The Euro and the US Dollar: A Tale of Two Currencies

The euro and the US dollar are two of the world’s most traded currencies, and their relative values are constantly fluctuating. This volatility can make it difficult for traders to predict which way the market will move, but by understanding the factors that influence the EUR/USD exchange rate, traders can make more informed decisions about their trades.

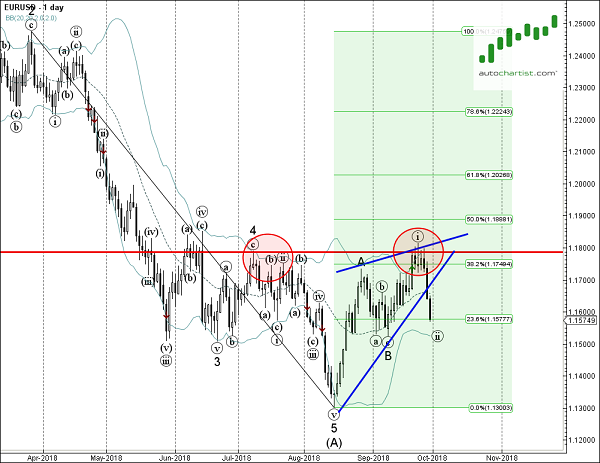

Image: forex24.pro

Factors Influencing the EUR/USD Exchange Rate

A number of factors can influence the EUR/USD exchange rate, including:

- Economic data: Economic data, such as GDP growth, inflation, and unemployment rates, can give traders an idea of the relative strength of the eurozone and the US economy. Strong economic data can lead to a stronger currency, while weak economic data can lead to a weaker currency.

- Interest rates: Interest rates are another important factor that can influence the EUR/USD exchange rate. Higher interest rates in the eurozone compared to the US can make the euro more attractive to investors, leading to a stronger euro. Conversely, lower interest rates in the eurozone can make the euro less attractive to investors, leading to a weaker euro.

- Political events: Political events, such as elections and referendums, can also have a significant impact on the EUR/USD exchange rate. Uncertainty about the future of the eurozone, for example, can lead to a weaker euro, while a more stable political environment can lead to a stronger euro.

- Global economic conditions: The global economy can also have a significant impact on the EUR/USD exchange rate. A strong global economy can lead to a stronger euro, while a weak global economy can lead to a weaker euro.

Trading the EUR/USD Forex Pair

Traders who want to trade the EUR/USD forex pair should be aware of the factors that can influence the exchange rate. By understanding these factors, traders can make more informed decisions about their trades.

Tips for Trading the EUR/USD Forex Pair

- Use technical analysis: Technical analysis is a method of analyzing price charts to identify trading opportunities. Traders can use technical analysis to identify trends, support and resistance levels, and other price patterns that can help them make informed trading decisions.

- Use fundamental analysis: Fundamental analysis is a method of analyzing economic data to identify trading opportunities. Traders can use fundamental analysis to understand the factors that are influencing the EUR/USD exchange rate and to make informed trading decisions.

- Manage your risk: Risk management is an important part of trading. Traders should always manage their risk by using stop-loss orders and position sizing.

Image: forextradingbot1.blogspot.com

FAQs About the EUR/USD Forex Pair

Q: What is the EUR/USD exchange rate?

A: The EUR/USD exchange rate is the price of one euro in US dollars.

Q: What factors influence the EUR/USD exchange rate?

A: A number of factors can influence the EUR/USD exchange rate, including economic data, interest rates, political events, and global economic conditions.

Q: How can I trade the EUR/USD forex pair?

A: Traders can trade the EUR/USD forex pair using a variety of methods, including technical analysis, fundamental analysis, and risk management.

Q: What are some tips for trading the EUR/USD forex pair?

A: Some tips for trading the EUR/USD forex pair include using technical analysis, fundamental analysis, and risk management.

Eur Usd Forex Forecast Today

Conclusion

The EUR/USD forex pair is one of the most traded currency pairs in the world. By understanding the factors that influence the exchange rate and by using the tips and advice provided in this article, traders can make more informed trading decisions.

Are you interested in learning more about the EUR/USD forex pair?