Introduction

In the realm of forex trading, managing risk is paramount to long-term success. Position sizing, the determination of the optimal trade size for a given account balance and risk tolerance, plays a crucial role in risk management. Enter the position size calculator forex, a powerful tool that simplifies this complex task and empowers traders to allocate capital wisely.

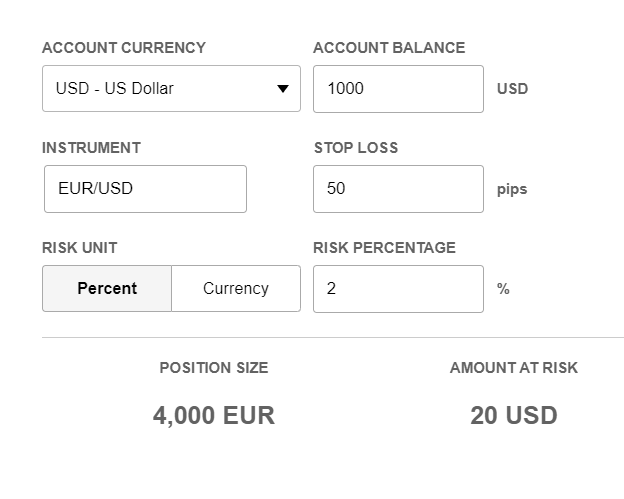

Image: primeforexindicators.com

Delving into Position Sizing

Position sizing refers to the process of calculating the suitable trade size based on factors such as account balance, risk tolerance, and market volatility. By optimizing position size, traders can mitigate potential losses and enhance their chances of profitability while maximizing the potential rewards.

Essential Elements of a Position Size Calculator

Forex position size calculators incorporate various parameters to determine the appropriate trade size:

- Account Balance: The total amount of funds available for trading.

- Risk Tolerance: An assessment of how much risk a trader is willing to accept on a single trade.

- Market Volatility: The degree of price fluctuations in the currency pair being traded.

- Risk-Reward Ratio: The ratio between the potential profit and the potential loss on a trade.

- Currency Pair: The specific currency pair being traded.

Customizing Position Size for Individual Strategies

Traders can tailor the calculator’s settings to align with their unique strategies. For example:

- Scalpers: Traders seeking quick, small profits may opt for higher risk tolerance and adjust the calculator accordingly.

- Swing Traders: Traders holding positions for hours or days might prefer a lower risk tolerance, resulting in a smaller position size.

- Position Traders: Traders holding positions for extended periods may employ a conservative risk tolerance and a correspondingly smaller position size.

Image: www.priceactionninja.com

Advantages of Using a Position Size Calculator Forex

Utilizing a position size calculator offers several advantages:

- Risk Management: Effectively limits the potential loss on a trade, mitigating risk and preserving capital.

- Capital Efficiency: Optimizes the allocation of trading funds, allowing for potential maximum returns given the available capital.

- **Time-Saving: Automates the position sizing process, saving valuable time that would otherwise be spent on manual calculations.

- **Accuracy: Eliminates the potential for human error in position sizing, ensuring consistency and accuracy.

Limitations of Position Size Calculators

While position size calculators provide valuable support, they do have limitations:

- Subjectivity of Risk Tolerance: Determining risk tolerance is subjective and can vary depending on the trader’s risk appetite.

- Market Volatility Assumptions: Calculators rely on assumptions about future market volatility, which can be unpredictable.

- Complex Strategies: Calculators may struggle to accommodate highly complex trading strategies that require advanced calculations.

Additional Considerations for Position Sizing

Beyond using a position size calculator, traders should consider the following additional factors:

- Historical Volatility: Examining historical price fluctuations can provide insights into the expected volatility of the currency pair.

- Drawdown Tolerance: Understanding how much of a drawdown (decline in account balance) a trader can withstand is crucial for setting appropriate risk parameters.

- Margin Requirements: Forex trades involve using leverage, so traders must be aware of the margin requirements associated with their positions.

Position Size Calculator Forex

Conclusion

The position size calculator forex serves as an invaluable tool for traders seeking to implement sound risk management practices. By accurately determining the optimal trade size, traders can safeguard their capital, enhance profit potential, and ultimately increase their chances of long-term success in the forex market. However, it is essential to acknowledge the limitations and exercise sound judgment when using these calculators, complementing them with a thorough understanding of the financial markets and a robust risk management strategy.