Introduction:

Image: www.btcc.com

The financial arena has witnessed a surge in the popularity of a distinctive instrument known as CFDs (Contracts for Difference). CFDs provide traders with a captivating opportunity to speculate on the price movements of underlying assets, such as stocks, indices, commodities, and currencies. Embarking on this trading endeavor necessitates a robust and reliable platform that not only facilitates trades but also empowers traders with the tools and resources to make informed decisions. This article delves into the captivating realm of CFD trading platforms, unraveling their complexities and guiding you towards selecting the most suitable platform for your trading pursuits.

Understanding CFD Trading Platforms:

CFD trading platforms function as digital marketplaces where traders execute transactions involving CFDs. These platforms serve as a bridge between traders and liquidity providers, enabling the exchange of contracts without the need for physical asset ownership. CFDs offer traders the ability to capitalize on both upward and downward price movements, opening avenues for profit in dynamic market conditions.

Components of a CFD Trading Platform:

-

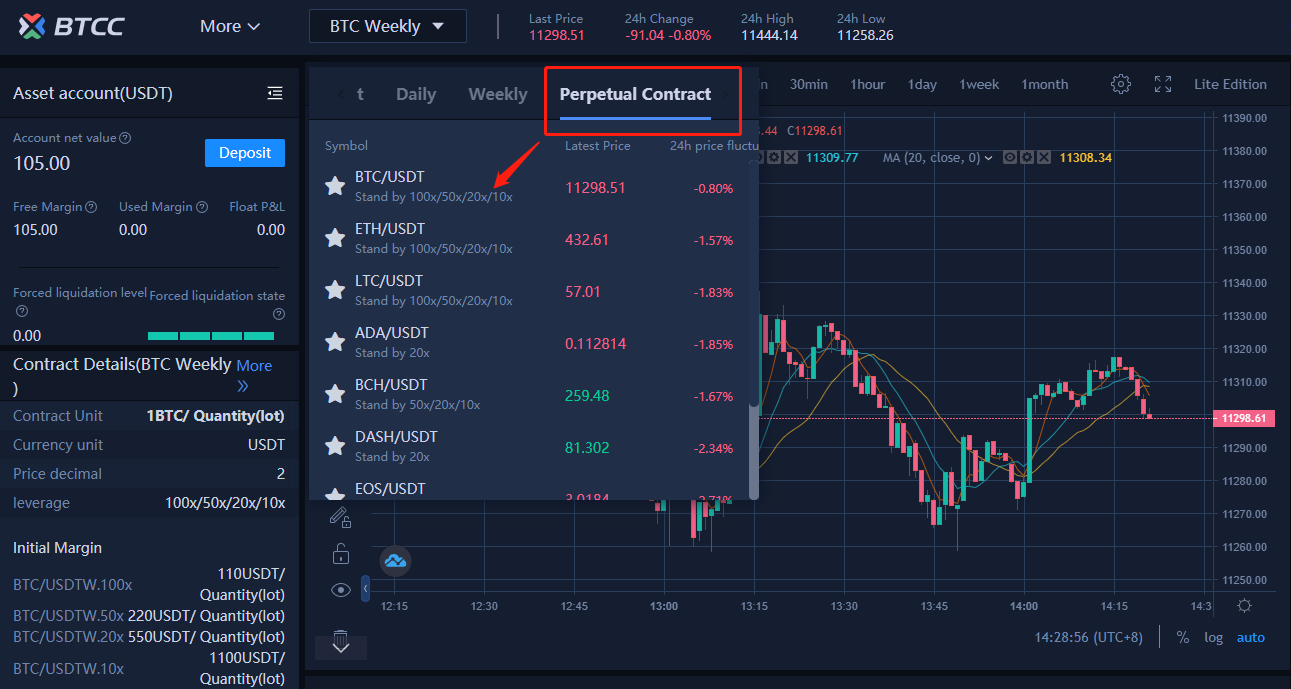

User Interface: A user-friendly interface plays a crucial role in enhancing the trading experience. Intuitiveness, easy navigation, and customizable features contribute to a seamless and efficient trading process.

-

Order Types: The platform should offer various order types, including market orders, limit orders, and stop-loss orders, providing traders with the flexibility to tailor their trading strategies.

-

Real-Time Data: Access to real-time market data is essential for successful trading. Platforms that integrate live streaming data feeds ensure traders remain abreast of market fluctuations.

-

Charting and Analysis Tools: Technical analysis is an integral part of CFD trading. Platforms with advanced charting capabilities and customizable indicators empower traders to identify trading opportunities and make informed decisions.

-

Security Measures: Robust security measures, such as encryption and two-factor authentication, safeguard traders against unauthorized access and data breaches, ensuring the integrity of trading activities.

Selecting the Right CFD Trading Platform:

Navigating the vast landscape of CFD trading platforms requires a discerning approach. Consider the following factors when making your choice:

-

Regulation and Licensing: Authoritative regulation and licensing signify that a platform operates in compliance with established industry standards and regulations.

-

Asset Coverage: Choose a platform that aligns with your trading preferences by offering the underlying assets you intend to trade.

-

Fees and Spreads: Transaction fees and spreads can impact your profitability. Compare platforms to identify the most cost-effective options.

-

Customer Support: Responsive and knowledgeable customer support is essential for resolving queries and ensuring a smooth trading experience.

-

Educational Resources: Platforms that provide educational materials, webinars, and tutorials empower traders to enhance their knowledge and trading skills.

Conclusion:

CFD trading platforms have revolutionized the way traders interact with the financial markets. By enabling access to a vast array of underlying assets, these platforms empower traders to capitalize on price movements and pursue their trading objectives. Understanding the fundamentals of CFD trading platforms and carefully considering the factors outlined in this article will guide you toward selecting a platform that aligns with your trading style and aspirations. Embrace the opportunities presented by CFD trading, but do so with caution and a thorough understanding of the inherent risks involved.

Image: brokernotes.co

Cfd Trading Platforms