Have you ever wondered how the value of the US dollar fluctuates against the Euro? Or perhaps you’ve heard whispers about “currency trading” and felt intrigued by the potential for profit. Welcome to the exciting world of forex trading, where currencies dance like a global ballet, influencing the financial fates of individuals and businesses alike. This comprehensive PDF guide is your passport to understanding the fundamentals of forex trading, equipping you with the knowledge to navigate the intricacies of this dynamic marketplace.

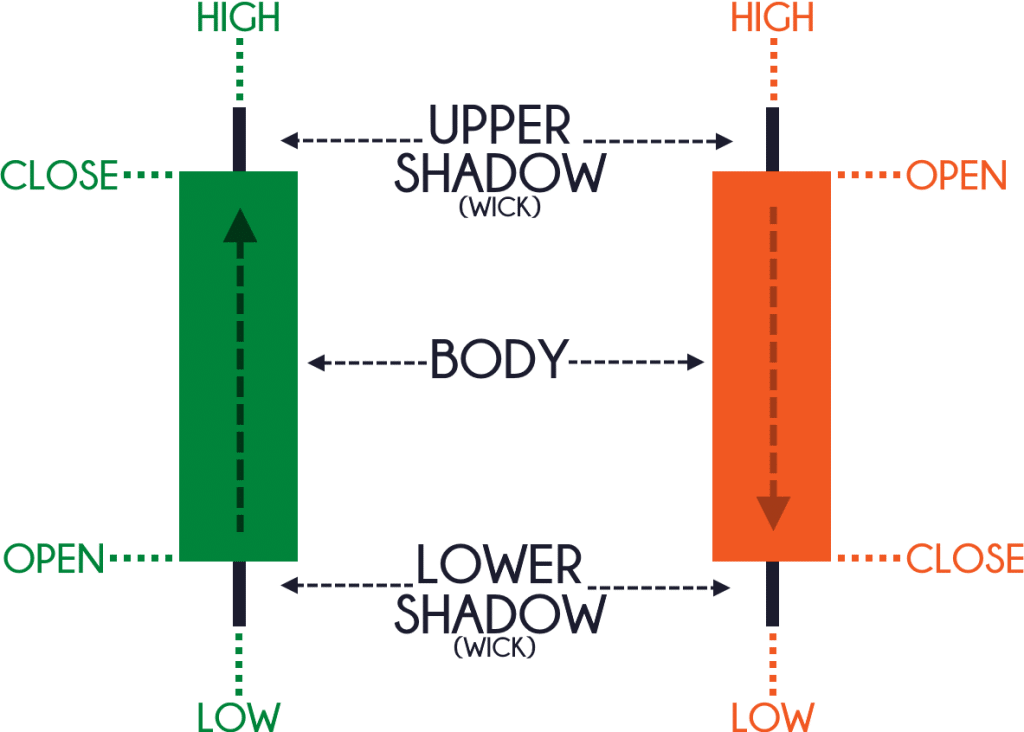

Image: www.tradingwithrayner.com

Forex, short for foreign exchange, is the largest and most liquid financial market in the world. Think of it as a giant global marketplace where currencies are constantly being bought and sold, driven by a complex interplay of economic factors, political events, and market sentiment. The potential for profit is tantalizing, but so are the risks. Unlike traditional stocks or bonds, currency fluctuations can be swift and unpredictable. This is why it’s absolutely crucial to approach forex trading with a solid understanding of its principles and a well-defined trading strategy.

Unveiling the Forex Market: A Deep Dive into the World of Currencies

What Makes Forex Tick?

The forex market thrives on the constant exchange of currencies. Consider the scenario of an American importer who needs to purchase goods from a European supplier. To do so, they must buy euros to pay for the products. This transaction is an example of a forex trade, where the demand for euros increases, potentially pushing its value higher against the US dollar.

The Anatomy of a Forex Pair

Forex trading doesn’t involve individual currencies; it revolves around pairs. You buy one currency and sell another. A typical forex pair is represented as, for instance, EUR/USD. This means you are buying euros and selling US dollars. The first currency listed is known as the “base currency” while the second is the “quote currency.”

Forex pairs are classified into two key categories: majors and minors. **Majors** feature the US dollar (USD) alongside other major currencies like the Euro (EUR), Japanese yen (JPY), British pound (GBP), and Swiss franc (CHF). **Minors** involve combinations of other major currencies, for example, EUR/GBP or AUD/NZD.

Image: financeillustrated.com

Key Concepts: Mastering the Language of Forex

Exchange Rate: The Price of One Currency in Terms of Another

The exchange rate is the core of forex trading. It determines how much of one currency you need to buy another. For example, if the EUR/USD exchange rate is 1.1000, this means 1 euro equals 1.1000 US dollars. Fluctuations in exchange rates are what drive profit or loss in forex trading.

Pips: Measuring the Tiny Wins and Losses

Pips, or points in percentage, are the smallest units of measurement for exchange rate changes. In most currency pairs, a pip represents a change of 0.0001. This might seem insignificant, but over large trades and frequent fluctuations, even small pips can add up to substantial profits or losses.

Lot Sizes: Scaling Your Trades

Lot sizes refer to the volume of currency traded in a single forex transaction. There are various standard lot sizes: standard lot (100,000 units of base currency), mini lot (10,000 units), micro lot (1,000 units), and nano lot (100 units). Choosing the right lot size is crucial for managing risk and optimizing potential profits.

Understanding the Factors that Move Currencies

Forex markets are driven by a dynamic interplay of factors. Here are some key influencers:

Economic Indicators: Data that Shapes Market Sentiment

Economic reports and statistics, such as GDP growth, inflation rates, unemployment figures, and interest rate decisions, can significantly impact currency valuations. Strong economic data for a particular country can bolster its currency, while weak data may weaken it.

Political Events: When Geopolitics Affect Currency Values

Political instability, elections, global agreements, and even natural disasters can create uncertainty and volatility in the forex market. Political events can dramatically influence investor sentiment, leading to sudden shifts in currency valuations.

Market Sentiment: The Collective Psychology of Traders

Forex trading is heavily influenced by market sentiment. When traders are optimistic about a particular currency, they are more likely to buy it, driving up its value. Conversely, pessimism and fear can lead to selling pressure and a decline in value.

Forex Trading Strategies: Mapping Your Path to Success

No single forex trading strategy guarantees success. It’s essential to find strategies that align with your risk tolerance, trading style, and market analysis approach. Here are a few common strategies:

Scalping: Capturing Quick Profits

Scalping is a high-frequency trading strategy that seeks to profit from small price fluctuations. Scalpers use technical analysis tools to identify short-term opportunities and enter and exit trades rapidly. This strategy requires significant technical skills and can involve high risk.

Day Trading: The Daily Dance of Buy and Sell

Day traders aim to capitalize on intraday price movements, entering and exiting trades within the same trading day. They rely heavily on technical analysis and news events, using various tools and strategies to manage risk and maximize profits.

Swing Trading: Riding the Waves of Market Trends

Swing traders hold positions for a few days or weeks, trying to capture the broader trend of the market. They use fundamental and technical analysis to identify potential entry and exit points and capitalize on medium-term price fluctuations.

Trend Following: Riding the Long-Term Trend

Trend followers focus on identifying and profiting from long-term trends in the market. They use technical indicators and other tools to spot emerging trends and hold positions for longer periods, potentially for weeks or even months.

Managing Risk: The Foundation of Sustainable Trading

Forex trading inherently carries risk. One of the most crucial aspects of responsible forex trading is risk management. A well-defined risk management strategy is essential to safeguard your capital and ensure long-term sustainability.

Stop-Loss Orders: Setting a Limit to Losses

Stop-loss orders are your safety net. They automatically close your position when the price reaches a predefined level, limiting your potential losses if the market turns against you. This vital tool helps mitigate the impact of unfavorable price movements and prevents significant losses.

Position Sizing: Determining the Right Trade Amount

Position sizing, or calculating the amount of capital to allocate to each trade, is another critical element of risk management. A common approach involves risk-management ratios that link your potential loss per trade to your overall account balance, limiting your exposure and ensuring you can survive inevitable losses.

Diversification: Spreading Your Risk across Multiple Pairs

Diversifying your forex portfolio by trading a variety of currency pairs can help reduce overall risk. By spreading your investments across different markets, you reduce the impact of adverse movements in any single pair on your overall portfolio performance.

The Journey to Success: Building Your Forex Trading Skills

Forex trading is a dynamic and ever-evolving field. It requires continuous learning, adaptation, and ongoing practice to achieve consistent success. Here are some practical steps to embark on your forex trading journey:

Democratization of Forex: The Rise of Online Trading Platforms

The internet has revolutionized forex trading, making it accessible to individuals with varying levels of experience and capital. Online brokerage platforms offer user-friendly interfaces, powerful charting tools, and real-time market data, enabling you to trade from the comfort of your home.

The Power of Education: Building Your Forex Foundation

A dedicated learning approach is essential for forex trading success. There are numerous resources available, including online courses, books, and educational websites. Understanding fundamental concepts, technical analysis tools, and risk management principles is crucial for building a solid foundation for your trading journey.

Demo Accounts: Testing Your Strategies in a Risk-Free Environment

Before venturing into live trading, leverage the power of demo accounts. These virtual trading platforms allow you to practice your strategies, test different tools, and gain experience with the trading interface without risking real money. Demo accounts are invaluable for developing your trading skills and building confidence before entering the real market.

The Importance of Patience: Mastering the Art of Waiting

Forex trading requires patience, discipline, and emotional control. Avoid chasing losses, resisting the urge to “get even” after a losing trade. Stay focused on your trading plan, manage your emotions, and allow time and experience to refine your strategies.

The Value of Community: Learning from Experienced Traders

Engaging with online communities, forums, and social media groups dedicated to forex trading can provide valuable insights, tips, and support along your trading journey. Learning from experienced traders and sharing experiences with others can enhance your understanding and accelerate your growth.

Forex Trading For Beginners Pdf

Final Thoughts: Embracing the Forex Journey

Forex trading presents a dynamic and potentially lucrative investment opportunity. This PDF guide has served as a framework for understanding the basics of forex trading – from fundamental concepts to trading strategies and risk management techniques. Remember, forex trading is a journey, not a destination. Embrace the learning process, continuously refine your skills, and approach the market with discipline, patience, and a well-defined trading plan. The rewards for your dedication and effort can be substantial, paving the way for financial success and a deeper understanding of the global marketplace.