The foreign exchange (forex) market is a global decentralized marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $5 trillion. The forex market is open 24 hours a day, 5 days a week, and currencies are traded in pairs. For example, the EUR/USD pair represents the exchange rate between the euro and the US dollar.

Image: sanapidyqel.web.fc2.com

The forex market is used by a wide range of participants, including individuals, businesses, and central banks. Individuals may trade forex for a variety of reasons, such as to speculate on currency movements, to hedge against currency risk, or to simply convert one currency to another. Businesses may trade forex to facilitate international trade or to manage their foreign currency exposure. Central banks may trade forex to influence their country’s exchange rate or to manage their foreign reserves.

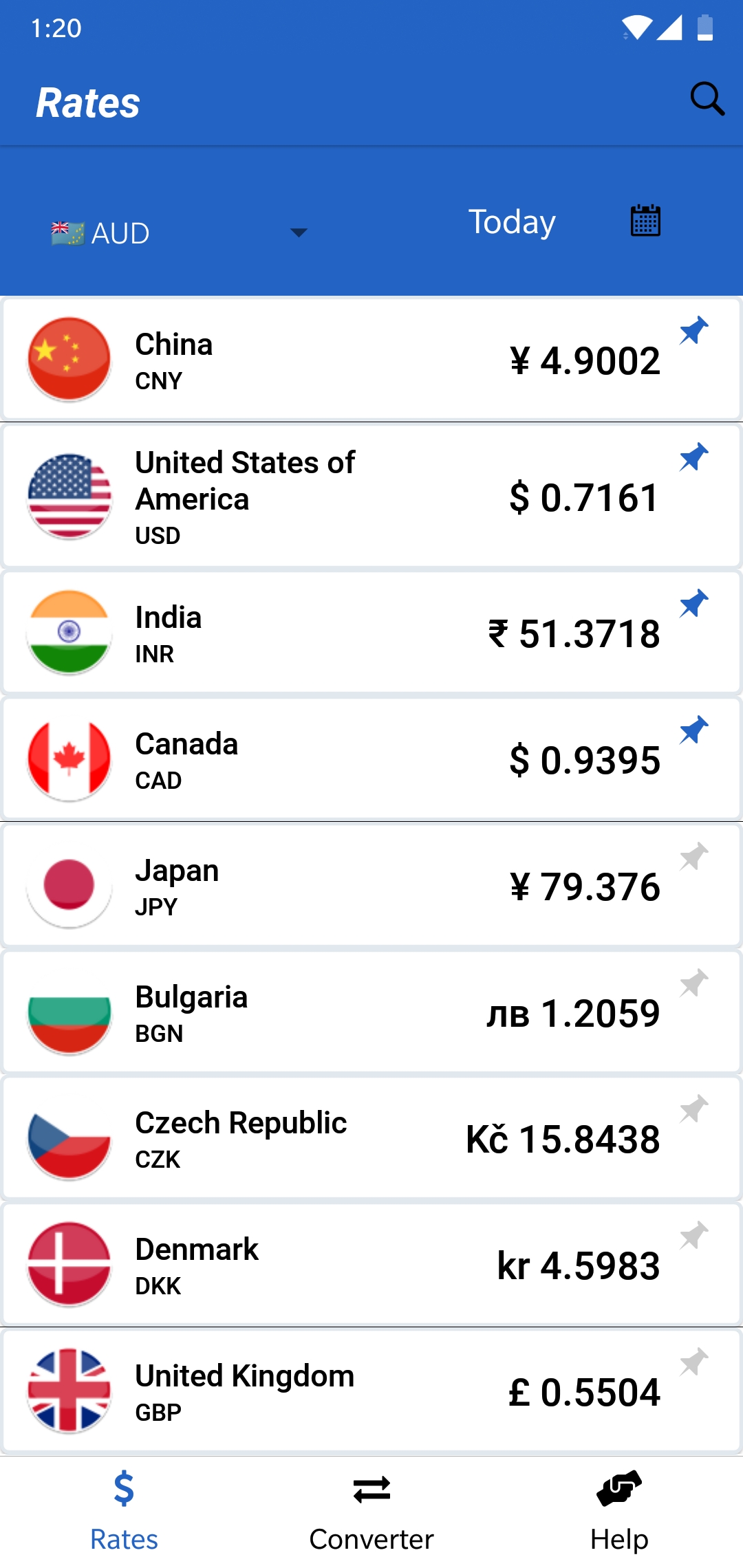

Live Forex Rates

Live forex rates are the real-time prices at which currencies are being traded. These rates are constantly changing, as they are influenced by a variety of factors, such as economic data, political events, and supply and demand.

There are a number of different ways to get live forex rates. One option is to use a forex broker. Forex brokers are companies that provide individuals and businesses with access to the forex market. They typically offer a variety of services, such as live forex rates, trading platforms, and news and analysis.

Another option for getting live forex rates is to use a forex website. Forex websites provide a variety of information about the forex market, including live forex rates, charts, and news. Some forex websites also offer trading platforms, which allow individuals and businesses to trade forex online.

Latest Trends and Developments

The forex market is constantly evolving, with new trends and developments emerging all the time. Some of the latest trends and developments in the forex market include:

- The increasing use of artificial intelligence (AI) and machine learning (ML) in forex trading

- The growing popularity of social trading

- The increasing use of mobile trading platforms

These trends are likely to continue to shape the forex market in the years to come.

Tips for Trading Forex

If you are interested in trading forex, there are a few things you should keep in mind. First, it is important to do your research and understand the risks involved. The forex market is a complex and volatile market, and it is important to have a clear understanding of how it works before you start trading. Second, it is important to develop a trading strategy and stick to it. A trading strategy is a set of rules that you will follow when making trades. Your trading strategy should be based on your own research and understanding of the market. Third, it is important to manage your risk carefully. The forex market is a leveraged market, which means that you can lose more money than you invest. It is important to use a risk management strategy to protect your capital.

Image: awesomeopensource.com

Explanation of Tips

The following is a more detailed explanation of the three tips for trading forex:

- Do your research and understand the risks involved. The forex market is a complex and volatile market, and it is important to have a clear understanding of how it works before you start trading. This includes understanding the different types of orders, the different types of markets, and the different factors that can affect currency prices. It is also important to be aware of the risks involved in forex trading, such as the risk of losing money.

- Develop a trading strategy and stick to it. Once you have a good understanding of the forex market, you need to develop a trading strategy. A trading strategy is a set of rules that you will follow when making trades. Your trading strategy should be based on your own research and understanding of the market. It should also be realistic and achievable. Once you have developed a trading strategy, it is important to stick to it. This will help you to avoid making impulsive trades and it will increase your chances of success.

- Manage your risk carefully. The forex market is a leveraged market, which means that you can lose more money than you invest. It is important to use a risk management strategy to protect your capital. This includes setting stop-loss orders and limiting your leverage. Stop-loss orders are orders that you place with your broker to automatically sell your currency pair if it reaches a certain price. This will help you to limit your losses if the market moves against you. Limiting your leverage will also help you to reduce your risk. Leverage is the amount of money that you borrow from your broker to trade forex. The higher your leverage, the greater your potential profits and losses.

FAQ

Q: What is the forex market?

A: The forex, or foreign exchange, market is a global decentralized marketplace where currencies are traded.

Q: How can I get live forex rates?

A: There are a number of different ways to get live forex rates, such as using a forex broker, a forex website, or a financial news website.

Q: What are some of the latest trends and developments in the forex market?

A: Some of the latest trends and developments in the forex market include the increasing use of artificial intelligence (AI) and machine learning (ML) in forex trading, the growing popularity of social trading, and the increasing use of mobile trading platforms.

Live Forex Rates In India

Conclusion

The forex market is a complex and volatile market, but it can also be a very rewarding market. If you are interested in trading forex, it is important to do your research and understand the risks involved. You should also develop a trading strategy and stick to it. By following these tips, you can increase your chances of success in the forex market.

Are you interested in learning more about the forex market? If so, I invite you to continue reading this blog or to visit the following resources: