Introduction: The Nexus of Economics and Currency Markets

In the labyrinthine world of economics, trade balance holds a pivotal position, intertwined with the intricate web of currency exchange rates and foreign exchange (forex) trading. Understanding the dynamics of this interconnected system empowers investors with the knowledge to navigate volatile markets and seize profitable opportunities. This comprehensive guide will delve into the intricate relationship between trade balance, CAD (Canadian dollar), and forex trade, offering a holistic perspective crucial for savvy economic decision-making.

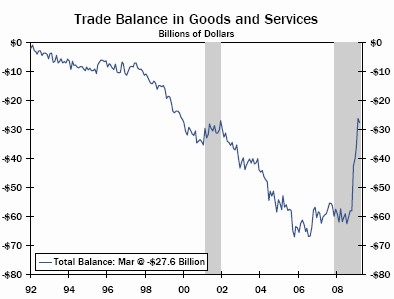

Image: www.varchev.com

The Concept of Trade Balance: A Nation’s Economic Health Barometer

At its core, trade balance represents the difference in value between a nation’s exports and imports over a specific period, typically a year. A positive trade balance signifies the country exports more goods and services than imports, reflecting an economic surplus. Conversely, a negative trade balance indicates more imports than exports, resulting in an economic deficit. Trade balance acts as a barometer of a country’s economic health, providing insights into its overall productivity, competitiveness, and economic growth outlook.

Exploring the Canadian Dollar (CAD): A Currency’s Strength and Influence

The Canadian dollar (CAD), fondly known as the “loonie,” is the official currency of Canada, the world’s 10th largest economy. CAD’s value is determined by supply and demand forces in the forex market, where it is actively traded against other currencies. The strength of the loonie is largely influenced by Canada’s economic performance, interest rate policies, and global commodity prices. A strong CAD makes Canadian exports more expensive and imports cheaper, potentially dampening economic growth. Conversely, a weaker currency boosts exports and curbs imports, stimulating economic expansion.

The Interplay of Trade Balance and CAD’s Value: A Delicate Dance

Trade balance and CAD’s value exhibit a delicate interdependence. A positive trade balance typically strengthens the currency, as increased exports generate greater demand for the domestic currency. This is because foreign buyers need to purchase the domestic currency to pay for the exports. Conversely, a negative trade balance tends to weaken the currency, as increased imports necessitate selling the domestic currency to pay for the imported goods and services. An astute understanding of this relationship allows investors to anticipate currency fluctuations and make informed forex trading decisions.

Image: icmtrading.blogspot.com

Navigating Forex Trade: Leveraging Trade Balance Insights

For forex traders, trade balance data provides valuable insights for strategic decision-making. Positive trade balances often signal a strengthening currency, creating opportunities for buying that currency and selling its counterparts. On the other hand, negative trade balances can indicate a weakening currency, potentially leading to selling it and buying stronger currencies. By considering trade balance data alongside other economic indicators, forex traders can enhance their ability to predict currency movements and capitalize on profitable trades.

Managing Economic Volatility: Trade Balance as a Policy Tool

Governments often employ trade balance management as a tool to influence economic growth and stability. By implementing policies that promote exports and discourage imports, policymakers can drive a trade surplus, potentially strengthening the domestic currency and boosting economic growth. However, excessive trade imbalances can have negative consequences, potentially leading to trade wars or protectionist policies. Balancing trade objectives with other economic goals requires a delicate touch and forward-looking planning by policymakers.

Trade Balance Cad Forex Trade

Conclusion: Empowering Investors with Trade Balance Knowledge

In the dynamic world of economics and finance, understanding trade balance, CAD, and forex trade is essential for investors seeking to make well-informed decisions. This comprehensive guide has unraveled the intricate interplay between these crucial factors, providing valuable insights into the financial landscape. By leveraging this knowledge, investors can navigate market volatility, anticipate currency fluctuations, and optimize their forex trading strategies, ultimately enhancing their ability to achieve financial success.