Introduction

The financial markets are a sea of data, and it can be difficult to know where to start when it comes to making trading decisions. One of the most common ways to analyze market data is through the use of candlestick charts. Candlestick charts provide a visual representation of price action, and they can be used to identify potential trading opportunities.

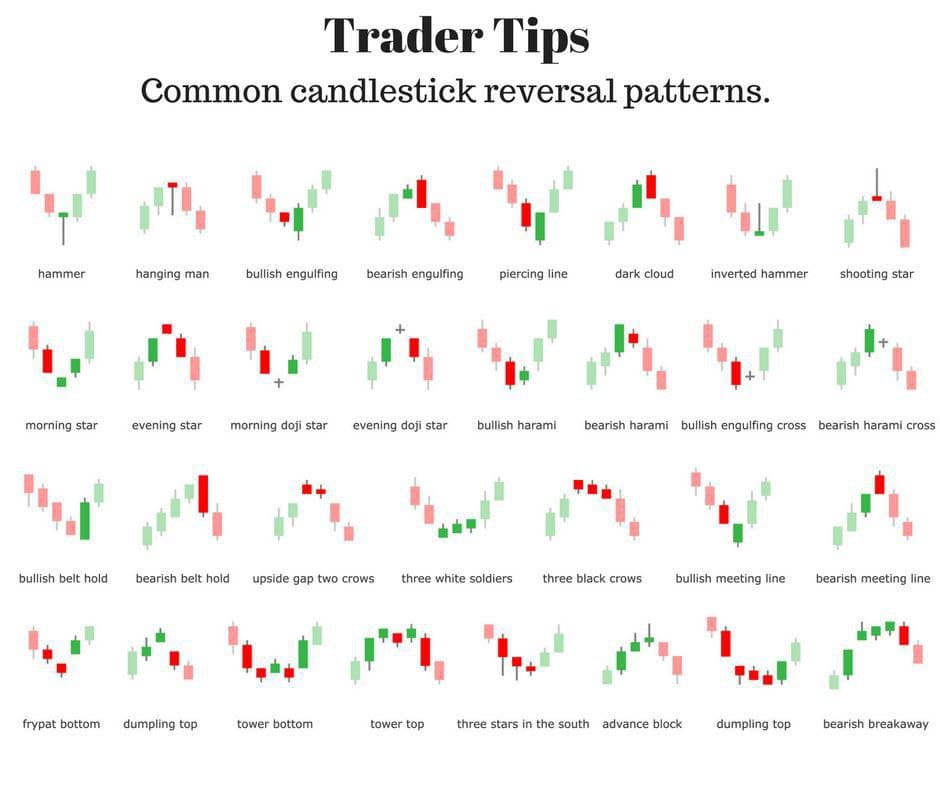

Image: games.udlvirtual.edu.pe

One of the most important candlestick patterns is the candle chart signal. A candle chart signal is a bullish or bearish pattern that can indicate a potential change in the market trend.

Candle Chart Signal Definition

A candle chart signal is a type of candlestick pattern that indicates a potential change in the market trend. Candle chart signals are typically formed when a candlestick closes outside of the range of the previous candlestick.

In this article, we will teach you all about the candle chart signal, including how to identify and trade this candlestick pattern.

Types of Candle Chart Signals

There are two types of candle chart signals: bullish and bearish.

- Bullish candle chart signals indicate a potential uptrend. These signals are typically formed when a candlestick closes above the range of the previous candlestick.

- Bearish candle chart signals indicate a potential downtrend. These signals are typically formed when a candlestick closes below the range of the previous candlestick.

How to Identify Candle Chart Signals

Candle chart signals are identified by looking for candlesticks that close outside of the range of the previous candlestick. Depending on the type of candle it is, this will indicate whether it’s a bullish or bearish signal.

For example, a bullish candle chart signal is formed when a candlestick closes above the high of the previous candlestick. A bearish candle chart signal is formed when a candlestick closes below the low of the previous candlestick.

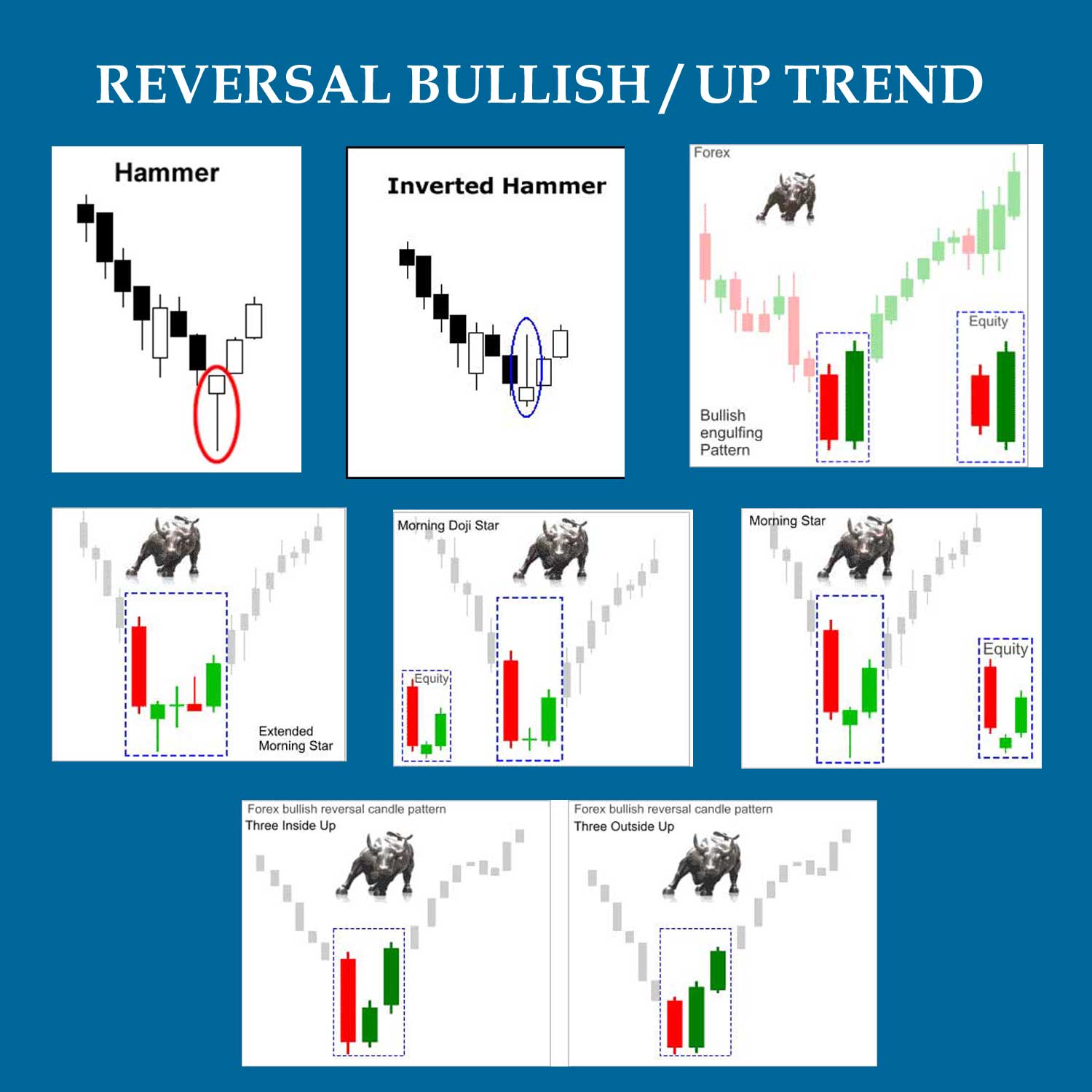

Image: forexswingprofit.com

How to Trade Candle Chart Signals

Trading candle chart signals can be done using a variety of strategies. One common strategy is to wait for the candlestick to close outside of the range of the previous candlestick and then enter a trade in the direction of the signal.

For example, if you see a bullish candlestick chart signal you could enter a long trade. If you see a bearish candlestick chart signal you could enter a short trade.

Tips for Trading Candle Chart Signals

Here are a few tips for trading candle chart signals:

- Use multiple candle chart signals to confirm your trading decisions. Do not rely on just one type of candlestick signal.

- Trade in the direction of the trend. Candle chart signals can indicate a potential change in the market trend, but they do not always predict the future.

- Manage your risk. Use stop-loss and take-profit orders to limit your losses.

- Be patient. Trading candlestick signals is not a get-rich-quick scheme. It takes time and practice to master.

- Learn from your mistakes. Everyone makes mistakes when trading candlestick signals. The key is to learn from your mistakes and avoid making them again.

Candle Chart Signal

Conclusion

Candle chart signals are a useful tool for identifying potential trading opportunities. However, it is important to use candle chart signals in conjunction with other trading tools and strategies. Trading candlestick signals can be a profitable way to trade, but it is important to manage your risk and be patient.

Are you interested in learning more about candle chart signals? Leave a comment below and let us know.