Ever wondered what those cryptic currency pairs like EUR/USD or GBP/JPY truly represent? Behind the seemingly random arrangement of letters lies a powerful duo: the base currency and the quote currency. Understanding this fundamental concept is crucial for navigating the complex world of foreign exchange trading, as it dictates how currency prices are quoted, the direction of price movements, and even the profitability of your trades.

Image: fxbasket.blogspot.com

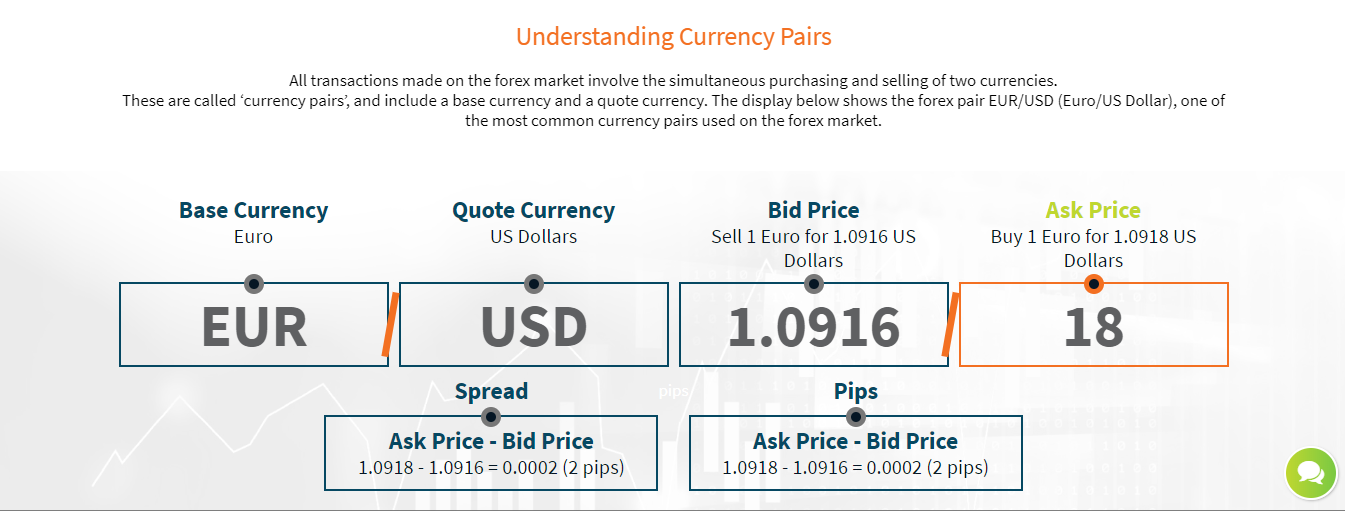

In essence, the base currency sits on the left side of the pair, while the quote currency resides on the right. Imagine it like this: the base currency is the one you’re ‘buying’ with the quote currency. When you see EUR/USD at 1.10, it signifies that 1 Euro can be exchanged for 1.10 US Dollars. But, there’s a lot more to this dance than meets the eye – let’s dive deeper into this mesmerizing world of currency pairs.

Defining the Players

The Base Currency: The Ruler of the Exchange

The base currency is the currency that is being measured, the ‘ruler’ used to gauge the value of the other currency. Think of it as the ‘standard’ against which the quote currency is compared. When analyzing the currency pair EUR/USD, the Euro (EUR) is the base currency. Its value directly dictates the price movement of the pair. If the Euro strengthens against the US Dollar, the EUR/USD exchange rate will rise. This means it takes more US Dollars to buy 1 Euro.

The Quote Currency: The One Being Measured

On the other side of the equation, we have the quote currency, the one that’s being measured relative to the base currency. In the EUR/USD example, the US Dollar (USD) is the quote currency. Its value is inherently tied to the base currency and fluctuates in relation to it. When the Euro strengthens, the value of the quote currency, the US Dollar, falls relative to the Euro, and vice-versa.

Image: 1investing.in

The Importance of Perspective: Reading the Exchange Rate

The base currency’s value is usually expressed as a numerical value, indicating how many units of the quote currency are needed to purchase one unit of the base currency. Let’s revisit our EUR/USD example. An exchange rate of 1.10 means you need 1.10 US Dollars to purchase 1 Euro. This understanding is vital for traders when interpreting price movements and determining whether a currency pair is rising or falling. A rising EUR/USD value signifies that the Euro is appreciating against the US Dollar, meaning it now takes more US Dollars to purchase 1 Euro.

Trading with the Duo: Base and Quote Currency in Action

In the exciting world of forex trading, understanding the base and quote currency is paramount. It influences your trading strategy, profitability, and overall success. Here’s how:

Spotting Trends: Base Currency Leads the Dance

The base currency is the one to watch when discerning market trends. When the base currency strengthens, the price of the currency pair increases, and vice versa. However, it’s crucial to remember that both currencies are constantly fluctuating against each other. You need to analyze the fundamentals, economic factors, and market sentiment surrounding each currency to make informed trading decisions.

Profit Potential: Understanding the Impact on Your Trades

Let’s say a trader is bullish on the Euro (EUR) and anticipates it will rise against the US Dollar (USD). They can purchase EUR/USD, hoping to sell it at a higher price later. If their prediction is correct and the EUR strengthens against the USD, the value of their position will rise. However, if the Euro weakens, the trader would incur a loss. Understanding how the base and quote currencies interact is essential for achieving consistent trading success.

Real-World Examples: Putting it into Practice

Let’s bring this to life with some real-world scenarios:

Scenario 1: The Rising Euro

Imagine the Euro (EUR) is expected to strengthen due to positive economic news. A trader enters a long position in EUR/USD, buying the pair at 1.10. If the Euro subsequently rises, the EUR/USD rate might increase to 1.15. This means the trader can now sell their position at a profit, pocketing the difference. They have effectively bought low and sold high, profiting from the rise in the value of the base currency (the Euro).

Scenario 2: The Weakening Yen

Now, let’s consider a situation where the Japanese Yen (JPY) is expected to weaken against the US Dollar (USD). A trader opens a short position in USD/JPY (note the currency pair is reversed here), betting on the weakening Yen to sell it later at a lower price. If the Yen weakens, pushing the USD/JPY rate down, the trader can close their position at a profit. They have effectively sold high and bought back low, taking advantage of the decline in the value of the quote currency (the Yen).

Beyond the Basics: Navigating the Forex Labyrinth

While base and quote currencies are fundamental building blocks, Forex trading encompasses a vast and intricate ecosystem. Economic indicators, geopolitical events, sentiment analysis, and technical analysis all contribute to the dynamic landscape of currency exchange. As a trader delves deeper into this world, they will encounter numerous nuances, complexities, and strategies. Understanding the base and quote currencies is just the beginning of this exciting journey!

Base Vs Quote Currency

https://youtube.com/watch?v=-XJ3rTmm7Gk

Conclusion

Unraveling the base and quote currency is like unlocking a secret code: it opens doors to a deeper understanding of the intricate world of currency trading. By mastering this fundamental concept, you gain valuable insights into price movements, trading strategies, and ultimately, your potential for success in the Forex market. Keep exploring, stay curious, and remember – the journey of a trader is a continuous learning experience!