Have you ever felt the exhilarating rush of Forex trading, only to find your profits melting away faster than a snowball in the Sahara? It’s a common struggle for many traders, especially those who haven’t yet mastered the art of position sizing. In the vast, dynamic world of Forex, a simple miscalculation in how much you invest can quickly turn a promising trade into a devastating loss. But fear not! Just as a carpenter wields a ruler to ensure precise measurements, the Forex position calculator is your tool to conquer this crucial aspect of trading and unlock the secrets to consistent profitability.

Image: blog.fxcc.com

In essence, a Forex position calculator is a digital oracle that unveils the exact amount of currency you should commit to a specific trade based on your risk appetite, account balance, and the volatility of the chosen currency pair. This seemingly simple tool can be your secret weapon, empowering you to manage risk effectively, maximize returns, and ultimately gain control over your trading destiny. But before we delve into the intricacies of using this powerful tool, let’s take a step back and explore the fundamental concepts of Forex position sizing.

Understanding the Essence of Forex Position Sizing

Imagine you’re at a casino, playing roulette. You could bet on a single number, hoping for a massive payout, or you could spread your chips across several numbers, guaranteeing a lower but more consistent return. Forex trading mirrors this concept. Position sizing is about striking the right balance between risk and reward in your trades. How much you invest determines your potential profit and loss, directly influencing your journey to financial success.

Here’s the key:

- Larger positions = Higher potential profits – and losses!

- Smaller positions = Lower potential profits – but also lower risks!

This simple equation forms the foundation of successful Forex trading. The goal is to find the sweet spot where you maximize your chances of profit while minimizing the potential damage caused by market fluctuations.

Why Use a Forex Position Calculator?

The truth is, calculating position size can be a daunting task for even experienced traders. It involves juggling several variables, including:

- Your account balance: This defines your overall trading capital.

- Your risk tolerance: How much are you willing to lose on a single trade?

- The stop-loss order: The price level at which you’ll exit a trade to limit losses.

- The current price of the currency pair: This determines how much you’ll spend to buy or sell a specific unit of currency.

- The pip value: The smallest unit of change in the exchange rate for a given currency pair.

Without a dedicated position calculator, manually crunching these numbers can be time-consuming, prone to errors, and potentially detrimental to your trading strategy. This is where the Forex position calculator steps in. By plugging in these key figures, the calculator automatically calculates the optimal position size, freeing you to focus on analyzing market trends and executing your trading plans.

Decoding the Components of a Forex Position Calculator

The magic of a Forex position calculator lies in its ability to simplify complex calculations. Let’s break down the key components that contribute to its effectiveness:

Image: scuba-dawgs.com

1. Account Balance: Your Foundation

Your account balance sets the stage for your trading journey. The calculator uses this figure to calculate both the maximum risk you can comfortably absorb and the potential profit you can realistically expect from each trade.

2. Stop-Loss Order: Your Safety Net

A stop-loss order is your lifeline, automatically closing your trade if the market moves against you and hits a predetermined price. The calculator incorporates this critical element to ensure your losses are confined within a predefined limit, preventing catastrophic blow-ups.

3. Risk Tolerance: Finding Your Comfort Zone

How much are you willing to lose on a single trade? This crucial question defines your risk tolerance. The calculator allows you to set a specific risk percentage, ensuring that your trades align with your desired level of comfort and financial stability.

4. Currency Pair Volatility: Riding the Waves

Forex markets are constantly in flux, driven by economic news, political events, and global sentiment. The calculator considers the volatility of the chosen currency pair, meaning it adjusts your position size based on the potential for sudden price swings. This allows you to adapt to changing market conditions effectively, mitigating risk during volatile periods.

5. Pip Value: Understanding the Building Blocks

The pip value is the smallest unit of change in the exchange rate for a specific currency pair. The calculator seamlessly integrates this factor, ensuring that your position size accurately reflects the potential financial impact of each pip movement.

Unlocking the Power of Forex Position Calculators

Now that you have a grasp of the key components, let’s explore the real-world applications of Forex position calculators. Picture this: You’re analyzing the EUR/USD pair, a popular currency pair in the forex market. You’ve done your homework, conducting thorough technical analysis, and believe that the Euro is poised to rise against the US Dollar. You set a stop-loss order 50 pips below the current price, ensuring you don’t lose more than a predetermined amount.

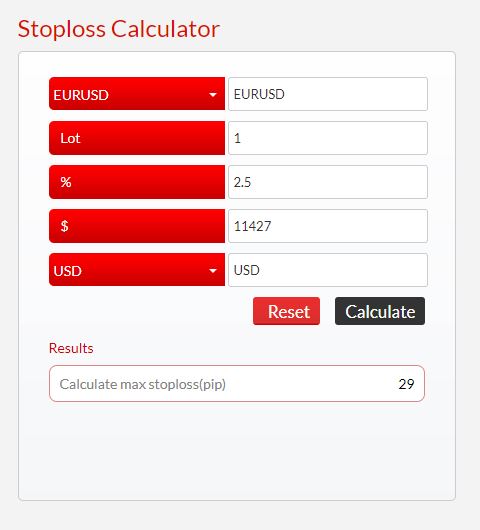

This is where the magic happens. Using a Forex position calculator, you plug in your account balance, risk percentage (e.g., 2% of your account balance), and the calculated stop-loss distance. The calculator instantly generates the ideal position size that aligns perfectly with your risk tolerance and trading strategy. Armed with this precise information, you confidently execute your trade, knowing that your risk is meticulously controlled, and your potential profit is maximized.

Types of Forex Position Calculators: Finding the Perfect Fit

The world of Forex position calculators is as diverse as the trading strategies themselves. Here’s a glimpse into the main categories:

1. Online Forex Position Calculators: The Quick Fix

Accessible directly from your web browser, these calculators offer a swift and straightforward solution for quickly determining your position size. You simply enter the necessary information, and the calculator instantly displays the recommended position size.

2. Forex Position Calculator Apps: Your Mobile Trading Companion

Designed for today’s on-the-go traders, these apps allow you to calculate position sizes right from your smartphone or tablet. They provide a seamless integration into your mobile trading experience, offering convenient access to this essential tool.

3. Built-in Forex Position Calculators: One-Stop Solutions

Many reputable Forex brokers offer built-in position calculators directly on their trading platforms. This streamlined approach provides an integrated and user-friendly experience, eliminating the need for external tools and streamlining your trading workflow.

4. Spreadsheet-Based Forex Position Calculators: A Custom Approach

For those who prefer a more customized approach, you can create your own position calculator using a spreadsheet program. This gives you the flexibility to tailor the calculations based on your specific needs and preferred variables. However, it requires a deeper understanding of the calculations involved.

Forex Position Calculator

Navigating the Forex Terrain: Tips for Mastering Position Sizing

While the Forex position calculator is a powerful tool, it’s essential to remember its limitations.

- It’s a guide, not a guarantee: The calculator relies on the information you provide, so ensuring accuracy is crucial. Don’t solely rely on its results; always factor in your own analysis and market context.

- Don’t neglect risk management: While the calculator helps determine position size, it doesn’t replace proper risk management practices. Always have a stop-loss order in place to limit potential losses.

- Adapt to market conditions: Volatility and market trends can change rapidly in Forex. Don’t be afraid to adjust your position size and risk management strategy as needed.

- Practice before you trade: Experiment with different scenarios and settings on a demo account to get comfortable with using the calculator before taking real trades.

The path to Forex success is paved with knowledge, discipline, and consistent effort. By embracing the power of the Forex position calculator, you take a significant step toward mastering position sizing, navigating the unpredictable Forex market with confidence, and maximizing your trading potential.