Delve into the captivating realm of foreign exchange trading with our comprehensive exploration of the most traded forex pairs that dominated 2018. Understanding the significance and dynamics of these currency pairs is crucial for navigating the ever-evolving financial markets, whether you’re a seasoned trader or an aspiring enthusiast. Join us as we unveil the secrets behind these market behemoths, charting their histories, analyzing their impact, and providing valuable insights for your trading strategies.

Image: homecare24.id

Defining Currency Pairs and Their Impact

In the world of forex, a currency pair represents the exchange rate between two individual currencies. The first currency in the pair is known as the base currency, while the second is the quote currency. Variations in the exchange rate indicate fluctuations in their relative values. Understanding these shifts is pivotal for determining the profitability of trades, as they reflect changes in economic conditions, political events, and investor sentiment.

The most traded forex pairs tend to involve the currencies of economically powerful nations with stable economies and liquid financial markets. These pairs offer advantages such as ample trading volume, which ensures greater liquidity and tighter spreads, reducing transaction costs for traders. Furthermore, the popularity of these pairs attracts more participants, creating a self-reinforcing cycle of increased activity and liquidity.

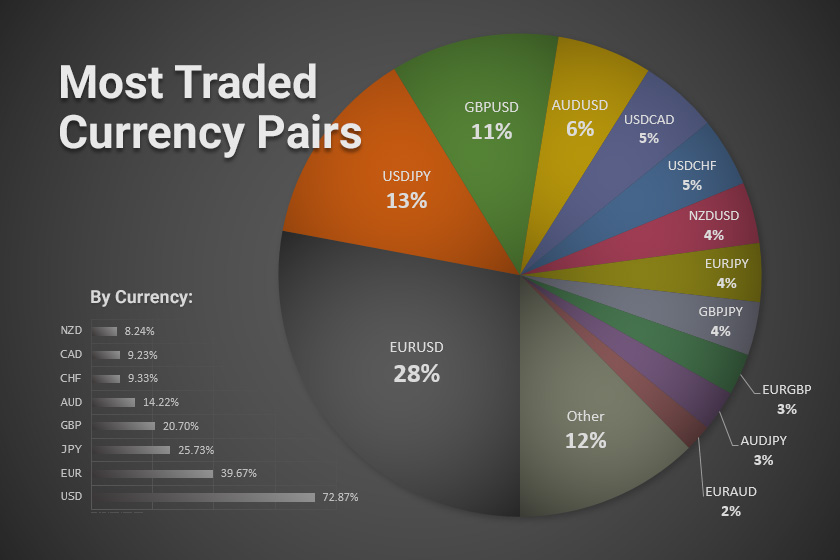

Unveiling the Forex Titans of 2018

-

EUR/USD (Euro/US Dollar): This pair, known informally as the “Euro-Dollar,” stands as the undisputed heavyweight of the forex market. Its dominance stems from the Euro representing the single currency of the European Union economies, while the US Dollar serves as the world’s reserve currency. The Euro-Dollar pair’s significant trading volume reflects the economic interdependence and global influence of the European Union and the United States.

-

USD/JPY (US Dollar/Japanese Yen): The “Dollar-Yen” pair ranks second in popularity and captures the economic dynamics between the world’s largest economy (the US) and the third-largest economy (Japan). The Japanese Yen’s reputation as a safe-haven currency during periods of market volatility contributes to the stability and liquidity of this currency pair.

-

GBP/USD (British Pound/US Dollar): Nicknamed “Cable,” this pair derives its name from the transatlantic telegraph cable that once transmitted exchange rate data. The GBP/USD pair mirrors the economic relationship between the United Kingdom and the United States, and it is closely influenced by factors such as interest rate decisions and economic indicators from both nations.

-

USD/CHF (US Dollar/Swiss Franc): The “Dollar-Franc” pair reflects the exchange rate dynamics between the US Dollar and the Swiss Franc, renowned for its stability and neutrality. Switzerland’s political and economic stability, along with the Franc’s safe-haven status, influences the behavior of this currency pair, making it a preferred choice for risk-averse traders during market turmoil.

-

AUD/USD (Australian Dollar/US Dollar): This “Aussie-Dollar” pair showcases the exchange rate between the Australian Dollar and the US Dollar. The Australian Dollar’s sensitivity to commodity prices, primarily dictated by its resource-intensive economy, adds a unique dimension to this pair and attracts traders seeking exposure to commodity market fluctuations.

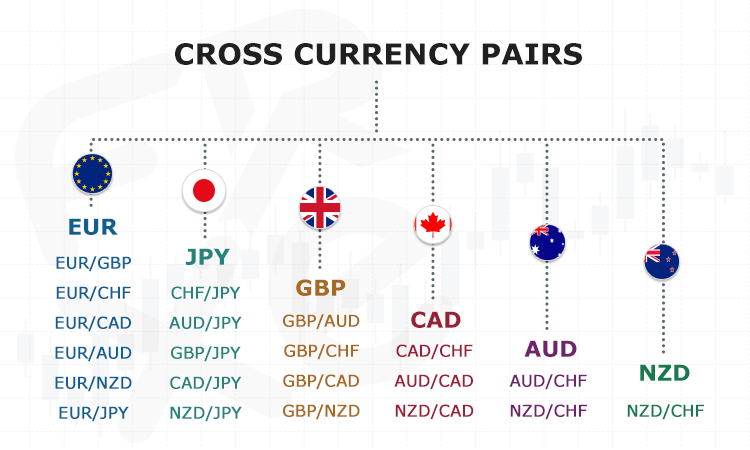

Additional Influential Forex Pairs

Beyond the top five, several other currency pairs also warrant attention due to their significant trading volumes and market impact:

-

USD/CAD (US Dollar/Canadian Dollar): Known as the “Loonie,” this pair reflects the economic relationship between the US and Canada. Influenced by factors such as oil prices and trade policies, the USD/CAD pair exhibits a close correlation with commodity markets.

-

NZD/USD (New Zealand Dollar/US Dollar): Nicknamed the “Kiwi,” this pair captures the exchange rate between the New Zealand Dollar and the US Dollar. Like the AUD/USD, the NZD/USD is susceptible to commodity price fluctuations, providing opportunities for traders looking to capitalize on the agricultural and tourism-driven New Zealand economy.

-

EUR/GBP (Euro/British Pound): This “Euro-Pound” pair depicts the exchange rate between the eurozone and the United Kingdom. Political developments, economic news, and Brexit-related dynamics significantly influence the behavior of this currency pair, making it a popular choice for speculative trading.

Image: howtotradeonforex.github.io

Navigating Forex Markets with Currency Pair Insights

Understanding the most traded forex pairs of 2018 empowers traders with a fundamental knowledge of market dynamics. By analyzing historical data, monitoring economic indicators, and keeping abreast of global events impacting these currency pairs, traders can develop informed trading strategies.

The high liquidity of these pairs facilitates quick order execution with minimal slippage, particularly during times of significant market volatility. Moreover, the ample trading volume ensures tighter spreads, reducing transaction costs and maximizing profitability.

Most Traded Forex Pairs 2018

Stay Informed for Trading Success

The forex market is an ever-evolving ecosystem, susceptible to external factors, economic data, and geopolitical shifts, necessitating the constant monitoring of market news, economic releases, and central bank announcements.

Consider leveraging trading tools and platforms that offer real-time data and analytical capabilities to stay ahead of market developments. Maintaining a comprehensive understanding of the most traded forex pairs, combined with sound risk management practices and a strategic approach, will enhance your preparedness to navigate the dynamic world of foreign exchange trading.