In the dynamic and ever-shifting landscape of financial markets, volatility reigns supreme. It is the invisible hand that shapes the fortunes of investors, a constant dance between gains and losses that has intrigued economists and bewildered traders for centuries. In the realm of indexes, this volatility takes on a life of its own, mirroring the collective sentiment of the market and influencing the decisions of countless investors. Embark on a journey into the capricious world of index volatility, where we unravel its mysteries and empower you with the knowledge to navigate its treacherous waters.

Image: en.cryptonomist.ch

Defining Volatility: The Pulse of the Market

In the simplest terms, volatility measures the magnitude of price fluctuations in an index over a given period. It captures the market’s inherent uncertainty, its propensity to swing wildly between euphoria and despair. A highly volatile index experiences significant price changes, while a less volatile index exhibits more stability and predictability. Understanding volatility is paramount for investors as it helps them assess risk, gauge potential returns, and make informed investment decisions.

The Volatility Spectrum: From Serenity to Chaos

The volatility of an index is not a static entity but ebbs and flows like the tides. Periods of relative calm, known as low volatility, are often characterized by steady price movements and a sense of complacency among investors. Conversely, high volatility reigns during times of market uncertainty, geopolitical turmoil, or economic shocks. In these turbulent waters, investors are constantly on edge, their emotions whipsawed by the unpredictable gyrations of the market.

The Anatomy of Volatility: A Symphony of Factors

Unraveling the drivers of index volatility requires a keen eye for economic and market dynamics. Economic releases, such as employment reports or inflation data, can send shockwaves through markets, inducing volatility. Political events, both domestic and international, can also shake the foundations of stability, leading to heightened price swings. Furthermore, changes in investor sentiment, influenced by factors such as fear or greed, can amplify volatility, creating a self-fulfilling prophecy.

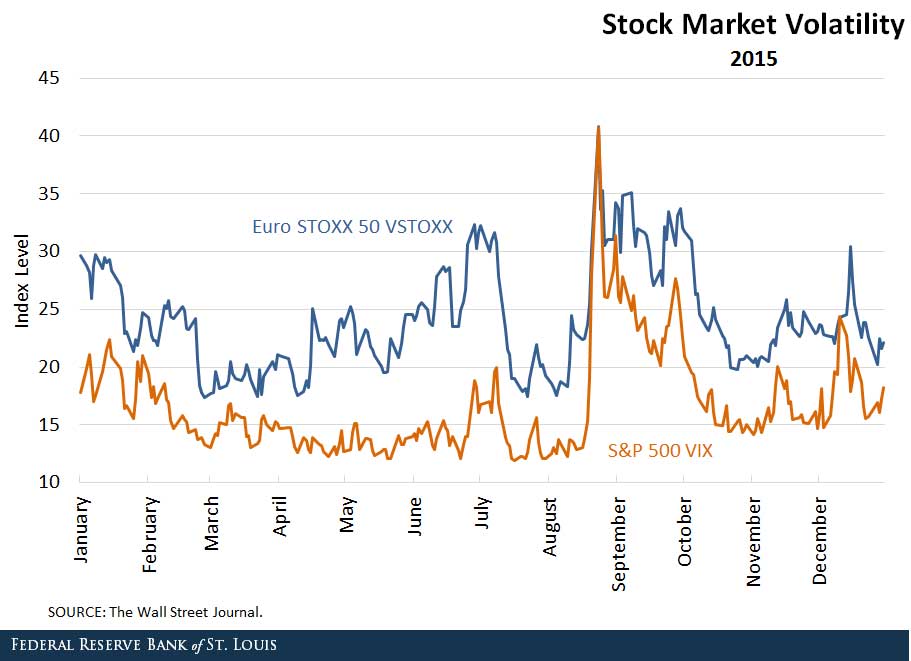

Image: www.stlouisfed.org

The Impact of Volatility: A Double-Edged Sword

Volatility can be both a bane and a boon for investors. For those with a penchant for risk and a keen eye for market timing, it offers the tantalizing prospect of amplified returns. However, it can also be an unforgiving mistress, inflicting heavy losses on unsuspecting or ill-prepared individuals. Understanding your risk tolerance and investment objectives is vital before venturing into the volatile arena of index investing.

Mastering Volatility: Navigating the Market’s Ebb and Flow

While volatility can be an intimidating force, it is not an insurmountable one. There are proven strategies investors can employ to mitigate its impact and maximize their chances of success. Diversification, the time-honored practice of spreading investments across different asset classes and markets, is the ultimate defense against excessive volatility. Dollar-cost averaging, a disciplined approach to investing a fixed amount at regular intervals, helps reduce the impact of market fluctuations.

Riding the Waves of Volatility: Opportunities Amidst the Turmoil

Even in the most volatile of markets, opportunities can be found for the discerning investor. When volatility spikes, it often creates buying opportunities in undervalued assets that have been unfairly punished by market sentiment. Conversely, during periods of low volatility, investors can lock in profits by selling overvalued assets that may be due for a correction. Timing is everything, and investors must be prepared to act swiftly and decisively when volatility presents these fleeting opportunities.

Volatility Of An Index

Conclusion: Embracing the Dance of Volatility

Volatility is an inherent characteristic of financial markets, a symphony of forces that shapes the ebb and flow of index movements. Understanding its drivers and its impact is the key to navigating the treacherous waters of index investing. By embracing volatility as a constant companion, investors can develop strategies that mitigate risk, maximize returns, and ultimately emerge victorious in the relentless market dance.

Remember, the siren’s song of volatility may be alluring, but it is a song that requires careful listening. By arming yourself with knowledge and discipline, you can master the market’s unpredictable rhythm and emerge as a seasoned investor, ready to conquer the ever-changing landscape of index investing.