Imagine yourself, sitting in front of your computer, watching the numbers dance across your screen. It’s not a casino, but a global market, and the numbers represent the ebb and flow of currencies. You’re looking at Forex pairs, the key to unlocking the world of foreign exchange trading. This is where the potential for profit lies, but it’s a world that can seem like a labyrinth of jargon and complex charts. But don’t worry. This article is your guide to reading Forex pairs like a seasoned trader, unraveling the mysteries and equipping you with the knowledge to navigate the fascinating world of currency exchange.

Image: www.youtube.com

Forex, short for foreign exchange, is the largest financial market in the world, with trillions of dollars changing hands every day. It’s where currencies are bought and sold, influencing everything from the price of goods we import to the value of our investments. At the heart of this market lies the Forex pair – two currencies, paired together, reflecting their value against each other. Understanding how to read these pairs is crucial for anyone considering entering the world of Forex trading. It’s the language of the market, and with a little knowledge, you can start to understand the whispers and shouts of the global economy.

Decoding the Basics: Forex Pair Terminology

Before we dive into the complex interplay of Forex pairs, let’s start with the fundamentals, the building blocks of understanding. It’s like learning the alphabet before you can read a book.

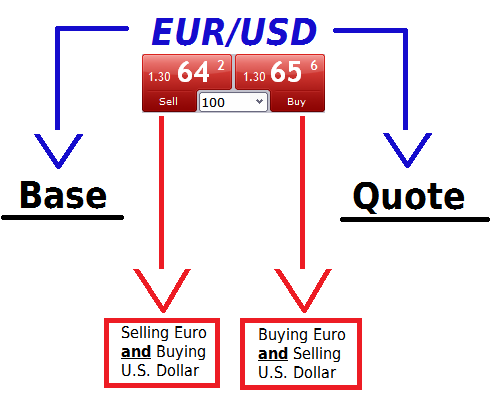

- Base Currency: The first currency in a Forex pair, it’s the currency you’re essentially buying.

- Quote Currency: The second currency in the pair, it’s the currency you’re using to buy the base currency.

- Forex Symbol: A three-letter abbreviation represents each currency.

- Direct Quote: Quotes the base currency in terms of the quote currency – for instance, EUR/USD. This means you’re seeing how much USD you need to pay for 1 Euro.

- Indirect Quote: Quotes the quote currency in terms of the base currency – for instance, USD/JPY. This means you’re seeing how much JPY you need to pay for 1 USD.

Let’s visualize this with an example. Consider the popular Forex pair, EUR/USD. This pair represents the value of the Euro against the US Dollar. In a direct quote, EUR is the base currency and USD is the quote currency. So, if the EUR/USD exchange rate is 1.1000, this means one Euro is equal to 1.1000 US Dollars. This is a direct quote.

Understanding the Relationship Between Forex Pairs

Forex pairs don’t exist in isolation. They intertwine and influence each other in a dynamic and complex dance of supply and demand. Understanding these relationships is crucial for deciphering the market’s whispers and making informed trading decisions. Consider these key concepts:

-

Directly Correlated Pairs: These pairs move in the same direction. If one goes up, the other goes up, and vice versa. This is often seen with pairs sharing a strong economic connection. For example, the Australian Dollar (AUD) and the New Zealand Dollar (NZD) often move in tandem, as both their economies are significantly influenced by commodity prices.

-

Inversely Correlated Pairs: These pairs move in opposite directions. If one goes up, the other goes down and vice versa. A classic example is the US Dollar (USD) and the Euro (EUR). When the USD strengthens, the EUR usually weakens.

-

Cross-Currency Pairs: These pairs involve two currencies that are not the US Dollar. For instance, EUR/JPY, or GBP/CHF. These pairs can be influenced by the dollar but are also impacted by the relationship between the two currencies involved.

Reading the Charts: Forex Pair Movement

Now that we understand the building blocks of Forex pairs, it’s time to peek into the window of the market, the charts. Forex charts are the visual representation of Forex pair movements over time. Just like a seismograph records the tremors of the Earth, Forex charts capture the fluctuations of currencies. Let’s delve into the most common types of charts:

-

Line Chart: A simple yet powerful tool. It connects a series of closing prices over a chosen time period, providing a clear overview of the price trend.

-

Bar Chart: Each bar represents a specific time period, usually a day, hour, or minute. The bar’s height reflects the price change during that period, with the opening, high, low, and closing price all represented within the bar.

-

Candlestick Chart: A visually rich chart using candlestick patterns to display the open, high, low, and close prices of a Forex pair within each time period. The color of the candlestick indicates whether the price closed higher (green) or lower (red) than the opening price.

Image: tradingstrategyguides.com

Forex Pair Analysis: Techniques to Uncover Insights

Reading Forex charts is one thing, but knowing how to interpret the information they provide is another. Several techniques can be used to uncover valuable insights from Forex pair data. Let’s explore some of them:

-

Technical Analysis: This method focuses on analyzing past price data, using charts and mathematical indicators to spot patterns and trends, predicting future prices. It’s like looking for clues in a detective novel, piecing together the clues to predict the next twist in the story.

-

Fundamental Analysis: It takes a broader approach, considering the economic and political factors influencing the value of currencies. It’s like reading the news headlines, understanding the big picture, and analyzing how events could affect currencies.

-

Sentiment Analysis: This approach explores the overall mood of the market, gauging the general opinion of traders and investors about a particular Forex pair. It’s like listening to the whispers in the trading room, gleaning insights from the collective wisdom of the crowd.

The Psychology of Trading: Understanding Emotions and Market Dynamics

Let’s not forget the human element that drives the Forex market. Emotions play an essential role in financial decisions – greed, fear, and hope. Understanding these emotions and their impact on market dynamics can be a valuable tool in Forex trading. For example, if a trader is driven by fear and sells a currency out of panic, it can create a downward pressure on the market. Conversely, if traders are driven by greed and buy excessively, it can create an upward pressure.

Expert Insights and Actionable Tips

Let’s turn to the voices of experience, the experts who have navigated these waters for years, sharing their wisdom and insights.

-

“Don’t chase the market.” Patience is golden in Forex trading. Don’t jump into a trade simply because the price is moving rapidly. Wait for the right opportunity, a confluence of factors suggesting a strong likelihood of a profitable outcome.

-

“Diversify your portfolio.” Don’t put all your eggs in one basket. Spread your trading across different Forex pairs, minimizing the impact of any single pair’s volatility.

-

“Practice risk management.” Always define your risk tolerance before entering a trade – how much you are willing to lose. Use stop-loss orders to limit your losses and protect your capital.

-

“Continuously learn and adapt.” The Forex market is constantly evolving. Be a lifelong learner, stay updated with the latest market trends, and adapt your trading strategies accordingly.

How To Read Forex Pairs

Conclusion: Embark on Your Forex Trading Journey

Reading Forex pairs is an essential skill for anyone interested in navigating the complex world of currency trading. It’s a skill that takes time and dedication, practice, and learning from both successes and failures. Like any language, it takes immersion, patience, and a genuine interest in mastering its nuances. By understanding the fundamentals, delving into technical and fundamental analyses, and remaining aware of the psychology at play, you can equip yourself with the tools to make informed decisions and navigate the exciting world of Forex.

This is just the beginning of your journey. There’s a vast sea of information, resources, and strategies to explore. There are countless books, articles, courses, and communities dedicated to Forex trading. Engage with these resources, experiment with different approaches, and don’t be afraid to ask questions. Remember, even seasoned traders continue to learn and adapt. Your Forex journey is now beginning, fueled by knowledge, discipline, and an unyielding curiosity.