feeds and announcements closely, as they can have a significant impact on market sentiment and price movements.

**Risk Management**

Due to the high volatility and fast price movements, risk management is crucial for trading during the New York session. Traders should set clear stop-loss and take-profit levels for each trade and adhere to a disciplined trading plan.

**Frequently Asked Questions (FAQs) on the New York Forex Session**

Q: When does the New York forex session start and end?

A: The New York forex session starts at 8:00 AM and ends at 12:00 PM Eastern Standard Time (EST).

Q: What are the advantages of trading during the New York session?

A: The advantages of trading during the New York session include high volume, liquidity, volatility, and a wide range of trading opportunities.

Q: What are the best trading strategies for the New York session?

A: Some of the most popular trading strategies for the New York session include trend trading, scalping, and range trading.

New York Session Forex Time

**Conclusion**

The New York forex session is a unique and dynamic trading environment that offers countless opportunities for profit. By understanding its characteristics, trading opportunities, and potential risks, traders can develop a successful trading strategy that aligns with their risk tolerance and trading style. Are you ready to embark on your New York forex trading journey?