Understanding the intricacies of currency trading is paramount, and calculating pips is a fundamental skill for forex traders. Pips (Percentage In Points) are the smallest price movements in a currency pair, representing the fractional changes that drive market dynamics. Accurately calculating pips is essential for analyzing market behavior, determining profit and loss potential, and making informed trading decisions. This comprehensive guide will equip you with the knowledge and techniques to calculate pips effortlessly.

Image: learn2.trade

Introduction to Pips

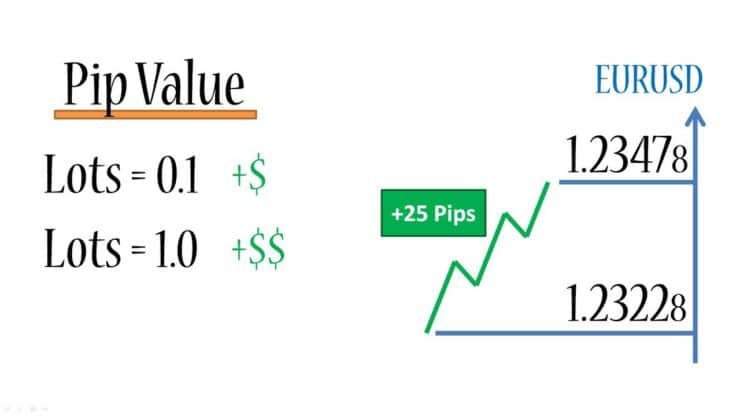

In the foreign exchange market, currency pairs are quoted in terms of bid and ask prices, representing the prices at which traders can buy and sell the base currency. The difference between these two prices is the spread, which encompasses the broker’s commission and profit margin. Pips measure the change in the value of a currency pair, usually expressed in the fourth decimal place for most major currency pairs and in the fifth decimal place for yen-based pairs.

Step-by-Step Pip Calculation

Calculating pips involves understanding the number of decimal places in the quoted price and the pip value, which varies depending on the currency pair being traded. Here are the steps to calculate pips:

-

Determine the Decimal Places: Identify the number of decimal places in the quoted price, typically four or five.

-

Establish the Pip Value: Determine the pip value for the currency pair by considering the base currency and the counter currency. For example, in the EUR/USD pair, one pip is equal to 0.0001 (1/10000).

-

Subtract Quotes: Calculate the difference between the bid and ask prices, representing the spread.

-

Divide by Pip Value: Divide the spread by the pip value to obtain the number of pips.

For example, if the EUR/USD bid price is 1.18500 and the ask price is 1.18505, the spread is 0.00005. Dividing this spread by 0.0001 (the pip value for EUR/USD) results in 5 pips.

Why Pips Matter in Forex Trading

Pips are significant in forex trading for several reasons:

-

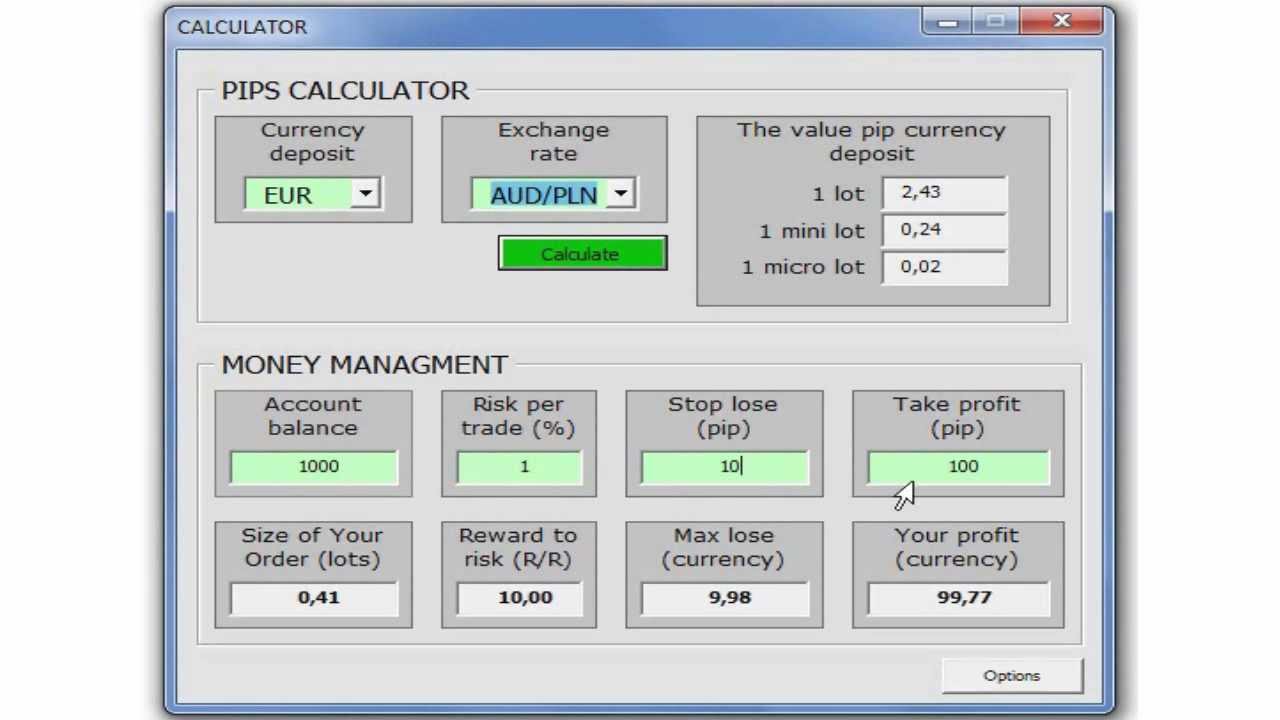

Profit/Loss Calculation: Pips help traders determine the profit or loss incurred on their trades. By multiplying the number of pips gained or lost by the trade size, traders can calculate their profit or loss.

-

Risk Management: Calculating pips enables traders to assess the potential risk involved in a trade. By knowing the pip value, traders can set stop-loss orders to limit potential losses to a predetermined level.

-

Market Analysis: Pips allow traders to analyze market movements and identify trends. By closely monitoring pip changes, traders can make informed decisions based on price fluctuations.

Image: robotforexsuperhedging.blogspot.com

How To Calculate Pips On Forex

Influence of Pip Calculation on Trading Strategies

The accuracy of pip calculation directly impacts the success of a trader’s strategies. Incorrect pip calculations can lead to erroneous profit/loss estimations and sub-optimal risk management. Therefore, it is essential to master pip calculation to maximize trading potential.

In conclusion, calculating pips is a fundamental skill for forex traders, enabling them to measure price movements, determine profit/loss potential, and assess risk. By thoroughly understanding the concepts and steps involved in pip calculation, traders can navigate the dynamic forex market with confidence and make informed trading decisions.