An Overview of the Global Currency Market

The foreign exchange market, also known as forex or FX, is the world’s largest financial market, with a daily trading volume of trillions of dollars. It is a decentralized market where currencies are traded against each other, and its primary purpose is to facilitate international trade and investment.

Image: jlcatj.gob.mx

Forex transactions involve the exchange of one currency for another, and they can be conducted for various reasons, such as:

- Commercial transactions: Businesses use forex markets to pay for imports and exports.

- Investment: Investors may buy or sell currencies to capitalize on exchange rate fluctuations.

- Hedging: Companies and individuals can use forex transactions to reduce the risk of currency fluctuations on their foreign investments or liabilities.

Forex Market participants

The forex market has various participants, including banks, investment banks, hedge funds, multinational corporations, retail traders, and central banks.

Forex trading is typically conducted through electronic trading platforms, which allow participants to buy and sell currencies in real-time. The most commonly traded currencies in the forex market are known as “major currency pairs,” which include the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), and Swiss franc (CHF).

Forex Trading strategies

Forex traders use various strategies to capitalize on market inefficiencies and profit from currency fluctuations. Some common trading strategies include:

- Trend trading: Traders follow established trends in currency prices.

- Scalping: Traders make frequent small profits by entering and exiting trades in quick succession.

- Swing trading: Traders hold positions for a few days or weeks, targeting larger price movements.

- Hedging: Traders use forex transactions to reduce the risk of currency fluctuations on their foreign investments or liabilities.

Forex Market Regulations

The forex market is regulated in different ways depending on the jurisdiction. In many countries, forex trading is overseen by financial regulators, such as the Securities and Exchange Commission (SEC) in the United States.

Forex market regulations aim to promote transparency, prevent fraud and market manipulation, and protect investors. Traders should be aware of the applicable regulations in their jurisdiction before participating in forex trading.

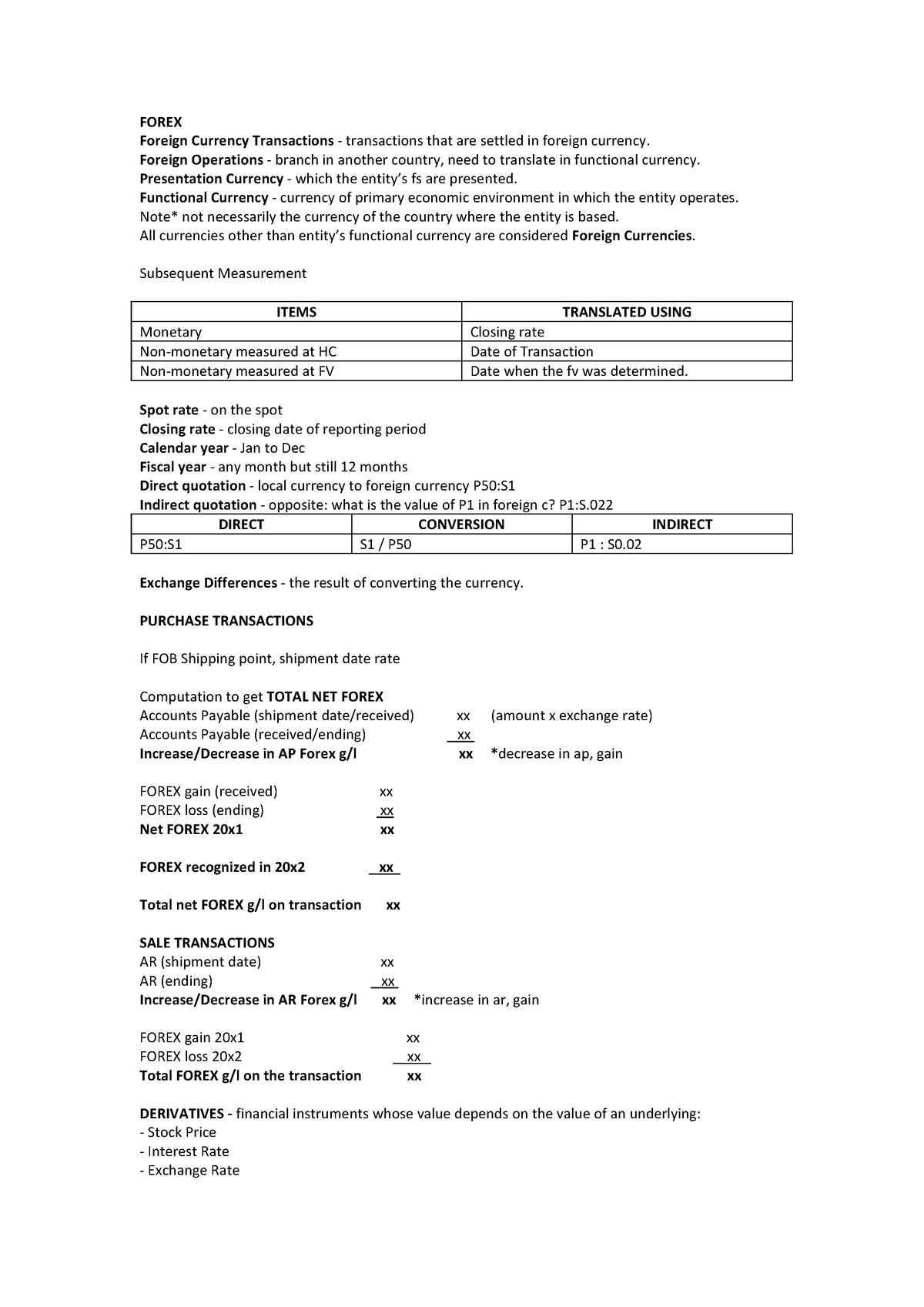

Image: www.studocu.com

Latest Trends in Forex Trading

The forex market is constantly evolving, and new trends are constantly emerging. Some recent trends in forex trading include:

- The rise of algorithmic trading: Computer algorithms are increasingly being used to automate the trading process.

- The growth of social trading: Traders are increasingly using social media and other online platforms to connect with each other and share trading ideas.

- The increase in mobile trading: Forex traders are increasingly using mobile devices to access the market.

Tips and Expert Advice for Forex Traders

Successful forex trading requires a combination of technical and fundamental analysis skills, as well as a sound understanding of the market and its dynamics. Here are some tips and expert advice for forex traders:

- Have a clear trading plan: Develop a trading plan outlining your trading strategy, risk management rules, and entry and exit criteria.

- Manage your risk: Use stop-loss orders and position sizing to manage your risk effectively.

- Be patient and disciplined: Forex trading requires patience and discipline. Avoid emotional trading and stick to your trading plan.

- Continuously educate yourself: The forex market is constantly evolving. Continuously educate yourself on market trends, economic indicators, and trading strategies.

FAQs on Forex International Transactions

Q: What is the purpose of a forex market?

A: To facilitate international trade and investment by enabling the exchange of different currencies.

Q: Who participates in the forex market?

A: Participants include banks, investment banks, hedge funds, multinational corporations, retail traders, and central banks.

Q: How is forex trading regulated?

A: Forex trading is regulated by different financial regulators in various jurisdictions, such as the SEC in the United States.

Q: What are some trends in forex trading?

A: Trends include the rise of algorithmic trading, growth of social trading, and increase in mobile trading.

Q: What advice can you give to aspiring forex traders?

A: Have a clear trading plan, manage your risk, be patient and disciplined, and continuously educate yourself.

What Is Forex International Transaction

https://youtube.com/watch?v=nXIokIQDfV4

Conclusion

The forex market is a vast and complex market that plays a vital role in the global economy. Forex international transactions enable businesses and individuals to trade, invest, and hedge risk. While forex trading can be lucrative, it is essential to understand the market’s risks and intricacies before participating.

Are you interested in learning more about forex international transactions? Leave your thoughts and questions in the comments section.