Imagine a world where you could peer into the minds of some of the most powerful corporations on Earth, understanding their triumphs and struggles before they even hit the headlines. This isn’t some sci-fi fantasy – it’s the reality we face as investors, consumers, and even just curious citizens. The “Magnificent 7,” a collective of seven tech titan companies dominating the global market, offer us a glimpse into this world through their earnings calls.

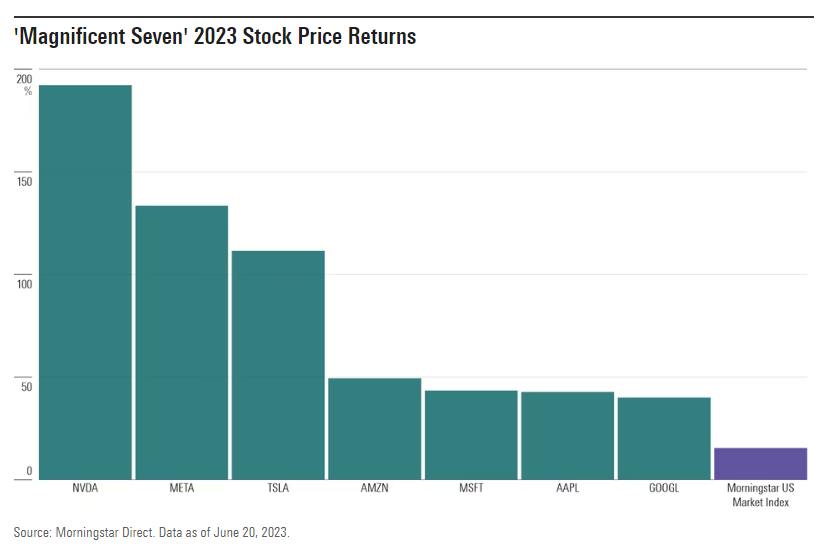

Image: www.morningstar.in

These calls, held a few times a year, are more than just financial reports – they’re indicators of economic health, technological innovation, and the very pulse of our digital age. This article delves into the significance of the Magnificent 7 earnings dates, exploring the valuable insights they provide and how you can utilize this knowledge in your own life.

Unveiling the Titans: Who Are the Magnificent 7?

The Magnificent 7, also known as the “Big Tech 7,” refer to a group of technology giants that have established an unparalleled dominance in the global marketplace. These companies are:

- Apple: The undisputed king of consumer electronics, known for its iPhones, Macs, and services like Apple Music and Apple Pay.

- Microsoft: A software behemoth, Microsoft reigns supreme in operating systems, productivity suites, and enterprise cloud services like Azure.

- Amazon: The e-commerce giant revolutionized shopping with its online marketplace, cloud platform (AWS), and expanding into areas like grocery delivery and entertainment.

- Alphabet (Google): The search engine giant, Alphabet’s tentacles extend across advertising, software, hardware, and even autonomous vehicles.

- Meta (Facebook): The social media kingpin, Meta connects billions of people through Facebook, Instagram, and WhatsApp.

- Nvidia: A chipmaker powering the world’s gaming and artificial intelligence (AI) revolution.

- Tesla: The electric vehicle pioneer, Tesla is rapidly changing the automotive industry with its innovative technology and ambitious vision.

The Earnings Dates: A Schedule of Significance

The earnings dates for these companies are highly anticipated events, captivating the attention of investors, analysts, and the general public alike. These dates offer a unique opportunity to gain a deeper understanding of the companies’ financial performance, strategic direction, and overall market sentiment.

Here is a breakdown of the typical earnings release schedule for the Magnificent 7:

- Apple: Typically releases earnings in the last week of January or the first week of February (fiscal Q1), last week of April or first week of May (fiscal Q2), last week of July or first week of August (fiscal Q3), and last week of October or first week of November (fiscal Q4).

- Microsoft: Releases earnings in the last week of January or first week of February (fiscal Q2), last week of April or first week of May (fiscal Q3), last week of July or first week of August (fiscal Q4), and last week of October or first week of November (fiscal Q1).

- Amazon: Releases earnings in the last week of January or first week of February (fiscal Q4), last week of April or first week of May (fiscal Q1), last week of July or first week of August (fiscal Q2), and last week of October or first week of November (fiscal Q3).

- Alphabet (Google): Releases earnings in the last week of January or first week of February (fiscal Q4), last week of April or first week of May (fiscal Q1), last week of July or first week of August (fiscal Q2), and last week of October or first week of November (fiscal Q3).

- Meta (Facebook): Releases earnings in the last week of January or first week of February (fiscal Q4), last week of April or first week of May (fiscal Q1), last week of July or first week of August (fiscal Q2), and last week of October or first week of November (fiscal Q3).

- Nvidia: Releases earnings in the last week of February or first week of March (fiscal Q1), last week of May or first week of June (fiscal Q2), last week of August or first week of September (fiscal Q3), and last week of November or first week of December (fiscal Q4).

- Tesla: Releases earnings in the last week of January or first week of February (fiscal Q4), last week of April or first week of May (fiscal Q1), last week of July or first week of August (fiscal Q2), and last week of October or first week of November (fiscal Q3).

Beyond the Numbers: Diving Deeper into the Earnings Calls

The earnings reports themselves are rich with data, providing insights into revenue, profits, and key performance indicators (KPIs). However, the real treasure lies in the earnings calls, where executives shed light on company strategies, future plans, and their outlook on the market.

Here’s what to look for when analyzing an earnings call:

- Management’s commentary: Listen closely to what the CEO and CFO have to say. Do they sound optimistic or cautious? Are they focusing on growth, profitability, or innovation?

- Key investment areas: What are the companies investing in? Emerging technologies, new markets, or expanding existing businesses?

- Competition landscape: Are the executives mentioning key competitors, and if so, how are they positioning their company in relation to them?

- Guidance: This is perhaps the most crucial aspect of an earnings call. Guidance refers to the company’s predictions for future revenue and earnings. Strong guidance can boost investor confidence, while weak guidance can send shockwaves through the market.

Image: www.businessinsider.nl

Understanding the Impact: How Earnings Affect You

The earnings of the Magnificent 7 don’t exist in a vacuum. They have a ripple effect that impacts businesses, investors, consumers, and even the broader economy. Here’s how:

- Investor decisions: Strong earnings, especially with positive guidance, can drive stock prices up, leading to opportunities for investors to capitalize on growth.

- Market sentiment: The overall sentiment or feeling towards the economy is often dictated by the performance of these companies. Strong earnings can boost confidence, while weak earnings can signal concerns about economic growth.

- Consumer trends: Analyzing the earnings calls can provide insight into changing consumer behavior. For example, if a company like Apple sees higher sales of its latest iPhone, it could indicate a growing demand for premium products even in a recession.

- Technological advancements: The earnings calls offer a window into the future of technology. Statements about investments in AI, cloud computing, or autonomous vehicles can provide a glimpse into how these technologies will shape the world.

Expert Insights for Actionable Knowledge

“The earnings calls of the Magnificent 7 offer investors a chance to get a sense of the health of the economy and the direction of technology,” says Sarah Williams, a seasoned financial analyst. “Pay close attention to the management’s commentary and their guidance for the future. This can give you valuable insights into investment opportunities and potential risks.”

To leverage these insights for your own benefit, consider:

- Track the earnings dates: Create a calendar with the Magnificent 7’s earnings release dates so you can stay up-to-date.

- Listen to the earnings calls: Many of these companies make their earnings calls accessible to the public. Pay close attention to the management’s discussion and tone.

- Analyze the data: Review the earnings reports and key metrics to get a deeper understanding of the companies’ performance.

- Follow reputable analysts: Financial analysts like Sarah Williams can provide valuable insights and interpretations of the earnings data.

Magnificent 7 Earnings Dates

The Conclusion: A Window into the Future

The Magnificent 7 earnings dates offer a glimpse into the future of technology, consumer behavior, and global economic trends. By understanding these events and their implications, you can make more informed decisions as investors, consumers, and citizens.

So, keep an eye on the calendar, listen carefully, and analyze the data – the insights from the Magnificent 7 can empower you to navigate the complexities of the digital age. Stay informed, stay engaged, and stay ahead of the curve.