Introduction

In the vibrant heart of global finance, where the relentless tides of money flow, the New York Forex Market stands tall. As the world’s largest and most liquid financial marketplace, it exerts a profound influence on the ebb and flow of global currencies. For savvy traders and investors, timing is everything, and understanding the opening time of this colossal market in Greenwich Mean Time (GMT) is crucial for maximizing returns. In this article, we embark on a comprehensive exploration of the New York Forex Market’s opening time in GMT, providing invaluable insights that will empower you to navigate this intricate financial landscape with confidence.

Image: getwallpapers.com

Delving into the Forex Arena

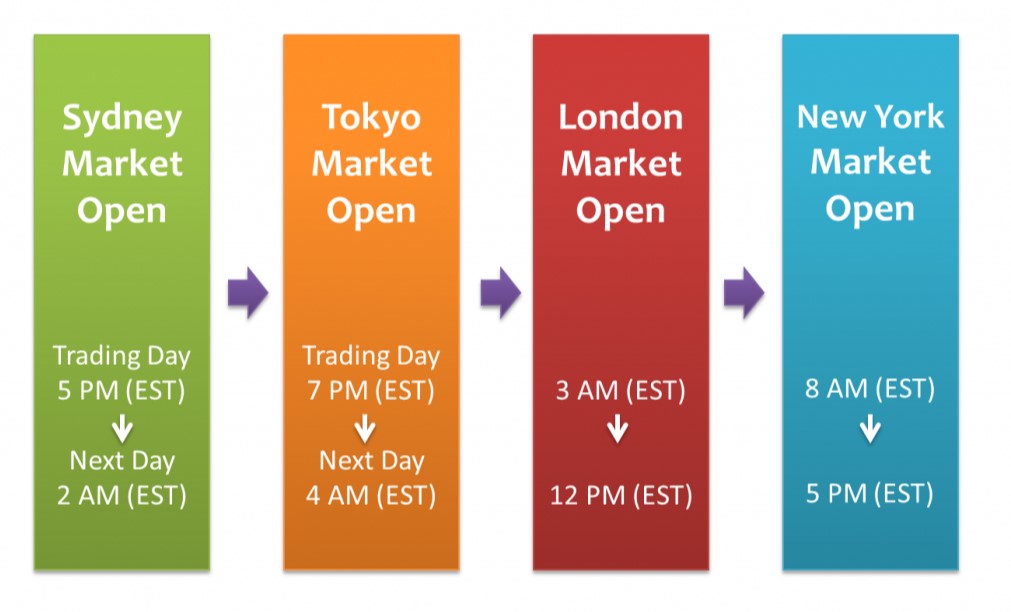

Foreign exchange, commonly known as forex, is an over-the-counter (OTC) marketplace where traders from around the globe converge to buy, sell, and speculate on currencies. Unlike traditional stock exchanges that have fixed trading hours, the forex market operates 24 hours a day, five days a week. This round-the-clock accessibility grants traders unprecedented flexibility in executing their strategies. However, with the market spanning across different time zones, it’s essential to grasp the opening times of key financial hubs to optimize trading opportunities.

Unveiling the New York Forex Market’s Opening Time in GMT

The New York Forex Market officially opens at 12:00 PM Eastern Time (ET), which translates to 5:00 PM GMT. The market operates seamlessly for 24 hours until 12:00 PM ET the following day, corresponding to 5:00 PM GMT. This prolonged trading period encompasses various economic and geopolitical events, allowing traders ample opportunities to capitalize on market movements. It’s worth noting that while the market is open 24/7, certain times of day exhibit heightened activity and liquidity.

Trading Advantages of Aligning with the New York Forex Market Open

The New York Forex Market’s opening coincides with the beginning of the European trading session, a period characterized by heightened volatility and market depth. This confluence creates an optimal environment for traders to enter or exit positions, taking advantage of the increased price fluctuations. Furthermore, the early evening hours in Europe and the afternoon hours in North America attract a vast pool of active traders, ensuring ample liquidity for smooth order execution.

Image: www.forex.academy

Strategic Considerations for GMT Traders

Traders located outside the GMT time zone should carefully consider the time difference when determining their entry and exit points in the New York Forex Market. As an illustrative example, a trader in London, which operates on GMT, seeking to participate in the market’s opening would need to initiate their trades at 5:00 PM GMT. Conversely, a trader in Tokyo, which adheres to Japan Standard Time (JST), nine hours ahead of GMT, would need to commence trading at 2:00 AM JST the following day to align with the New York Forex Market’s open.

The Significance of Market Overlap

The overlap between the New York and European Forex Market sessions, spanning from 12:00 PM to 5:00 PM ET, presents a window of opportunity for traders to leverage the combined liquidity of both markets. This period witnesses high trading volumes, increased volatility, and a plethora of technical trading opportunities. Traders proficient in identifying and capitalizing on market trends during this time can potentially maximize their profitability.

Exploring Currency Pairs Traded in the New York Forex Market

The New York Forex Market facilitates trading in a vast array of currency pairs, including major currency pairs such as EUR/USD, USD/JPY, GBP/USD, and AUD/USD. These pairs command the highest trading volumes and offer competitive spreads, making them ideal for both scalpers and trend-following traders. Additionally, the New York Forex Market also offers trading in emerging market currencies, providing traders with opportunities to diversify their portfolios and potentially capitalize on developing economies’ growth.

The Impact of Global Economic Events on the New York Forex Market

The New York Forex Market is deeply intertwined with global economic events, and geopolitical developments can significantly influence its dynamics. Economic data releases, central bank announcements, and political uncertainties can trigger rapid price movements, creating both opportunities and risks for traders. By staying abreast of the latest economic news and geopolitical developments, traders can make informed decisions and adjust their strategies accordingly.

New York Forex Market Open Time In Gmt

Conclusion

Understanding the New York Forex Market’s opening time in GMT is a pivotal element for successful trading. Aligning your trading activities with the opening of this global financial hub grants access to increased volatility, liquidity, and trading opportunities. Whether you reside in the heart of New York or trade from a distant time zone, grasping the GMT equivalent of the market’s opening time empowers you to make informed decisions and optimize your trading