Image: forex-station.com

Forex online, also known as foreign exchange trading, has become a popular way to trade currencies and potentially profit from changes in their value. The forex market is the world’s largest and most liquid financial trading market, with an average daily trading volume of over $5 trillion.

Forex Market: An Overview

The forex market is a decentralized network of banks, financial institutions, and individual traders who exchange currencies at floating rates. It operates 24 hours a day, five days a week in various trading centers around the world, with the main centers located in London, New York, Tokyo, and Sydney.

The forex market is driven by supply and demand for currencies. When the demand for a currency increases compared to another currency, its value will increase. Conversely, when demand for a currency decreases relative to another currency, its value will fall.

How Forex Trading Works

Forex trading involves buying and selling currencies in pairs. For example, a trader could buy the Euro (EUR) against the US dollar (USD) with the expectation that the EUR will strengthen against the USD. If the EUR does indeed strengthen against the USD, the trader would profit from the trade.

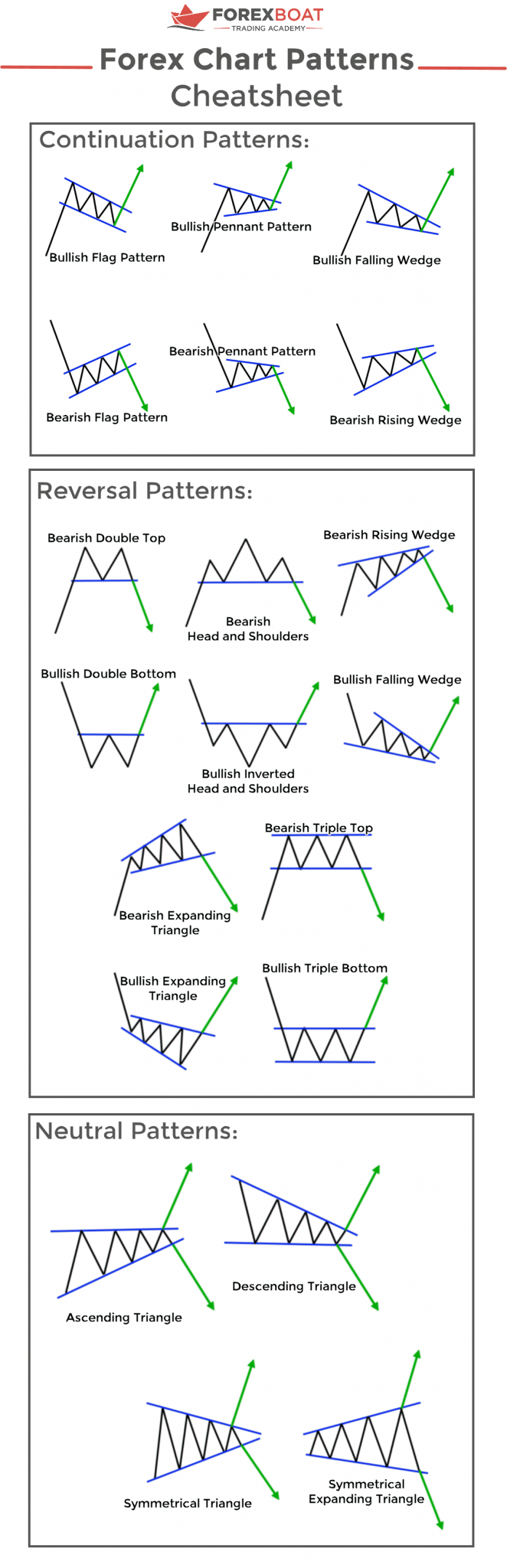

Traders use charts, technical indicators, and market analysis to predict price movements. They can open trades through a forex broker, which provides them with trading platforms, execution services, and a leverage facility.

Expert Tips for Forex Trading Success

Successful forex trading requires a solid understanding of the market, risk management skills, and a disciplined trading strategy. Here are a few tips from experienced traders:

- Learn about the market: Before entering the forex market, study the major currency pairs, their characteristics, and the factors that influence their exchange rates.

- Start small:Begin with small trades and gradually increase your position size as you gain experience and confidence.

- Use stop-loss orders: Stop-loss orders ensure that potential losses are limited in case of adverse price movements.

- Trade with a plan: Develop a trading strategy that outlines your entry and exit points, risk management parameters, and profit targets.

- Control your emotions: Forex trading can be volatile, so it’s crucial to stay calm and make decisions based on logical analysis, rather than emotions.

Image: forexboat.com

Forex Trading FAQs

Q: What is the minimum capital required for forex trading?

A: The minimum capital required depends on the broker you choose and the trading strategy you employ. Some brokers offer micro-accounts that accommodate traders with limited capital.

Q: Can I make big money in forex trading?

A: Forex trading can potentially be lucrative, but it’s important to remember that it also involves risk. The key to success is to have a solid understanding of the market, manage your risk effectively, and never invest more than you can afford to lose.

Q: Is forex trading a form of gambling?

A: No, forex trading is not gambling. It involves rigorous analysis and risk management strategies to make informed trading decisions. While there is an element of risk involved, it can be mitigated with proper knowledge and a disciplined trading approach.

Forex On Line

Conclusion

Forex trading online provides an accessible way to participate in the global currency market. By understanding the market dynamics, practicing risk management, and following expert advice, traders can potentially capitalize on opportunities and earn profits.

If you are interested in exploring the world of forex trading, it’s highly recommended that you seek additional resources, consult with experienced traders or financial professionals, and continue your research to make informed decisions.